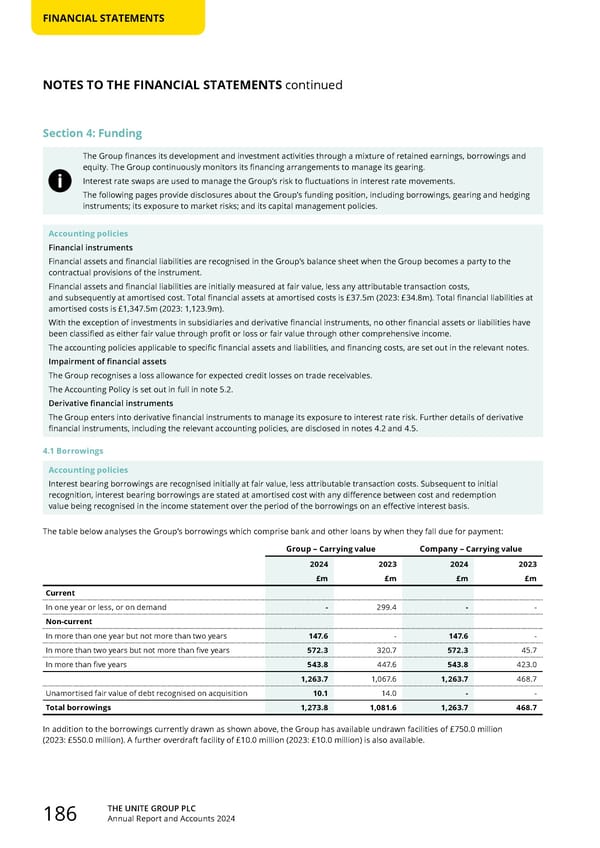

THE UNITE GROUP PLC Annual Report and Accounts 2024 186 FINANCIAL STATEMENTS Section 4: Funding The Group finances its development and investment activities through a mixture of retained earnings, borrowings and equity. The Group continuously monitors its financing arrangements to manage its gearing. Interest rate swaps are used to manage the Group’s risk to fluctuations in interest rate movements. The following pages provide disclosures about the Group’s funding position, including borrowings, gearing and hedging instruments; its exposure to market risks; and its capital management policies. Accounting policies Financial instruments Financial assets and financial liabilities are recognised in the Group’s balance sheet when the Group becomes a party to the contractual provisions of the instrument. Financial assets and financial liabilities are initially measured at fair value, less any attributable transaction costs, and subsequently at amortised cost. Total financial assets at amortised costs is £37.5m (2023: £34.8m). Total financial liabilities at amortised costs is £1,347.5m (2023: 1,123.9m). With the exception of investments in subsidiaries and derivative financial instruments, no other financial assets or liabilities have been classified as either fair value through profit or loss or fair value through other comprehensive income. The accounting policies applicable to specific financial assets and liabilities, and financing costs, are set out in the relevant notes. Impairment of financial assets The Group recognises a loss allowance for expected credit losses on trade receivables. The Accounting Policy is set out in full in note 5.2. Derivative financial instruments The Group enters into derivative financial instruments to manage its exposure to interest rate risk. Further details of derivative financial instruments, including the relevant accounting policies, are disclosed in notes 4.2 and 4.5. 4.1 Borrowings Accounting policies Interest bearing borrowings are recognised initially at fair value, less attributable transaction costs. Subsequent to initial recognition, interest bearing borrowings are stated at amortised cost with any difference between cost and redemption value being recognised in the income statement over the period of the borrowings on an effective interest basis. The table below analyses the Group’s borrowings which comprise bank and other loans by when they fall due for payment: Group – Carrying value Company – Carrying value 2024 2023 2024 2023 £m £m £m £m Current In one year or less, or on demand - 299.4 - - Non-current In more than one year but not more than two years 147.6 - 147.6 - In more than two years but not more than five years 572.3 320.7 572.3 45.7 In more than five years 543.8 447.6 543.8 423.0 1,263.7 1,067.6 1,263.7 468.7 Unamortised fair value of debt recognised on acquisition 10.1 14.0 - - Total borrowings 1,273.8 1,081.6 1,263.7 468.7 In addition to the borrowings currently drawn as shown above, the Group has available undrawn facilities of £750.0 million (2023: £550.0 million). A further overdraft facility of £10.0 million (2023: £10.0 million) is also available. NOTES TO THE FINANCIAL STATEMENTS continued

Home for Success: Unite Students Annual Report 2024 Page 187 Page 189

Home for Success: Unite Students Annual Report 2024 Page 187 Page 189