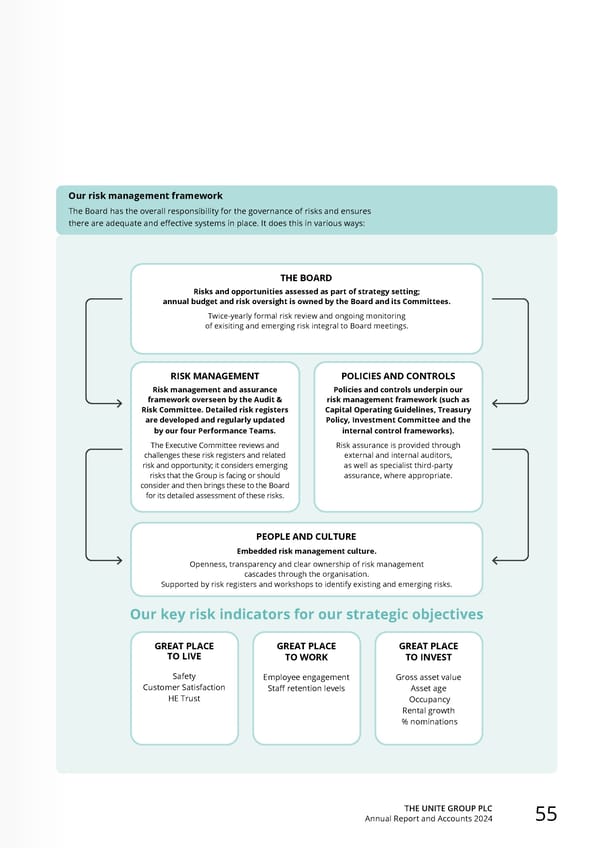

THE UNITE GROUP PLC Annual Report and Accounts 2024 55 Our risk management framework The Board has the overall responsibility for the governance of risks and ensures there are adequate and effective systems in place. It does this in various ways: THE BOARD Risks and opportunities assessed as part of strategy setting; annual budget and risk oversight is owned by the Board and its Committees. Twice-yearly formal risk review and ongoing monitoring of exisiting and emerging risk integral to Board meetings. PEOPLE AND CULTURE Embedded risk management culture. Openness, transparency and clear ownership of risk management cascades through the organisation. Supported by risk registers and workshops to identify existing and emerging risks. RISK MANAGEMENT Risk management and assurance framework overseen by the Audit & Risk Committee. Detailed risk registers are developed and regularly updated by our four Performance Teams. The Executive Committee reviews and challenges these risk registers and related risk and opportunity; it considers emerging risks that the Group is facing or should consider and then brings these to the Board for its detailed assessment of these risks. POLICIES AND CONTROLS Policies and controls underpin our risk management framework (such as Capital Operating Guidelines, Treasury Policy, Investment Committee and the internal control frameworks). Risk assurance is provided through external and internal auditors, as well as specialist third-party assurance, where appropriate. Our key risk indicators for our strategic objectives GREAT PLACE TO LIVE Safety Customer Satisfaction HE Trust GREAT PLACE TO WORK Employee engagement Staff retention levels GREAT PLACE TO INVEST Gross asset value Asset age Occupancy Rental growth % nominations

Home for Success: Unite Students Annual Report 2024 Page 56 Page 58

Home for Success: Unite Students Annual Report 2024 Page 56 Page 58