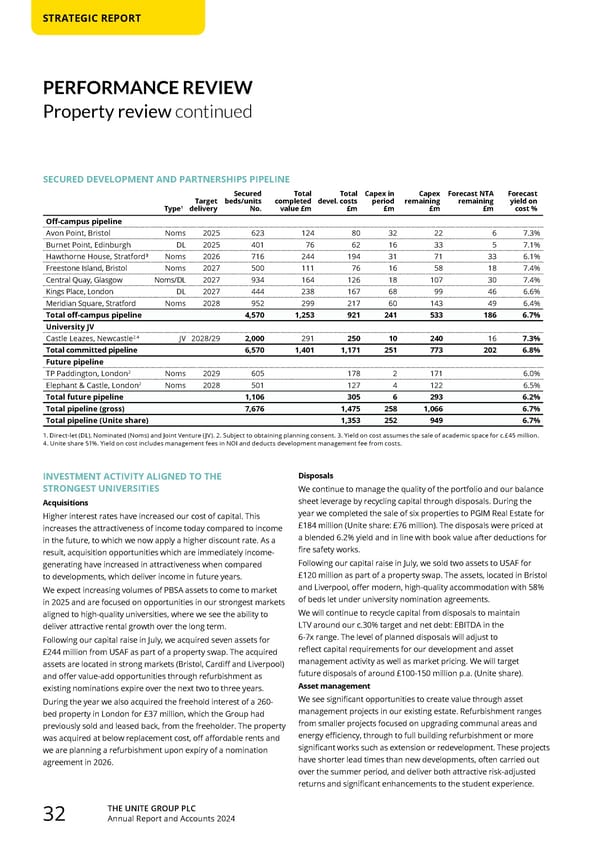

THE UNITE GROUP PLC Annual Report and Accounts 2024 32 STRATEGIC REPORT PERFORMANCE REVIEW Property review continued SECURED DEVELOPMENT AND PARTNERSHIPS PIPELINE Type1 Target delivery Secured beds/units No. Total completed value £m Total devel. costs £m Capex in period £m Capex remaining £m Forecast NTA remaining £m Forecast yield on cost % Off-campus pipeline Avon Point, Bristol Noms 2025 623 124 80 32 22 6 7.3% Burnet Point, Edinburgh DL 2025 401 76 62 16 33 5 7.1% Hawthorne House, Stratford³ Noms 2026 716 244 194 31 71 33 6.1% Freestone Island, Bristol Noms 2027 500 111 76 16 58 18 7.4% Central Quay, Glasgow Noms/DL 2027 934 164 126 18 107 30 7.4% Kings Place, London DL 2027 444 238 167 68 99 46 6.6% Meridian Square, Stratford Noms 2028 952 299 217 60 143 49 6.4% Total off-campus pipeline 4,570 1,253 921 241 533 186 6.7% University JV Castle Leazes, Newcastle2,4 JV 2028/29 2,000 291 250 10 240 16 7.3% Total committed pipeline 6,570 1,401 1,171 251 773 202 6.8% Future pipeline TP Paddington, London2 Noms 2029 605 178 2 171 6.0% Elephant & Castle, London2 Noms 2028 501 127 4 122 6.5% Total future pipeline 1,106 305 6 293 6.2% Total pipeline (gross) 7,676 1,475 258 1,066 6.7% Total pipeline (Unite share) 1,353 252 949 6.7% 1. Direct-let (DL), Nominated (Noms) and Joint Venture (JV). 2. Subject to obtaining planning consent. 3. Yield on cost assumes the sale of academic space for c.£45 million. 4. Unite share 51%. Yield on cost includes management fees in NOI and deducts development management fee from costs. INVESTMENT ACTIVITY ALIGNED TO THE STRONGEST UNIVERSITIES Acquisitions Higher interest rates have increased our cost of capital. This increases the attractiveness of income today compared to income in the future, to which we now apply a higher discount rate. As a result, acquisition opportunities which are immediately income- generating have increased in attractiveness when compared to developments, which deliver income in future years. We expect increasing volumes of PBSA assets to come to market in 2025 and are focused on opportunities in our strongest markets aligned to high-quality universities, where we see the ability to deliver attractive rental growth over the long term. Following our capital raise in July, we acquired seven assets for £244 million from USAF as part of a property swap. The acquired assets are located in strong markets (Bristol, Cardiff and Liverpool) and offer value-add opportunities through refurbishment as existing nominations expire over the next two to three years. During the year we also acquired the freehold interest of a 260- bed property in London for £37 million, which the Group had previously sold and leased back, from the freeholder. The property was acquired at below replacement cost, off affordable rents and we are planning a refurbishment upon expiry of a nomination agreement in 2026. Disposals We continue to manage the quality of the portfolio and our balance sheet leverage by recycling capital through disposals. During the year we completed the sale of six properties to PGIM Real Estate for £184 million (Unite share: £76 million). The disposals were priced at a blended 6.2% yield and in line with book value after deductions for fire safety works. Following our capital raise in July, we sold two assets to USAF for £120 million as part of a property swap. The assets, located in Bristol and Liverpool, offer modern, high-quality accommodation with 58% of beds let under university nomination agreements. We will continue to recycle capital from disposals to maintain LTV around our c.30% target and net debt: EBITDA in the 6-7x range. The level of planned disposals will adjust to reflect capital requirements for our development and asset management activity as well as market pricing. We will target future disposals of around £100-150 million p.a. (Unite share). Asset management We see significant opportunities to create value through asset management projects in our existing estate. Refurbishment ranges from smaller projects focused on upgrading communal areas and energy efficiency, through to full building refurbishment or more significant works such as extension or redevelopment. These projects have shorter lead times than new developments, often carried out over the summer period, and deliver both attractive risk-adjusted returns and significant enhancements to the student experience.

Home for Success: Unite Students Annual Report 2024 Page 33 Page 35

Home for Success: Unite Students Annual Report 2024 Page 33 Page 35