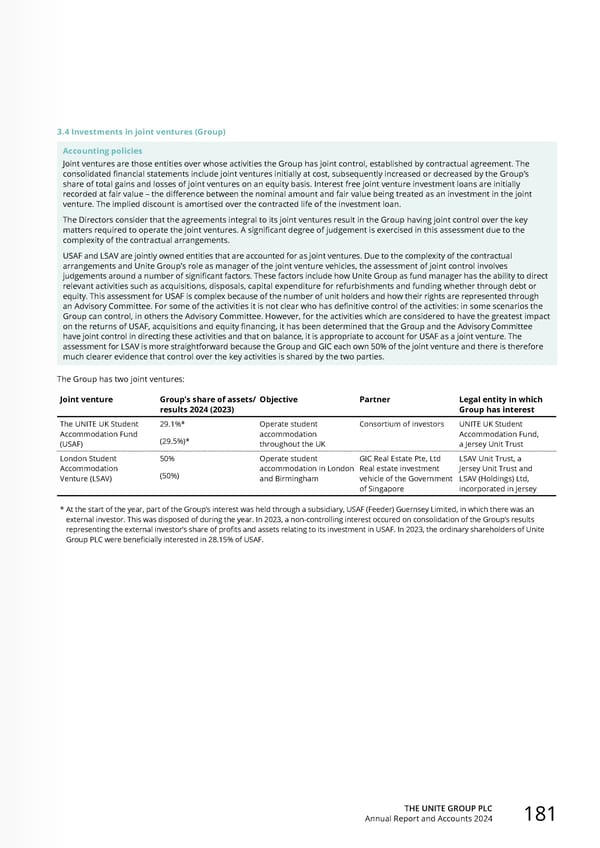

THE UNITE GROUP PLC Annual Report and Accounts 2024 181 3.4 Investments in joint ventures (Group) Accounting policies Joint ventures are those entities over whose activities the Group has joint control, established by contractual agreement. The consolidated financial statements include joint ventures initially at cost, subsequently increased or decreased by the Group’s share of total gains and losses of joint ventures on an equity basis. Interest free joint venture investment loans are initially recorded at fair value – the difference between the nominal amount and fair value being treated as an investment in the joint venture. The implied discount is amortised over the contracted life of the investment loan. The Directors consider that the agreements integral to its joint ventures result in the Group having joint control over the key matters required to operate the joint ventures. A significant degree of judgement is exercised in this assessment due to the complexity of the contractual arrangements. USAF and LSAV are jointly owned entities that are accounted for as joint ventures. Due to the complexity of the contractual arrangements and Unite Group’s role as manager of the joint venture vehicles, the assessment of joint control involves judgements around a number of significant factors. These factors include how Unite Group as fund manager has the ability to direct relevant activities such as acquisitions, disposals, capital expenditure for refurbishments and funding whether through debt or equity. This assessment for USAF is complex because of the number of unit holders and how their rights are represented through an Advisory Committee. For some of the activities it is not clear who has definitive control of the activities: in some scenarios the Group can control, in others the Advisory Committee. However, for the activities which are considered to have the greatest impact on the returns of USAF, acquisitions and equity financing, it has been determined that the Group and the Advisory Committee have joint control in directing these activities and that on balance, it is appropriate to account for USAF as a joint venture. The assessment for LSAV is more straightforward because the Group and GIC each own 50% of the joint venture and there is therefore much clearer evidence that control over the key activities is shared by the two parties. The Group has two joint ventures: Joint venture Group’s share of assets/ results 2024 (2023) Objective Partner Legal entity in which Group has interest The UNITE UK Student Accommodation Fund (USAF) 29.1%* (29.5%)* Operate student accommodation throughout the UK Consortium of investors UNITE UK Student Accommodation Fund, a Jersey Unit Trust London Student Accommodation Venture (LSAV) 50% (50%) Operate student accommodation in London and Birmingham GIC Real Estate Pte, Ltd Real estate investment vehicle of the Government of Singapore LSAV Unit Trust, a Jersey Unit Trust and LSAV (Holdings) Ltd, incorporated in Jersey * At the start of the year, part of the Group’s interest was held through a subsidiary, USAF (Feeder) Guernsey Limited, in which there was an external investor. This was disposed of during the year. In 2023, a non-controlling interest occured on consolidation of the Group’s results representing the external investor’s share of profits and assets relating to its investment in USAF. In 2023, the ordinary shareholders of Unite Group PLC were beneficially interested in 28.15% of USAF.

Home for Success: Unite Students Annual Report 2024 Page 182 Page 184

Home for Success: Unite Students Annual Report 2024 Page 182 Page 184