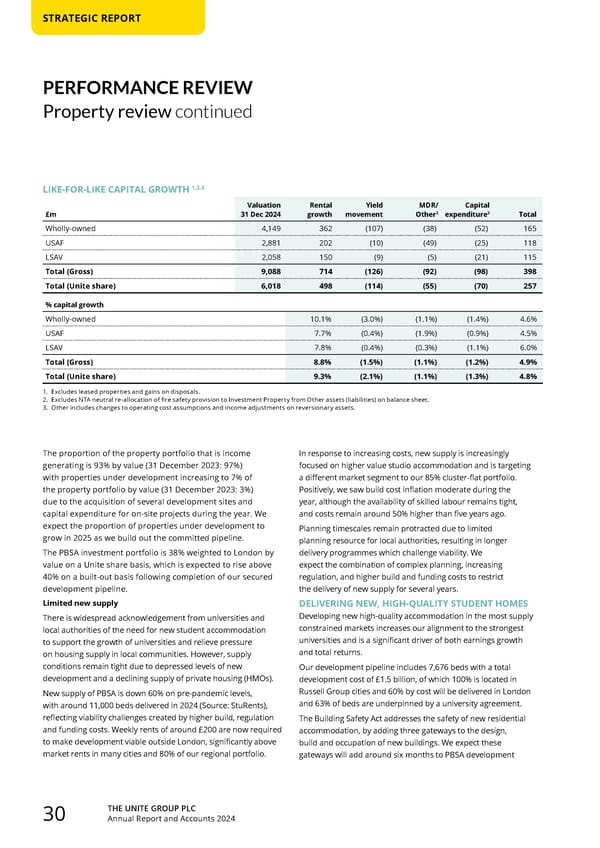

THE UNITE GROUP PLC Annual Report and Accounts 2024 30 The proportion of the property portfolio that is income generating is 93% by value (31 December 2023: 97%) with properties under development increasing to 7% of the property portfolio by value (31 December 2023: 3%) due to the acquisition of several development sites and capital expenditure for on-site projects during the year. We expect the proportion of properties under development to grow in 2025 as we build out the committed pipeline. The PBSA investment portfolio is 38% weighted to London by value on a Unite share basis, which is expected to rise above 40% on a built-out basis following completion of our secured development pipeline. Limited new supply There is widespread acknowledgement from universities and local authorities of the need for new student accommodation to support the growth of universities and relieve pressure on housing supply in local communities. However, supply conditions remain tight due to depressed levels of new development and a declining supply of private housing (HMOs). New supply of PBSA is down 60% on pre-pandemic levels, with around 11,000 beds delivered in 2024 (Source: StuRents), reflecting viability challenges created by higher build, regulation and funding costs. Weekly rents of around £200 are now required to make development viable outside London, significantly above market rents in many cities and 80% of our regional portfolio. In response to increasing costs, new supply is increasingly focused on higher value studio accommodation and is targeting a different market segment to our 85% cluster-flat portfolio. Positively, we saw build cost inflation moderate during the year, although the availability of skilled labour remains tight, and costs remain around 50% higher than five years ago. Planning timescales remain protracted due to limited planning resource for local authorities, resulting in longer delivery programmes which challenge viability. We expect the combination of complex planning, increasing regulation, and higher build and funding costs to restrict the delivery of new supply for several years. DELIVERING NEW, HIGH-QUALITY STUDENT HOMES Developing new high-quality accommodation in the most supply constrained markets increases our alignment to the strongest universities and is a significant driver of both earnings growth and total returns. Our development pipeline includes 7,676 beds with a total development cost of £1.5 billion, of which 100% is located in Russell Group cities and 60% by cost will be delivered in London and 63% of beds are underpinned by a university agreement. The Building Safety Act addresses the safety of new residential accommodation, by adding three gateways to the design, build and occupation of new buildings. We expect these gateways will add around six months to PBSA development STRATEGIC REPORT PERFORMANCE REVIEW Property review continued LIKE-FOR-LIKE CAPITAL GROWTH 1,2,3 £m Valuation 31 Dec 2024 Rental growth Yield movement MDR/ Other2 Capital expenditure3 Total Wholly-owned 4,149 362 (107) (38) (52) 165 USAF 2,881 202 (10) (49) (25) 118 LSAV 2,058 150 (9) (5) (21) 115 Total (Gross) 9,088 714 (126) (92) (98) 398 Total (Unite share) 6,018 498 (114) (55) (70) 257 % capital growth Wholly-owned 10.1% (3.0%) (1.1%) (1.4%) 4.6% USAF 7.7% (0.4%) (1.9%) (0.9%) 4.5% LSAV 7.8% (0.4%) (0.3%) (1.1%) 6.0% Total (Gross) 8.8% (1.5%) (1.1%) (1.2%) 4.9% Total (Unite share) 9.3% (2.1%) (1.1%) (1.3%) 4.8% 1. Excludes leased properties and gains on disposals. 2. Excludes NTA neutral re-allocation of fire safety provision to Investment Property from Other assets (liabilities) on balance sheet. 3. Other includes changes to operating cost assumptions and income adjustments on reversionary assets.

Home for Success: Unite Students Annual Report 2024 Page 31 Page 33

Home for Success: Unite Students Annual Report 2024 Page 31 Page 33