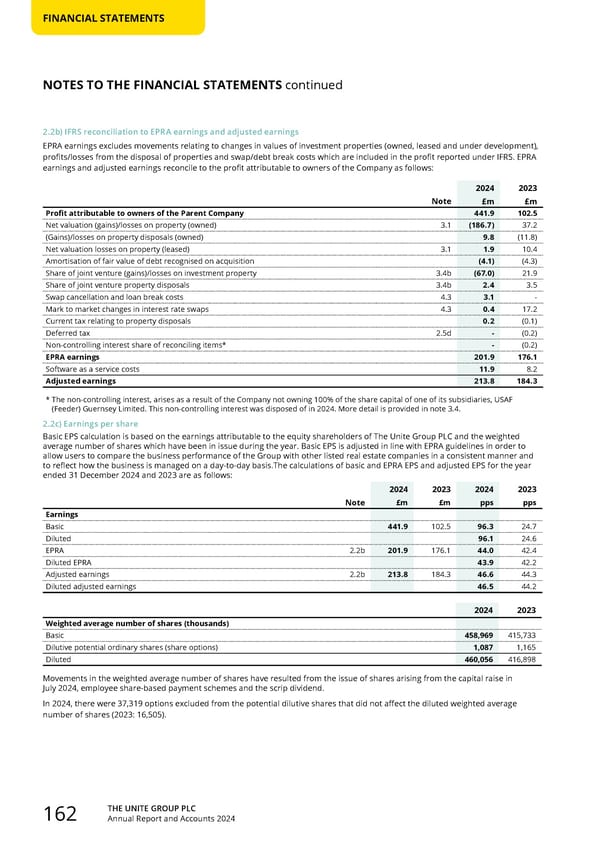

THE UNITE GROUP PLC Annual Report and Accounts 2024 162 FINANCIAL STATEMENTS NOTES TO THE FINANCIAL STATEMENTS continued 2.2b) IFRS reconciliation to EPRA earnings and adjusted earnings EPRA earnings excludes movements relating to changes in values of investment properties (owned, leased and under development), profits/losses from the disposal of properties and swap/debt break costs which are included in the profit reported under IFRS. EPRA earnings and adjusted earnings reconcile to the profit attributable to owners of the Company as follows: Note 2024 2023 £m £m Profit attributable to owners of the Parent Company 441.9 102.5 Net valuation (gains)/losses on property (owned) 3.1 (186.7) 37.2 (Gains)/losses on property disposals (owned) 9.8 (11.8) Net valuation losses on property (leased) 3.1 1.9 10.4 Amortisation of fair value of debt recognised on acquisition (4.1) (4.3) Share of joint venture (gains)/losses on investment property 3.4b (67.0) 21.9 Share of joint venture property disposals 3.4b 2.4 3.5 Swap cancellation and loan break costs 4.3 3.1 - Mark to market changes in interest rate swaps 4.3 0.4 17.2 Current tax relating to property disposals 0.2 (0.1) Deferred tax 2.5d - (0.2) Non-controlling interest share of reconciling items* - (0.2) EPRA earnings 201.9 176.1 Software as a service costs 11.9 8.2 Adjusted earnings 213.8 184.3 * The non-controlling interest, arises as a result of the Company not owning 100% of the share capital of one of its subsidiaries, USAF (Feeder) Guernsey Limited. This non-controlling interest was disposed of in 2024. More detail is provided in note 3.4. 2.2c) Earnings per share Basic EPS calculation is based on the earnings attributable to the equity shareholders of The Unite Group PLC and the weighted average number of shares which have been in issue during the year. Basic EPS is adjusted in line with EPRA guidelines in order to allow users to compare the business performance of the Group with other listed real estate companies in a consistent manner and to reflect how the business is managed on a day-to-day basis.The calculations of basic and EPRA EPS and adjusted EPS for the year ended 31 December 2024 and 2023 are as follows: Note 2024 2023 2024 2023 £m £m pps pps Earnings Basic 441.9 102.5 96.3 24.7 Diluted 96.1 24.6 EPRA 2.2b 201.9 176.1 44.0 42.4 Diluted EPRA 43.9 42.2 Adjusted earnings 2.2b 213.8 184.3 46.6 44.3 Diluted adjusted earnings 46.5 44.2 2024 2023 Weighted average number of shares (thousands) Basic 458,969 415,733 Dilutive potential ordinary shares (share options) 1,087 1,165 Diluted 460,056 416,898 Movements in the weighted average number of shares have resulted from the issue of shares arising from the capital raise in July 2024, employee share-based payment schemes and the scrip dividend. In 2024, there were 37,319 options excluded from the potential dilutive shares that did not affect the diluted weighted average number of shares (2023: 16,505).

Home for Success: Unite Students Annual Report 2024 Page 163 Page 165

Home for Success: Unite Students Annual Report 2024 Page 163 Page 165