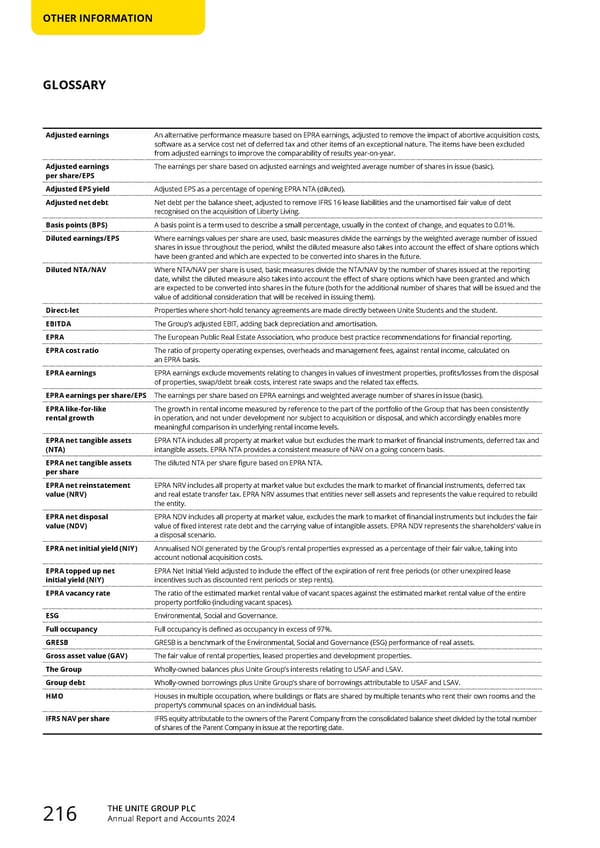

THE UNITE GROUP PLC Annual Report and Accounts 2024 216 OTHER INFORMATION Adjusted earnings An alternative performance measure based on EPRA earnings, adjusted to remove the impact of abortive acquisition costs, software as a service cost net of deferred tax and other items of an exceptional nature. The items have been excluded from adjusted earnings to improve the comparability of results year-on-year. Adjusted earnings per share/EPS The earnings per share based on adjusted earnings and weighted average number of shares in issue (basic). Adjusted EPS yield Adjusted EPS as a percentage of opening EPRA NTA (diluted). Adjusted net debt Net debt per the balance sheet, adjusted to remove IFRS 16 lease liabilities and the unamortised fair value of debt recognised on the acquisition of Liberty Living. Basis points (BPS) A basis point is a term used to describe a small percentage, usually in the context of change, and equates to 0.01%. Diluted earnings/EPS Where earnings values per share are used, basic measures divide the earnings by the weighted average number of issued shares in issue throughout the period, whilst the diluted measure also takes into account the effect of share options which have been granted and which are expected to be converted into shares in the future. Diluted NTA/NAV Where NTA/NAV per share is used, basic measures divide the NTA/NAV by the number of shares issued at the reporting date, whilst the diluted measure also takes into account the effect of share options which have been granted and which are expected to be converted into shares in the future (both for the additional number of shares that will be issued and the value of additional consideration that will be received in issuing them). Direct-let Properties where short-hold tenancy agreements are made directly between Unite Students and the student. EBITDA The Group’s adjusted EBIT, adding back depreciation and amortisation. EPRA The European Public Real Estate Association, who produce best practice recommendations for financial reporting. EPRA cost ratio The ratio of property operating expenses, overheads and management fees, against rental income, calculated on an EPRA basis. EPRA earnings EPRA earnings exclude movements relating to changes in values of investment properties, profits/losses from the disposal of properties, swap/debt break costs, interest rate swaps and the related tax effects. EPRA earnings per share/EPS The earnings per share based on EPRA earnings and weighted average number of shares in issue (basic). EPRA like-for-like rental growth The growth in rental income measured by reference to the part of the portfolio of the Group that has been consistently in operation, and not under development nor subject to acquisition or disposal, and which accordingly enables more meaningful comparison in underlying rental income levels. EPRA net tangible assets (NTA) EPRA NTA includes all property at market value but excludes the mark to market of financial instruments, deferred tax and intangible assets. EPRA NTA provides a consistent measure of NAV on a going concern basis. EPRA net tangible assets per share The diluted NTA per share figure based on EPRA NTA. EPRA net reinstatement value (NRV) EPRA NRV includes all property at market value but excludes the mark to market of financial instruments, deferred tax and real estate transfer tax. EPRA NRV assumes that entities never sell assets and represents the value required to rebuild the entity. EPRA net disposal value (NDV) EPRA NDV includes all property at market value, excludes the mark to market of financial instruments but includes the fair value of fixed interest rate debt and the carrying value of intangible assets. EPRA NDV represents the shareholders’ value in a disposal scenario. EPRA net initial yield (NIY) Annualised NOI generated by the Group’s rental properties expressed as a percentage of their fair value, taking into account notional acquisition costs. EPRA topped up net initial yield (NIY) EPRA Net Initial Yield adjusted to include the effect of the expiration of rent free periods (or other unexpired lease incentives such as discounted rent periods or step rents). EPRA vacancy rate The ratio of the estimated market rental value of vacant spaces against the estimated market rental value of the entire property portfolio (including vacant spaces). ESG Environmental, Social and Governance. Full occupancy Full occupancy is defined as occupancy in excess of 97%. GRESB GRESB is a benchmark of the Environmental, Social and Governance (ESG) performance of real assets. Gross asset value (GAV) The fair value of rental properties, leased properties and development properties. The Group Wholly-owned balances plus Unite Group’s interests relating to USAF and LSAV. Group debt Wholly-owned borrowings plus Unite Group’s share of borrowings attributable to USAF and LSAV. HMO Houses in multiple occupation, where buildings or flats are shared by multiple tenants who rent their own rooms and the property’s communal spaces on an individual basis. IFRS NAV per share IFRS equity attributable to the owners of the Parent Company from the consolidated balance sheet divided by the total number of shares of the Parent Company in issue at the reporting date. GLOSSARY

Home for Success: Unite Students Annual Report 2024 Page 217 Page 219

Home for Success: Unite Students Annual Report 2024 Page 217 Page 219