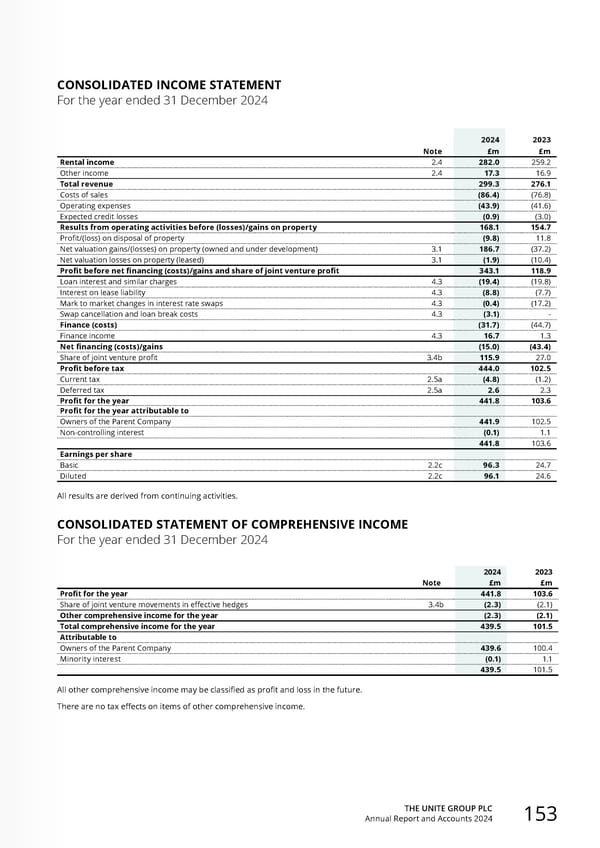

THE UNITE GROUP PLC Annual Report and Accounts 2024 153 2024 2023 Note £m £m Rental income 2.4 282.0 259.2 Other income 2.4 17.3 16.9 Total revenue 299.3 276.1 Costs of sales (86.4) (76.8) Operating expenses (43.9) (41.6) Expected credit losses (0.9) (3.0) Results from operating activities before (losses)/gains on property 168.1 154.7 Profit/(loss) on disposal of property (9.8) 11.8 Net valuation gains/(losses) on property (owned and under development) 3.1 186.7 (37.2) Net valuation losses on property (leased) 3.1 (1.9) (10.4) Profit before net financing (costs)/gains and share of joint venture profit 343.1 118.9 Loan interest and similar charges 4.3 (19.4) (19.8) Interest on lease liability 4.3 (8.8) (7.7) Mark to market changes in interest rate swaps 4.3 (0.4) (17.2) Swap cancellation and loan break costs 4.3 (3.1) - Finance (costs) (31.7) (44.7) Finance income 4.3 16.7 1.3 Net financing (costs)/gains (15.0) (43.4) Share of joint venture profit 3.4b 115.9 27.0 Profit before tax 444.0 102.5 Current tax 2.5a (4.8) (1.2) Deferred tax 2.5a 2.6 2.3 Profit for the year 441.8 103.6 Profit for the year attributable to Owners of the Parent Company 441.9 102.5 Non-controlling interest (0.1) 1.1 441.8 103.6 Earnings per share Basic 2.2c 96.3 24.7 Diluted 2.2c 96.1 24.6 All results are derived from continuing activities. CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME For the year ended 31 December 2024 2024 2023 Note £m £m Profit for the year 441.8 103.6 Share of joint venture movements in effective hedges 3.4b (2.3) (2.1) Other comprehensive income for the year (2.3) (2.1) Total comprehensive income for the year 439.5 101.5 Attributable to Owners of the Parent Company 439.6 100.4 Minority interest (0.1) 1.1 439.5 101.5 All other comprehensive income may be classified as profit and loss in the future. There are no tax effects on items of other comprehensive income. CONSOLIDATED INCOME STATEMENT For the year ended 31 December 2024

Home for Success: Unite Students Annual Report 2024 Page 154 Page 156

Home for Success: Unite Students Annual Report 2024 Page 154 Page 156