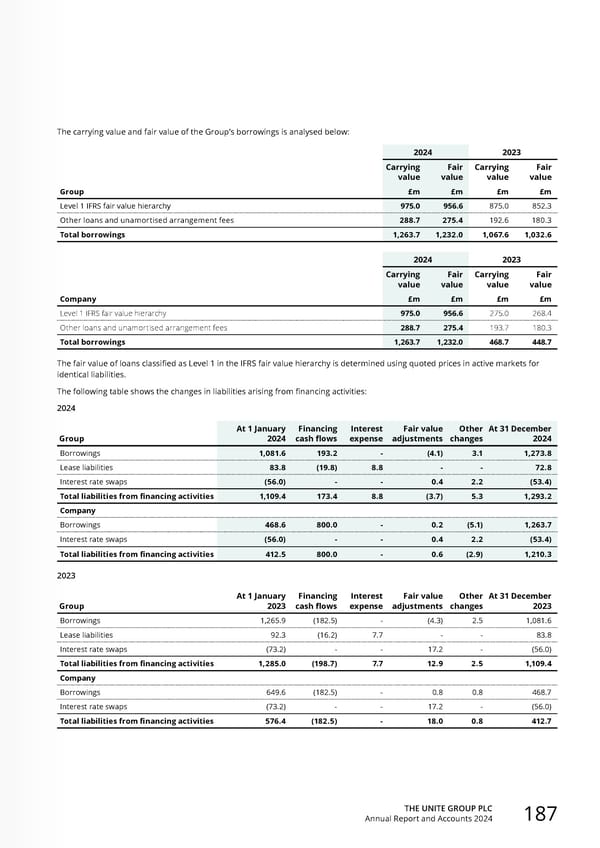

THE UNITE GROUP PLC Annual Report and Accounts 2024 187 The carrying value and fair value of the Group’s borrowings is analysed below: 2024 2023 Group Carrying value Fair value Carrying value Fair value £m £m £m £m Level 1 IFRS fair value hierarchy 975.0 956.6 875.0 852.3 Other loans and unamortised arrangement fees 288.7 275.4 192.6 180.3 Total borrowings 1,263.7 1,232.0 1,067.6 1,032.6 2024 2023 Company Carrying value Fair value Carrying value Fair value £m £m £m £m Level 1 IFRS fair value hierarchy 975.0 956.6 275.0 268.4 Other loans and unamortised arrangement fees 288.7 275.4 193.7 180.3 Total borrowings 1,263.7 1,232.0 468.7 448.7 The fair value of loans classified as Level 1 in the IFRS fair value hierarchy is determined using quoted prices in active markets for identical liabilities. The following table shows the changes in liabilities arising from financing activities: 2024 Group At 1 January 2024 Financing cash flows Interest expense Fair value adjustments Other changes At 31 December 2024 Borrowings 1,081.6 193.2 - (4.1) 3.1 1,273.8 Lease liabilities 83.8 (19.8) 8.8 - - 72.8 Interest rate swaps (56.0) - - 0.4 2.2 (53.4) Total liabilities from financing activities 1,109.4 173.4 8.8 (3.7) 5.3 1,293.2 Company Borrowings 468.6 800.0 - 0.2 (5.1) 1,263.7 Interest rate swaps (56.0) - - 0.4 2.2 (53.4) Total liabilities from financing activities 412.5 800.0 - 0.6 (2.9) 1,210.3 2023 Group At 1 January 2023 Financing cash flows Interest expense Fair value adjustments Other changes At 31 December 2023 Borrowings 1,265.9 (182.5) - (4.3) 2.5 1,081.6 Lease liabilities 92.3 (16.2) 7.7 - - 83.8 Interest rate swaps (73.2) - - 17.2 - (56.0) Total liabilities from financing activities 1,285.0 (198.7) 7.7 12.9 2.5 1,109.4 Company Borrowings 649.6 (182.5) - 0.8 0.8 468.7 Interest rate swaps (73.2) - - 17.2 - (56.0) Total liabilities from financing activities 576.4 (182.5) - 18.0 0.8 412.7

Home for Success: Unite Students Annual Report 2024 Page 188 Page 190

Home for Success: Unite Students Annual Report 2024 Page 188 Page 190