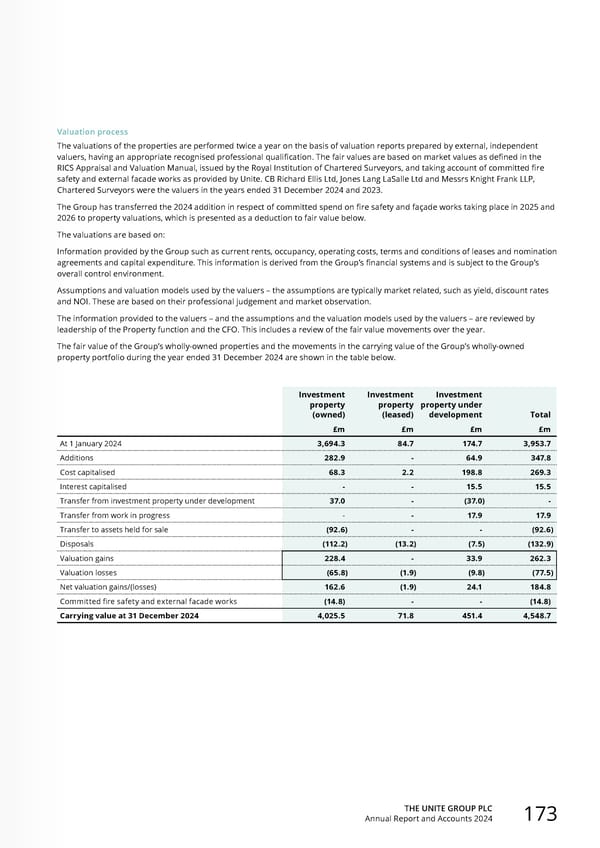

THE UNITE GROUP PLC Annual Report and Accounts 2024 173 Valuation process The valuations of the properties are performed twice a year on the basis of valuation reports prepared by external, independent valuers, having an appropriate recognised professional qualification. The fair values are based on market values as defined in the RICS Appraisal and Valuation Manual, issued by the Royal Institution of Chartered Surveyors, and taking account of committed fire safety and external facade works as provided by Unite. CB Richard Ellis Ltd, Jones Lang LaSalle Ltd and Messrs Knight Frank LLP, Chartered Surveyors were the valuers in the years ended 31 December 2024 and 2023. The Group has transferred the 2024 addition in respect of committed spend on fire safety and façade works taking place in 2025 and 2026 to property valuations, which is presented as a deduction to fair value below. The valuations are based on: Information provided by the Group such as current rents, occupancy, operating costs, terms and conditions of leases and nomination agreements and capital expenditure. This information is derived from the Group’s financial systems and is subject to the Group’s overall control environment. Assumptions and valuation models used by the valuers – the assumptions are typically market related, such as yield, discount rates and NOI. These are based on their professional judgement and market observation. The information provided to the valuers – and the assumptions and the valuation models used by the valuers – are reviewed by leadership of the Property function and the CFO. This includes a review of the fair value movements over the year. The fair value of the Group’s wholly-owned properties and the movements in the carrying value of the Group’s wholly-owned property portfolio during the year ended 31 December 2024 are shown in the table below. Investment property (owned) Investment property (leased) Investment property under development Total £m £m £m £m At 1 January 2024 3,694.3 84.7 174.7 3,953.7 Additions 282.9 - 64.9 347.8 Cost capitalised 68.3 2.2 198.8 269.3 Interest capitalised - - 15.5 15.5 Transfer from investment property under development 37.0 - (37.0) - Transfer from work in progress - - 17.9 17.9 Transfer to assets held for sale (92.6) - - (92.6) Disposals (112.2) (13.2) (7.5) (132.9) Valuation gains 228.4 - 33.9 262.3 Valuation losses (65.8) (1.9) (9.8) (77.5) Net valuation gains/(losses) 162.6 (1.9) 24.1 184.8 Committed fire safety and external facade works (14.8) - - (14.8) Carrying value at 31 December 2024 4,025.5 71.8 451.4 4,548.7

Home for Success: Unite Students Annual Report 2024 Page 174 Page 176

Home for Success: Unite Students Annual Report 2024 Page 174 Page 176