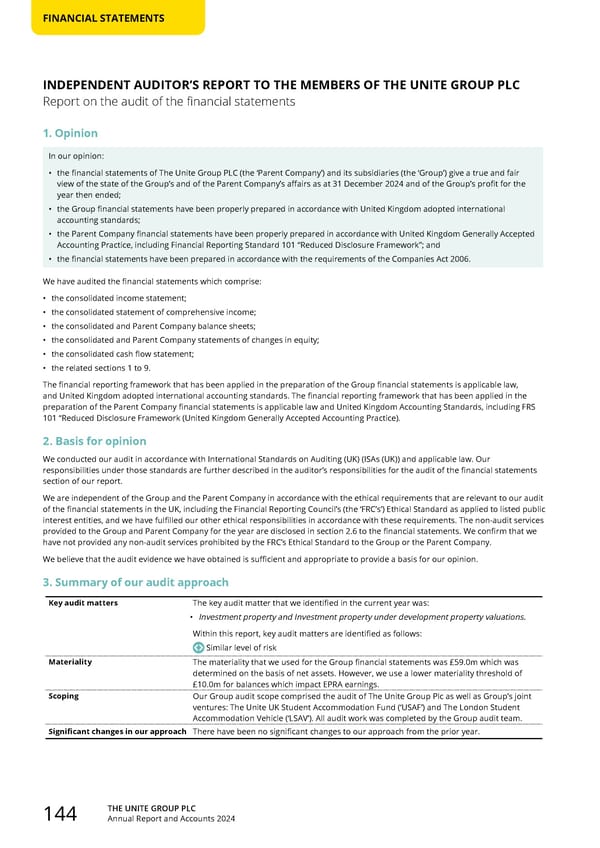

THE UNITE GROUP PLC Annual Report and Accounts 2024 144 FINANCIAL STATEMENTS INDEPENDENT AUDITOR’S REPORT TO THE MEMBERS OF THE UNITE GROUP PLC Report on the audit of the financial statements 1. Opinion In our opinion: • the financial statements of The Unite Group PLC (the ‘Parent Company’) and its subsidiaries (the ‘Group’) give a true and fair view of the state of the Group’s and of the Parent Company’s affairs as at 31 December 2024 and of the Group’s profit for the year then ended; • the Group financial statements have been properly prepared in accordance with United Kingdom adopted international accounting standards; • the Parent Company financial statements have been properly prepared in accordance with United Kingdom Generally Accepted Accounting Practice, including Financial Reporting Standard 101 “Reduced Disclosure Framework”; and • the financial statements have been prepared in accordance with the requirements of the Companies Act 2006. We have audited the financial statements which comprise: • the consolidated income statement; • the consolidated statement of comprehensive income; • the consolidated and Parent Company balance sheets; • the consolidated and Parent Company statements of changes in equity; • the consolidated cash flow statement; • the related sections 1 to 9. The financial reporting framework that has been applied in the preparation of the Group financial statements is applicable law, and United Kingdom adopted international accounting standards. The financial reporting framework that has been applied in the preparation of the Parent Company financial statements is applicable law and United Kingdom Accounting Standards, including FRS 101 “Reduced Disclosure Framework (United Kingdom Generally Accepted Accounting Practice). 2. Basis for opinion We conducted our audit in accordance with International Standards on Auditing (UK) (ISAs (UK)) and applicable law. Our responsibilities under those standards are further described in the auditor’s responsibilities for the audit of the financial statements section of our report. We are independent of the Group and the Parent Company in accordance with the ethical requirements that are relevant to our audit of the financial statements in the UK, including the Financial Reporting Council’s (the ‘FRC’s’) Ethical Standard as applied to listed public interest entities, and we have fulfilled our other ethical responsibilities in accordance with these requirements. The non-audit services provided to the Group and Parent Company for the year are disclosed in section 2.6 to the financial statements. We confirm that we have not provided any non-audit services prohibited by the FRC’s Ethical Standard to the Group or the Parent Company. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion. 3. Summary of our audit approach Key audit matters The key audit matter that we identified in the current year was: • Investment property and Investment property under development property valuations. Within this report, key audit matters are identified as follows: Similar level of risk Materiality The materiality that we used for the Group financial statements was £59.0m which was determined on the basis of net assets. However, we use a lower materiality threshold of £10.0m for balances which impact EPRA earnings. Scoping Our Group audit scope comprised the audit of The Unite Group Plc as well as Group’s joint ventures: The Unite UK Student Accommodation Fund (‘USAF’) and The London Student Accommodation Vehicle (‘LSAV’). All audit work was completed by the Group audit team. Significant changes in our approach There have been no significant changes to our approach from the prior year.

Home for Success: Unite Students Annual Report 2024 Page 145 Page 147

Home for Success: Unite Students Annual Report 2024 Page 145 Page 147