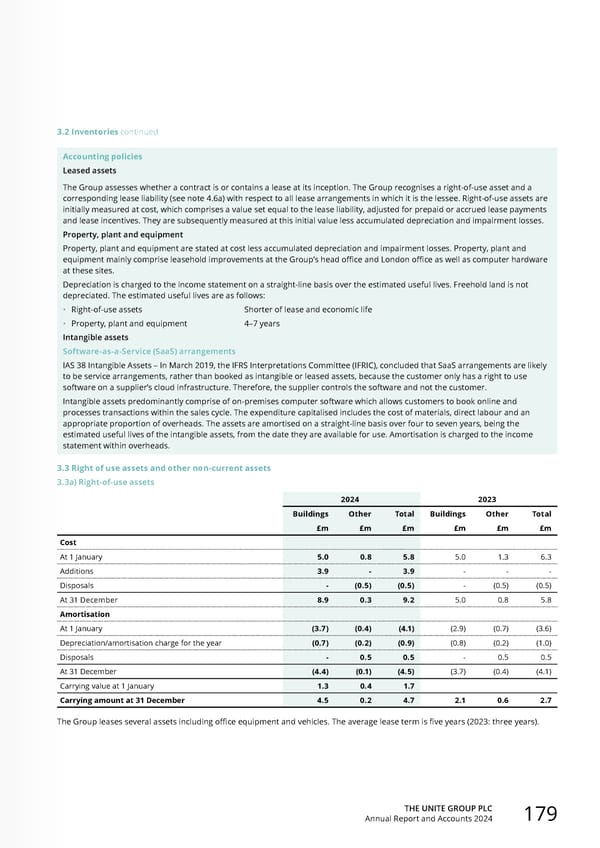

THE UNITE GROUP PLC Annual Report and Accounts 2024 179 3.2 Inventories continued Accounting policies Leased assets The Group assesses whether a contract is or contains a lease at its inception. The Group recognises a right-of-use asset and a corresponding lease liability (see note 4.6a) with respect to all lease arrangements in which it is the lessee. Right-of-use assets are initially measured at cost, which comprises a value set equal to the lease liability, adjusted for prepaid or accrued lease payments and lease incentives. They are subsequently measured at this initial value less accumulated depreciation and impairment losses. Property, plant and equipment Property, plant and equipment are stated at cost less accumulated depreciation and impairment losses. Property, plant and equipment mainly comprise leasehold improvements at the Group’s head office and London office as well as computer hardware at these sites. Depreciation is charged to the income statement on a straight-line basis over the estimated useful lives. Freehold land is not depreciated. The estimated useful lives are as follows: • Right-of-use assets Shorter of lease and economic life • Property, plant and equipment 4–7 years Intangible assets Software-as-a-Service (SaaS) arrangements IAS 38 Intangible Assets – In March 2019, the IFRS Interpretations Committee (IFRIC), concluded that SaaS arrangements are likely to be service arrangements, rather than booked as intangible or leased assets, because the customer only has a right to use software on a supplier’s cloud infrastructure. Therefore, the supplier controls the software and not the customer. Intangible assets predominantly comprise of on-premises computer software which allows customers to book online and processes transactions within the sales cycle. The expenditure capitalised includes the cost of materials, direct labour and an appropriate proportion of overheads. The assets are amortised on a straight-line basis over four to seven years, being the estimated useful lives of the intangible assets, from the date they are available for use. Amortisation is charged to the income statement within overheads. 3.3 Right of use assets and other non-current assets 3.3a) Right-of-use assets 2024 2023 Buildings Other Total Buildings Other Total £m £m £m £m £m £m Cost At 1 January 5.0 0.8 5.8 5.0 1.3 6.3 Additions 3.9 - 3.9 - - - Disposals - (0.5) (0.5) - (0.5) (0.5) At 31 December 8.9 0.3 9.2 5.0 0.8 5.8 Amortisation At 1 January (3.7) (0.4) (4.1) (2.9) (0.7) (3.6) Depreciation/amortisation charge for the year (0.7) (0.2) (0.9) (0.8) (0.2) (1.0) Disposals - 0.5 0.5 - 0.5 0.5 At 31 December (4.4) (0.1) (4.5) (3.7) (0.4) (4.1) Carrying value at 1 January 1.3 0.4 1.7 Carrying amount at 31 December 4.5 0.2 4.7 2.1 0.6 2.7 The Group leases several assets including office equipment and vehicles. The average lease term is five years (2023: three years).

Home for Success: Unite Students Annual Report 2024 Page 180 Page 182

Home for Success: Unite Students Annual Report 2024 Page 180 Page 182