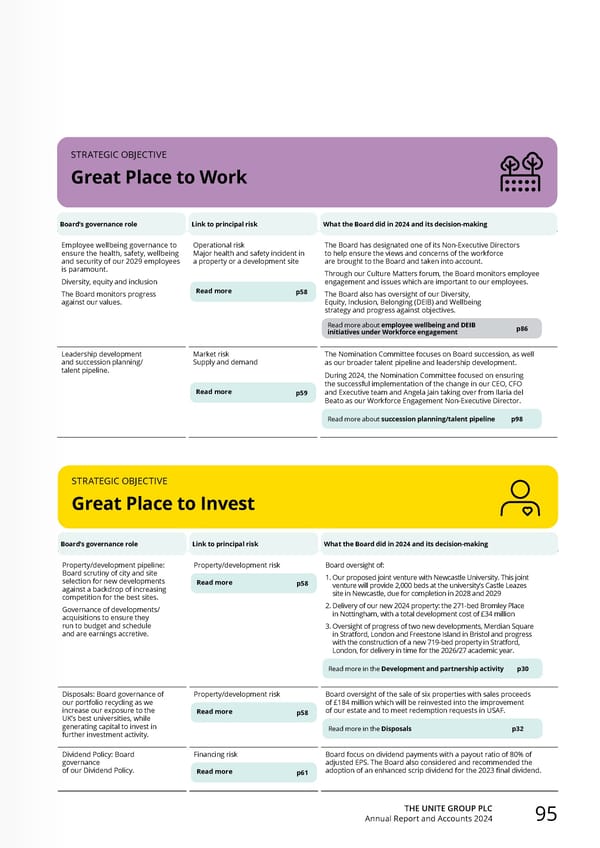

THE UNITE GROUP PLC Annual Report and Accounts 2024 95 STRATEGIC OBJECTIVE Great Place to Work Board’s governance role Link to principal risk What the Board did in 2024 and its decision-making Employee wellbeing governance to ensure the health, safety, wellbeing and security of our 2029 employees is paramount. Diversity, equity and inclusion The Board monitors progress against our values. Operational risk Major health and safety incident in a property or a development site Read more p58 The Board has designated one of its Non-Executive Directors to help ensure the views and concerns of the workforce are brought to the Board and taken into account. Through our Culture Matters forum, the Board monitors employee engagement and issues which are important to our employees. The Board also has oversight of our Diversity, Equity, Inclusion, Belonging (DEIB) and Wellbeing strategy and progress against objectives. Read more about employee wellbeing and DEIB initiatives under Workforce engagement p86 Leadership development and succession planning/ talent pipeline. Market risk Supply and demand Read more p59 The Nomination Committee focuses on Board succession, as well as our broader talent pipeline and leadership development. During 2024, the Nomination Committee focused on ensuring the successful implementation of the change in our CEO, CFO and Executive team and Angela Jain taking over from Ilaria del Beato as our Workforce Engagement Non-Executive Director. Read more about succession planning/talent pipeline p98 STRATEGIC OBJECTIVE Great Place to Invest Board’s governance role Link to principal risk What the Board did in 2024 and its decision-making Property/development pipeline: Board scrutiny of city and site selection for new developments against a backdrop of increasing competition for the best sites. Governance of developments/ acquisitions to ensure they run to budget and schedule and are earnings accretive. Property/development risk Read more p58 Board oversight of: 1. Our proposed joint venture with Newcastle University. This joint venture will provide 2,000 beds at the university’s Castle Leazes site in Newcastle, due for completion in 2028 and 2029 2. Delivery of our new 2024 property: the 271-bed Bromley Place in Nottingham, with a total development cost of £34 million 3. Oversight of progress of two new developments, Merdian Square in Stratford, London and Freestone Island in Bristol and progress with the construction of a new 719-bed property in Stratford, London, for delivery in time for the 2026/27 academic year. Read more in the Development and partnership activity p30 Disposals: Board governance of our portfolio recycling as we increase our exposure to the UK’s best universities, while generating capital to invest in further investment activity. Property/development risk Read more p58 Board oversight of the sale of six properties with sales proceeds of £184 million which will be reinvested into the improvement of our estate and to meet redemption requests in USAF. Read more in the Disposals p32 Dividend Policy: Board governance of our Dividend Policy. Financing risk Read more p61 Board focus on dividend payments with a payout ratio of 80% of adjusted EPS. The Board also considered and recommended the adoption of an enhanced scrip dividend for the 2023 final dividend.

Home for Success: Unite Students Annual Report 2024 Page 96 Page 98

Home for Success: Unite Students Annual Report 2024 Page 96 Page 98