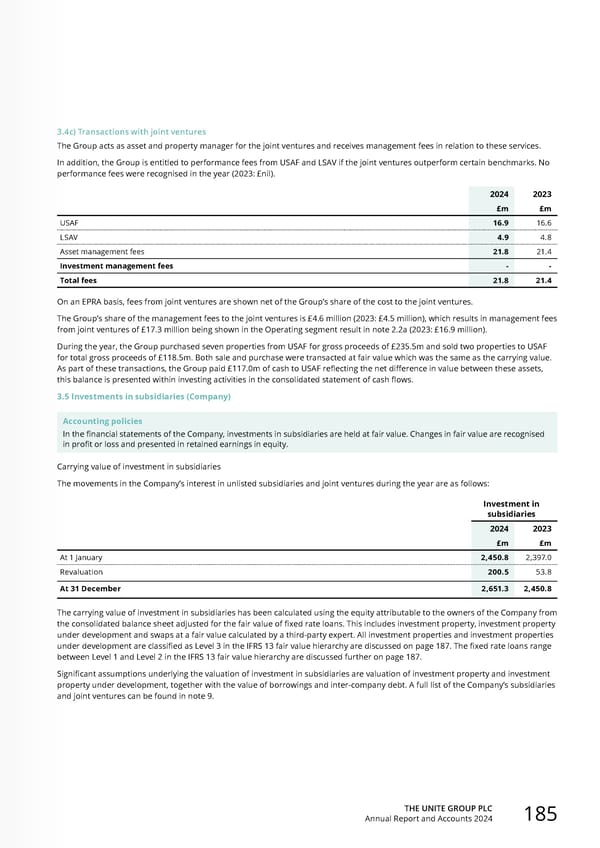

THE UNITE GROUP PLC Annual Report and Accounts 2024 185 3.4c) Transactions with joint ventures The Group acts as asset and property manager for the joint ventures and receives management fees in relation to these services. In addition, the Group is entitled to performance fees from USAF and LSAV if the joint ventures outperform certain benchmarks. No performance fees were recognised in the year (2023: £nil). 2024 2023 £m £m USAF 16.9 16.6 LSAV 4.9 4.8 Asset management fees 21.8 21.4 Investment management fees - - Total fees 21.8 21.4 On an EPRA basis, fees from joint ventures are shown net of the Group’s share of the cost to the joint ventures. The Group’s share of the management fees to the joint ventures is £4.6 million (2023: £4.5 million), which results in management fees from joint ventures of £17.3 million being shown in the Operating segment result in note 2.2a (2023: £16.9 million). During the year, the Group purchased seven properties from USAF for gross proceeds of £235.5m and sold two properties to USAF for total gross proceeds of £118.5m. Both sale and purchase were transacted at fair value which was the same as the carrying value. As part of these transactions, the Group paid £117.0m of cash to USAF reflecting the net difference in value between these assets, this balance is presented within investing activities in the consolidated statement of cash flows. 3.5 Investments in subsidiaries (Company) Accounting policies In the financial statements of the Company, investments in subsidiaries are held at fair value. Changes in fair value are recognised in profit or loss and presented in retained earnings in equity. Carrying value of investment in subsidiaries The movements in the Company’s interest in unlisted subsidiaries and joint ventures during the year are as follows: Investment in subsidiaries 2024 2023 £m £m At 1 January 2,450.8 2,397.0 Revaluation 200.5 53.8 At 31 December 2,651.3 2,450.8 The carrying value of investment in subsidiaries has been calculated using the equity attributable to the owners of the Company from the consolidated balance sheet adjusted for the fair value of fixed rate loans. This includes investment property, investment property under development and swaps at a fair value calculated by a third-party expert. All investment properties and investment properties under development are classified as Level 3 in the IFRS 13 fair value hierarchy are discussed on page 187. The fixed rate loans range between Level 1 and Level 2 in the IFRS 13 fair value hierarchy are discussed further on page 187. Significant assumptions underlying the valuation of investment in subsidiaries are valuation of investment property and investment property under development, together with the value of borrowings and inter-company debt. A full list of the Company’s subsidiaries and joint ventures can be found in note 9.

Home for Success: Unite Students Annual Report 2024 Page 186 Page 188

Home for Success: Unite Students Annual Report 2024 Page 186 Page 188