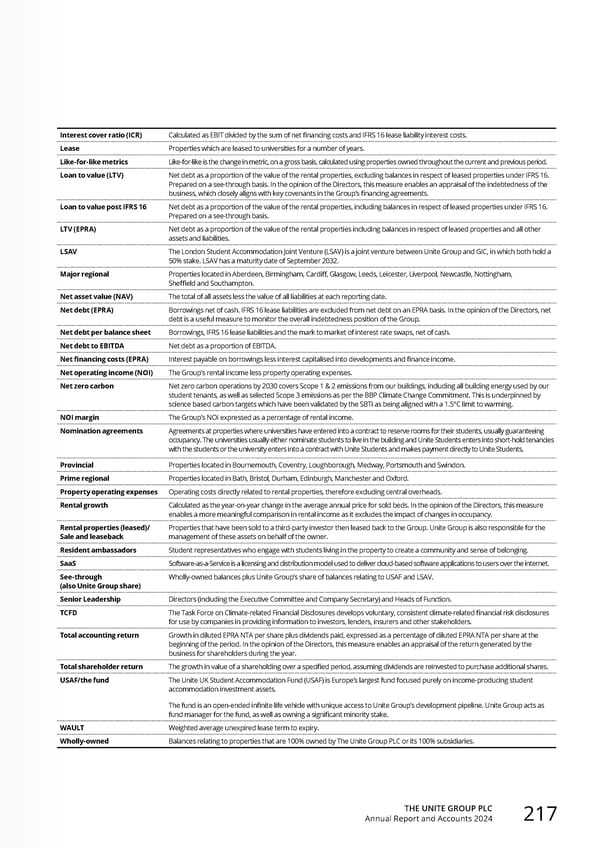

THE UNITE GROUP PLC Annual Report and Accounts 2024 217 Interest cover ratio (ICR) Calculated as EBIT divided by the sum of net financing costs and IFRS 16 lease liability interest costs. Lease Properties which are leased to universities for a number of years. Like-for-like metrics Like-for-like is the change in metric, on a gross basis, calculated using properties owned throughout the current and previous period. Loan to value (LTV) Net debt as a proportion of the value of the rental properties, excluding balances in respect of leased properties under IFRS 16. Prepared on a see-through basis. In the opinion of the Directors, this measure enables an appraisal of the indebtedness of the business, which closely aligns with key covenants in the Group’s financing agreements. Loan to value post IFRS 16 Net debt as a proportion of the value of the rental properties, including balances in respect of leased properties under IFRS 16. Prepared on a see-through basis. LTV (EPRA) Net debt as a proportion of the value of the rental properties including balances in respect of leased properties and all other assets and liabilities. LSAV The London Student Accommodation Joint Venture (LSAV) is a joint venture between Unite Group and GIC, in which both hold a 50% stake. LSAV has a maturity date of September 2032. Major regional Properties located in Aberdeen, Birmingham, Cardiff, Glasgow, Leeds, Leicester, Liverpool, Newcastle, Nottingham, Sheffield and Southampton. Net asset value (NAV) The total of all assets less the value of all liabilities at each reporting date. Net debt (EPRA) Borrowings net of cash. IFRS 16 lease liabilities are excluded from net debt on an EPRA basis. In the opinion of the Directors, net debt is a useful measure to monitor the overall indebtedness position of the Group. Net debt per balance sheet Borrowings, IFRS 16 lease liabilities and the mark to market of interest rate swaps, net of cash. Net debt to EBITDA Net debt as a proportion of EBITDA. Net financing costs (EPRA) Interest payable on borrowings less interest capitalised into developments and finance income. Net operating income (NOI) The Group’s rental income less property operating expenses. Net zero carbon Net zero carbon operations by 2030 covers Scope 1 & 2 emissions from our buildings, including all building energy used by our student tenants, as well as selected Scope 3 emissions as per the BBP Climate Change Commitment. This is underpinned by science based carbon targets which have been validated by the SBTi as being aligned with a 1.5°C limit to warming. NOI margin The Group’s NOI expressed as a percentage of rental income. Nomination agreements Agreements at properties where universities have entered into a contract to reserve rooms for their students, usually guaranteeing occupancy. The universities usually either nominate students to live in the building and Unite Students enters into short-hold tenancies with the students or the university enters into a contract with Unite Students and makes payment directly to Unite Students. Provincial Properties located in Bournemouth, Coventry, Loughborough, Medway, Portsmouth and Swindon. Prime regional Properties located in Bath, Bristol, Durham, Edinburgh, Manchester and Oxford. Property operating expenses Operating costs directly related to rental properties, therefore excluding central overheads. Rental growth Calculated as the year-on-year change in the average annual price for sold beds. In the opinion of the Directors, this measure enables a more meaningful comparison in rental income as it excludes the impact of changes in occupancy. Rental properties (leased)/ Sale and leaseback Properties that have been sold to a third-party investor then leased back to the Group. Unite Group is also responsible for the management of these assets on behalf of the owner. Resident ambassadors Student representatives who engage with students living in the property to create a community and sense of belonging. SaaS Software-as-a-Service is a licensing and distribution model used to deliver cloud-based software applications to users over the internet. See-through (also Unite Group share) Wholly-owned balances plus Unite Group’s share of balances relating to USAF and LSAV. Senior Leadership Directors (including the Executive Committee and Company Secretary) and Heads of Function. TCFD The Task Force on Climate-related Financial Disclosures develops voluntary, consistent climate-related financial risk disclosures for use by companies in providing information to investors, lenders, insurers and other stakeholders. Total accounting return Growth in diluted EPRA NTA per share plus dividends paid, expressed as a percentage of diluted EPRA NTA per share at the beginning of the period. In the opinion of the Directors, this measure enables an appraisal of the return generated by the business for shareholders during the year. Total shareholder return The growth in value of a shareholding over a specified period, assuming dividends are reinvested to purchase additional shares. USAF/the fund The Unite UK Student Accommodation Fund (USAF) is Europe’s largest fund focused purely on income-producing student accommodation investment assets. The fund is an open-ended infinite life vehicle with unique access to Unite Group’s development pipeline. Unite Group acts as fund manager for the fund, as well as owning a significant minority stake. WAULT Weighted average unexpired lease term to expiry. Wholly-owned Balances relating to properties that are 100% owned by The Unite Group PLC or its 100% subsidiaries.

Home for Success: Unite Students Annual Report 2024 Page 218 Page 220

Home for Success: Unite Students Annual Report 2024 Page 218 Page 220