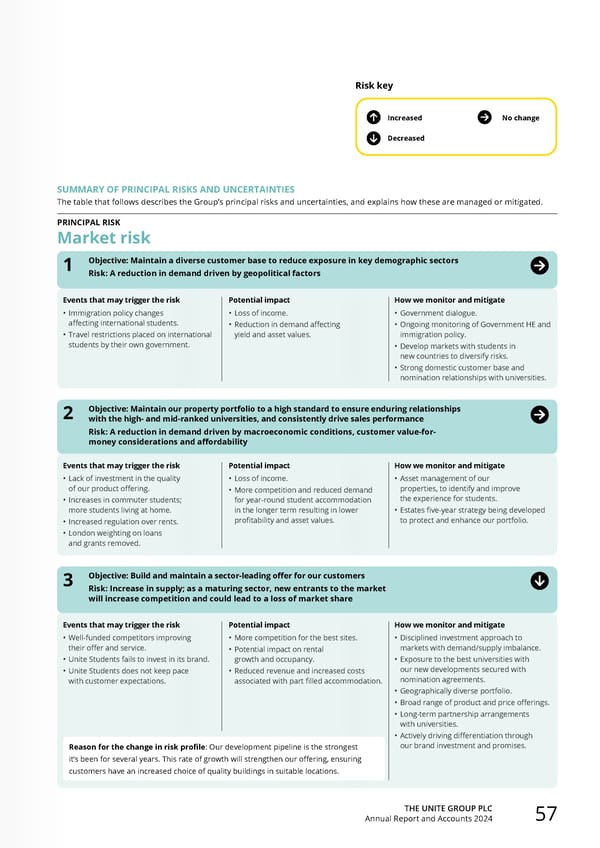

THE UNITE GROUP PLC Annual Report and Accounts 2024 57 SUMMARY OF PRINCIPAL RISKS AND UNCERTAINTIES The table that follows describes the Group’s principal risks and uncertainties, and explains how these are managed or mitigated. PRINCIPAL RISK Market risk Events that may trigger the risk • Immigration policy changes affecting international students. • Travel restrictions placed on international students by their own government. Potential impact • Loss of income. • Reduction in demand affecting yield and asset values. How we monitor and mitigate • Government dialogue. • Ongoing monitoring of Government HE and immigration policy. • Develop markets with students in new countries to diversify risks. • Strong domestic customer base and nomination relationships with universities. 1 Objective: Maintain a diverse customer base to reduce exposure in key demographic sectors Risk: A reduction in demand driven by geopolitical factors 2 Objective: Maintain our property portfolio to a high standard to ensure enduring relationships with the high- and mid-ranked universities, and consistently drive sales performance Risk: A reduction in demand driven by macroeconomic conditions, customer value-for- money considerations and affordability Events that may trigger the risk • Lack of investment in the quality of our product offering. • Increases in commuter students; more students living at home. • Increased regulation over rents. • London weighting on loans and grants removed. Potential impact • Loss of income. • More competition and reduced demand for year-round student accommodation in the longer term resulting in lower profitability and asset values. How we monitor and mitigate • Asset management of our properties, to identify and improve the experience for students. • Estates five-year strategy being developed to protect and enhance our portfolio. 3 Objective: Build and maintain a sector-leading offer for our customers Risk: Increase in supply; as a maturing sector, new entrants to the market will increase competition and could lead to a loss of market share Events that may trigger the risk • Well-funded competitors improving their offer and service. • Unite Students fails to invest in its brand. • Unite Students does not keep pace with customer expectations. Potential impact • More competition for the best sites. • Potential impact on rental growth and occupancy. • Reduced revenue and increased costs associated with part filled accommodation. How we monitor and mitigate • Disciplined investment approach to markets with demand/supply imbalance. • Exposure to the best universities with our new developments secured with nomination agreements. • Geographically diverse portfolio. • Broad range of product and price offerings. • Long-term partnership arrangements with universities. • Actively driving differentiation through our brand investment and promises. Increased Decreased Risk key No change Reason for the change in risk profile: Our development pipeline is the strongest it’s been for several years. This rate of growth will strengthen our offering, ensuring customers have an increased choice of quality buildings in suitable locations.

Home for Success: Unite Students Annual Report 2024 Page 58 Page 60

Home for Success: Unite Students Annual Report 2024 Page 58 Page 60