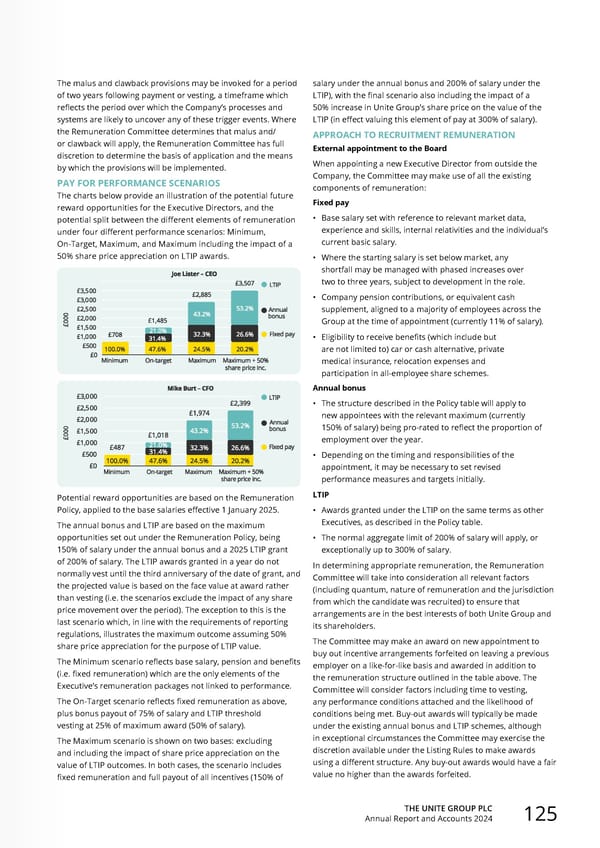

THE UNITE GROUP PLC Annual Report and Accounts 2024 125 The malus and clawback provisions may be invoked for a period of two years following payment or vesting, a timeframe which reflects the period over which the Company’s processes and systems are likely to uncover any of these trigger events. Where the Remuneration Committee determines that malus and/ or clawback will apply, the Remuneration Committee has full discretion to determine the basis of application and the means by which the provisions will be implemented. PAY FOR PERFORMANCE SCENARIOS The charts below provide an illustration of the potential future reward opportunities for the Executive Directors, and the potential split between the different elements of remuneration under four different performance scenarios: Minimum, On-Target, Maximum, and Maximum including the impact of a 50% share price appreciation on LTIP awards. Potential reward opportunities are based on the Remuneration Policy, applied to the base salaries effective 1 January 2025. The annual bonus and LTIP are based on the maximum opportunities set out under the Remuneration Policy, being 150% of salary under the annual bonus and a 2025 LTIP grant of 200% of salary. The LTIP awards granted in a year do not normally vest until the third anniversary of the date of grant, and the projected value is based on the face value at award rather than vesting (i.e. the scenarios exclude the impact of any share price movement over the period). The exception to this is the last scenario which, in line with the requirements of reporting regulations, illustrates the maximum outcome assuming 50% share price appreciation for the purpose of LTIP value. The Minimum scenario reflects base salary, pension and benefits (i.e. fixed remuneration) which are the only elements of the Executive’s remuneration packages not linked to performance. The On-Target scenario reflects fixed remuneration as above, plus bonus payout of 75% of salary and LTIP threshold vesting at 25% of maximum award (50% of salary). The Maximum scenario is shown on two bases: excluding and including the impact of share price appreciation on the value of LTIP outcomes. In both cases, the scenario includes fixed remuneration and full payout of all incentives (150% of salary under the annual bonus and 200% of salary under the LTIP), with the final scenario also including the impact of a 50% increase in Unite Group’s share price on the value of the LTIP (in effect valuing this element of pay at 300% of salary). APPROACH TO RECRUITMENT REMUNERATION External appointment to the Board When appointing a new Executive Director from outside the Company, the Committee may make use of all the existing components of remuneration: Fixed pay • Base salary set with reference to relevant market data, experience and skills, internal relativities and the individual’s current basic salary. • Where the starting salary is set below market, any shortfall may be managed with phased increases over two to three years, subject to development in the role. • Company pension contributions, or equivalent cash supplement, aligned to a majority of employees across the Group at the time of appointment (currently 11% of salary). • Eligibility to receive benefits (which include but are not limited to) car or cash alternative, private medical insurance, relocation expenses and participation in all-employee share schemes. Annual bonus • The structure described in the Policy table will apply to new appointees with the relevant maximum (currently 150% of salary) being pro-rated to reflect the proportion of employment over the year. • Depending on the timing and responsibilities of the appointment, it may be necessary to set revised performance measures and targets initially. LTIP • Awards granted under the LTIP on the same terms as other Executives, as described in the Policy table. • The normal aggregate limit of 200% of salary will apply, or exceptionally up to 300% of salary. In determining appropriate remuneration, the Remuneration Committee will take into consideration all relevant factors (including quantum, nature of remuneration and the jurisdiction from which the candidate was recruited) to ensure that arrangements are in the best interests of both Unite Group and its shareholders. The Committee may make an award on new appointment to buy out incentive arrangements forfeited on leaving a previous employer on a like-for-like basis and awarded in addition to the remuneration structure outlined in the table above. The Committee will consider factors including time to vesting, any performance conditions attached and the likelihood of conditions being met. Buy-out awards will typically be made under the existing annual bonus and LTIP schemes, although in exceptional circumstances the Committee may exercise the discretion available under the Listing Rules to make awards using a different structure. Any buy-out awards would have a fair value no higher than the awards forfeited.

Home for Success: Unite Students Annual Report 2024 Page 126 Page 128

Home for Success: Unite Students Annual Report 2024 Page 126 Page 128