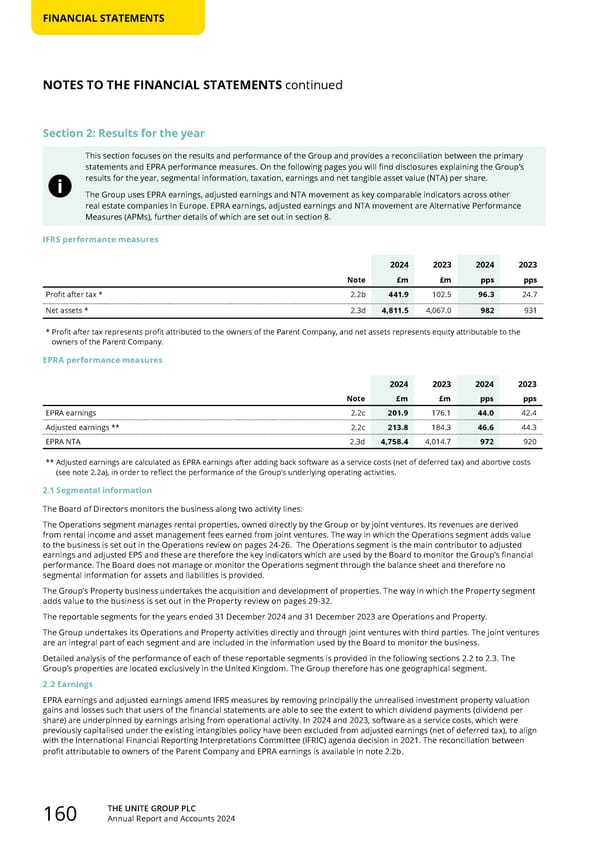

THE UNITE GROUP PLC Annual Report and Accounts 2024 160 FINANCIAL STATEMENTS NOTES TO THE FINANCIAL STATEMENTS continued Section 2: Results for the year This section focuses on the results and performance of the Group and provides a reconciliation between the primary statements and EPRA performance measures. On the following pages you will find disclosures explaining the Group’s results for the year, segmental information, taxation, earnings and net tangible asset value (NTA) per share. The Group uses EPRA earnings, adjusted earnings and NTA movement as key comparable indicators across other real estate companies in Europe. EPRA earnings, adjusted earnings and NTA movement are Alternative Performance Measures (APMs), further details of which are set out in section 8. IFRS performance measures 2024 2023 2024 2023 Note £m £m pps pps Profit after tax * 2.2b 441.9 102.5 96.3 24.7 Net assets * 2.3d 4,811.5 4,067.0 982 931 * Profit after tax represents profit attributed to the owners of the Parent Company, and net assets represents equity attributable to the owners of the Parent Company. EPRA performance measures 2024 2023 2024 2023 Note £m £m pps pps EPRA earnings 2.2c 201.9 176.1 44.0 42.4 Adjusted earnings ** 2.2c 213.8 184.3 46.6 44.3 EPRA NTA 2.3d 4,758.4 4,014.7 972 920 ** Adjusted earnings are calculated as EPRA earnings after adding back software as a service costs (net of deferred tax) and abortive costs (see note 2.2a), in order to reflect the performance of the Group’s underlying operating activities. 2.1 Segmental information The Board of Directors monitors the business along two activity lines: The Operations segment manages rental properties, owned directly by the Group or by joint ventures. Its revenues are derived from rental income and asset management fees earned from joint ventures. The way in which the Operations segment adds value to the business is set out in the Operations review on pages 24-26. The Operations segment is the main contributor to adjusted earnings and adjusted EPS and these are therefore the key indicators which are used by the Board to monitor the Group’s financial performance. The Board does not manage or monitor the Operations segment through the balance sheet and therefore no segmental information for assets and liabilities is provided. The Group’s Property business undertakes the acquisition and development of properties. The way in which the Property segment adds value to the business is set out in the Property review on pages 29-32. The reportable segments for the years ended 31 December 2024 and 31 December 2023 are Operations and Property. The Group undertakes its Operations and Property activities directly and through joint ventures with third parties. The joint ventures are an integral part of each segment and are included in the information used by the Board to monitor the business. Detailed analysis of the performance of each of these reportable segments is provided in the following sections 2.2 to 2.3. The Group’s properties are located exclusively in the United Kingdom. The Group therefore has one geographical segment. 2.2 Earnings EPRA earnings and adjusted earnings amend IFRS measures by removing principally the unrealised investment property valuation gains and losses such that users of the financial statements are able to see the extent to which dividend payments (dividend per share) are underpinned by earnings arising from operational activity. In 2024 and 2023, software as a service costs, which were previously capitalised under the existing intangibles policy have been excluded from adjusted earnings (net of deferred tax), to align with the International Financial Reporting Interpretations Committee (IFRIC) agenda decision in 2021. The reconciliation between profit attributable to owners of the Parent Company and EPRA earnings is available in note 2.2b.

Home for Success: Unite Students Annual Report 2024 Page 161 Page 163

Home for Success: Unite Students Annual Report 2024 Page 161 Page 163