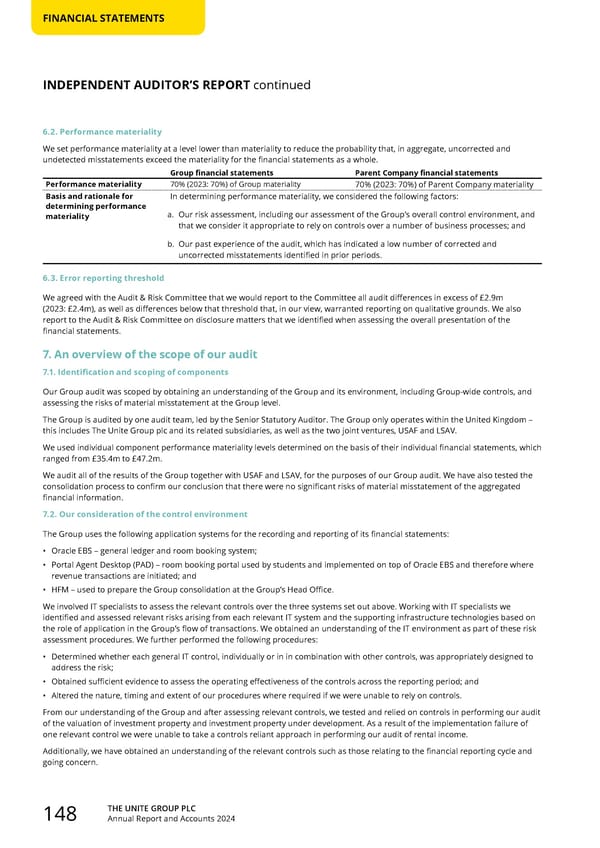

THE UNITE GROUP PLC Annual Report and Accounts 2024 148 FINANCIAL STATEMENTS INDEPENDENT AUDITOR’S REPORT continued 6.2. Performance materiality We set performance materiality at a level lower than materiality to reduce the probability that, in aggregate, uncorrected and undetected misstatements exceed the materiality for the financial statements as a whole. Group financial statements Parent Company financial statements Performance materiality 70% (2023: 70%) of Group materiality 70% (2023: 70%) of Parent Company materiality Basis and rationale for determining performance materiality In determining performance materiality, we considered the following factors: a. Our risk assessment, including our assessment of the Group’s overall control environment, and that we consider it appropriate to rely on controls over a number of business processes; and b. Our past experience of the audit, which has indicated a low number of corrected and uncorrected misstatements identified in prior periods. 6.3. Error reporting threshold We agreed with the Audit & Risk Committee that we would report to the Committee all audit differences in excess of £2.9m (2023: £2.4m), as well as differences below that threshold that, in our view, warranted reporting on qualitative grounds. We also report to the Audit & Risk Committee on disclosure matters that we identified when assessing the overall presentation of the financial statements. 7. An overview of the scope of our audit 7.1. Identification and scoping of components Our Group audit was scoped by obtaining an understanding of the Group and its environment, including Group-wide controls, and assessing the risks of material misstatement at the Group level. The Group is audited by one audit team, led by the Senior Statutory Auditor. The Group only operates within the United Kingdom – this includes The Unite Group plc and its related subsidiaries, as well as the two joint ventures, USAF and LSAV. We used individual component performance materiality levels determined on the basis of their individual financial statements, which ranged from £35.4m to £47.2m. We audit all of the results of the Group together with USAF and LSAV, for the purposes of our Group audit. We have also tested the consolidation process to confirm our conclusion that there were no significant risks of material misstatement of the aggregated financial information. 7.2. Our consideration of the control environment The Group uses the following application systems for the recording and reporting of its financial statements: • Oracle EBS – general ledger and room booking system; • Portal Agent Desktop (PAD) – room booking portal used by students and implemented on top of Oracle EBS and therefore where revenue transactions are initiated; and • HFM – used to prepare the Group consolidation at the Group’s Head Office. We involved IT specialists to assess the relevant controls over the three systems set out above. Working with IT specialists we identified and assessed relevant risks arising from each relevant IT system and the supporting infrastructure technologies based on the role of application in the Group’s flow of transactions. We obtained an understanding of the IT environment as part of these risk assessment procedures. We further performed the following procedures: • Determined whether each general IT control, individually or in in combination with other controls, was appropriately designed to address the risk; • Obtained sufficient evidence to assess the operating effectiveness of the controls across the reporting period; and • Altered the nature, timing and extent of our procedures where required if we were unable to rely on controls. From our understanding of the Group and after assessing relevant controls, we tested and relied on controls in performing our audit of the valuation of investment property and investment property under development. As a result of the implementation failure of one relevant control we were unable to take a controls reliant approach in performing our audit of rental income. Additionally, we have obtained an understanding of the relevant controls such as those relating to the financial reporting cycle and going concern.

Home for Success: Unite Students Annual Report 2024 Page 149 Page 151

Home for Success: Unite Students Annual Report 2024 Page 149 Page 151