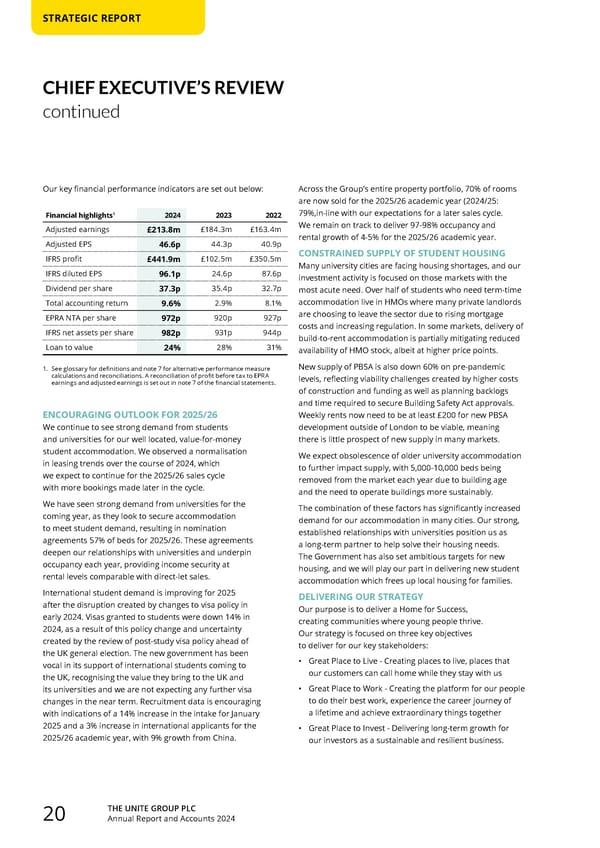

THE UNITE GROUP PLC Annual Report and Accounts 2024 20 Our key financial performance indicators are set out below: Financial highlights1 2024 2023 2022 Adjusted earnings £213.8m £184.3m £163.4m Adjusted EPS 46.6p 44.3p 40.9p IFRS profit £441.9m £102.5m £350.5m IFRS diluted EPS 96.1p 24.6p 87.6p Dividend per share 37.3p 35.4p 32.7p Total accounting return 9.6% 2.9% 8.1% EPRA NTA per share 972p 920p 927p IFRS net assets per share 982p 931p 944p Loan to value 24% 28% 31% 1. See glossary for definitions and note 7 for alternative performance measure calculations and reconciliations. A reconciliation of profit before tax to EPRA earnings and adjusted earnings is set out in note 7 of the financial statements. ENCOURAGING OUTLOOK FOR 2025/26 We continue to see strong demand from students and universities for our well located, value-for-money student accommodation. We observed a normalisation in leasing trends over the course of 2024, which we expect to continue for the 2025/26 sales cycle with more bookings made later in the cycle. We have seen strong demand from universities for the coming year, as they look to secure accommodation to meet student demand, resulting in nomination agreements 57% of beds for 2025/26. These agreements deepen our relationships with universities and underpin occupancy each year, providing income security at rental levels comparable with direct-let sales. International student demand is improving for 2025 after the disruption created by changes to visa policy in early 2024. Visas granted to students were down 14% in 2024, as a result of this policy change and uncertainty created by the review of post-study visa policy ahead of the UK general election. The new government has been vocal in its support of international students coming to the UK, recognising the value they bring to the UK and its universities and we are not expecting any further visa changes in the near term. Recruitment data is encouraging with indications of a 14% increase in the intake for January 2025 and a 3% increase in international applicants for the 2025/26 academic year, with 9% growth from China. Across the Group’s entire property portfolio, 70% of rooms are now sold for the 2025/26 academic year (2024/25: 79%,in-line with our expectations for a later sales cycle. We remain on track to deliver 97-98% occupancy and rental growth of 4-5% for the 2025/26 academic year. CONSTRAINED SUPPLY OF STUDENT HOUSING Many university cities are facing housing shortages, and our investment activity is focused on those markets with the most acute need. Over half of students who need term-time accommodation live in HMOs where many private landlords are choosing to leave the sector due to rising mortgage costs and increasing regulation. In some markets, delivery of build-to-rent accommodation is partially mitigating reduced availability of HMO stock, albeit at higher price points. New supply of PBSA is also down 60% on pre-pandemic levels, reflecting viability challenges created by higher costs of construction and funding as well as planning backlogs and time required to secure Building Safety Act approvals. Weekly rents now need to be at least £200 for new PBSA development outside of London to be viable, meaning there is little prospect of new supply in many markets. We expect obsolescence of older university accommodation to further impact supply, with 5,000-10,000 beds being removed from the market each year due to building age and the need to operate buildings more sustainably. The combination of these factors has significantly increased demand for our accommodation in many cities. Our strong, established relationships with universities position us as a long-term partner to help solve their housing needs. The Government has also set ambitious targets for new housing, and we will play our part in delivering new student accommodation which frees up local housing for families. DELIVERING OUR STRATEGY Our purpose is to deliver a Home for Success, creating communities where young people thrive. Our strategy is focused on three key objectives to deliver for our key stakeholders: • Great Place to Live - Creating places to live, places that our customers can call home while they stay with us • Great Place to Work - Creating the platform for our people to do their best work, experience the career journey of a lifetime and achieve extraordinary things together • Great Place to Invest - Delivering long-term growth for our investors as a sustainable and resilient business. STRATEGIC REPORT CHIEF EXECUTIVE’S REVIEW continued

Home for Success: Unite Students Annual Report 2024 Page 21 Page 23

Home for Success: Unite Students Annual Report 2024 Page 21 Page 23