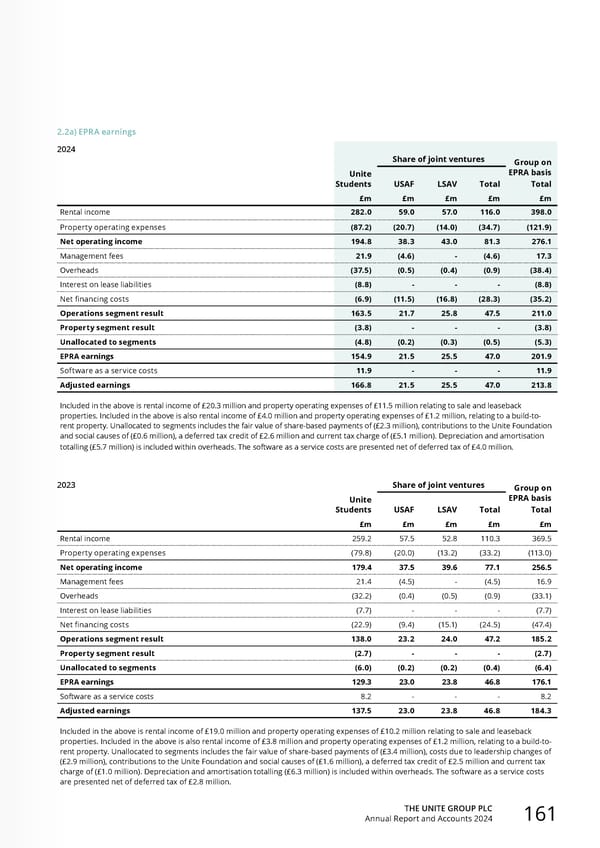

THE UNITE GROUP PLC Annual Report and Accounts 2024 161 2.2a) EPRA earnings 2024 Share of joint ventures Group on EPRA basis Unite Students USAF LSAV Total Total £m £m £m £m £m Rental income 282.0 59.0 57.0 116.0 398.0 Property operating expenses (87.2) (20.7) (14.0) (34.7) (121.9) Net operating income 194.8 38.3 43.0 81.3 276.1 Management fees 21.9 (4.6) - (4.6) 17.3 Overheads (37.5) (0.5) (0.4) (0.9) (38.4) Interest on lease liabilities (8.8) - - - (8.8) Net financing costs (6.9) (11.5) (16.8) (28.3) (35.2) Operations segment result 163.5 21.7 25.8 47.5 211.0 Property segment result (3.8) - - - (3.8) Unallocated to segments (4.8) (0.2) (0.3) (0.5) (5.3) EPRA earnings 154.9 21.5 25.5 47.0 201.9 Software as a service costs 11.9 - - - 11.9 Adjusted earnings 166.8 21.5 25.5 47.0 213.8 Included in the above is rental income of £20.3 million and property operating expenses of £11.5 million relating to sale and leaseback properties. Included in the above is also rental income of £4.0 million and property operating expenses of £1.2 million, relating to a build-to- rent property. Unallocated to segments includes the fair value of share-based payments of (£2.3 million), contributions to the Unite Foundation and social causes of (£0.6 million), a deferred tax credit of £2.6 million and current tax charge of (£5.1 million). Depreciation and amortisation totalling (£5.7 million) is included within overheads. The software as a service costs are presented net of deferred tax of £4.0 million. 2023 Share of joint ventures Group on EPRA basis Unite Students USAF LSAV Total Total £m £m £m £m £m Rental income 259.2 57.5 52.8 110.3 369.5 Property operating expenses (79.8) (20.0) (13.2) (33.2) (113.0) Net operating income 179.4 37.5 39.6 77.1 256.5 Management fees 21.4 (4.5) - (4.5) 16.9 Overheads (32.2) (0.4) (0.5) (0.9) (33.1) Interest on lease liabilities (7.7) - - - (7.7) Net financing costs (22.9) (9.4) (15.1) (24.5) (47.4) Operations segment result 138.0 23.2 24.0 47.2 185.2 Property segment result (2.7) - - - (2.7) Unallocated to segments (6.0) (0.2) (0.2) (0.4) (6.4) EPRA earnings 129.3 23.0 23.8 46.8 176.1 Software as a service costs 8.2 - - - 8.2 Adjusted earnings 137.5 23.0 23.8 46.8 184.3 Included in the above is rental income of £19.0 million and property operating expenses of £10.2 million relating to sale and leaseback properties. Included in the above is also rental income of £3.8 million and property operating expenses of £1.2 million, relating to a build-to- rent property. Unallocated to segments includes the fair value of share-based payments of (£3.4 million), costs due to leadership changes of (£2.9 million), contributions to the Unite Foundation and social causes of (£1.6 million), a deferred tax credit of £2.5 million and current tax charge of (£1.0 million). Depreciation and amortisation totalling (£6.3 million) is included within overheads. The software as a service costs are presented net of deferred tax of £2.8 million.

Home for Success: Unite Students Annual Report 2024 Page 162 Page 164

Home for Success: Unite Students Annual Report 2024 Page 162 Page 164