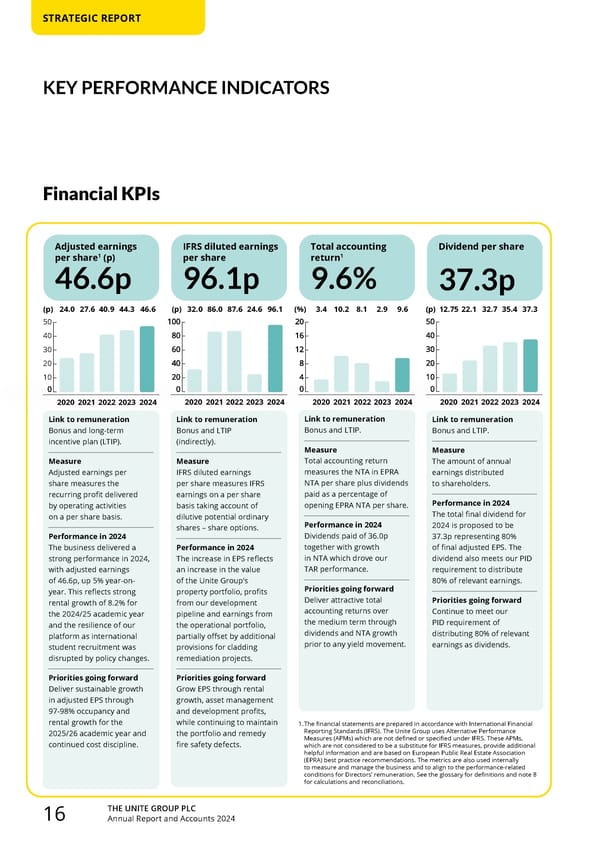

THE UNITE GROUP PLC Annual Report and Accounts 2024 16 10 20 30 40 50 Link to remuneration Bonus and LTIP. Measure Total accounting return measures the NTA in EPRA NTA per share plus dividends paid as a percentage of opening EPRA NTA per share. Performance in 2024 Dividends paid of 36.0p together with growth in NTA which drove our TAR performance. Priorities going forward Deliver attractive total accounting returns over the medium term through dividends and NTA growth prior to any yield movement. 2024 2023 2022 2021 2020 KEY PERFORMANCE INDICATORS STRATEGIC REPORT Financial KPIs 46.6 44.3 40.9 27.6 24.0 (p) (p) (p) (%) 96.1 24.6 87.6 86.0 32.0 9.6 2.9 8.1 10.2 3.4 37.3 35.4 32.7 22.1 12.75 Adjusted earnings per share1 (p) 46.6p IFRS diluted earnings per share 96.1p Total accounting return1 9.6% Dividend per share 37.3p Link to remuneration Bonus and long-term incentive plan (LTIP). Measure Adjusted earnings per share measures the recurring profit delivered by operating activities on a per share basis. Performance in 2024 The business delivered a strong performance in 2024, with adjusted earnings of 46.6p, up 5% year-on- year. This reflects strong rental growth of 8.2% for the 2024/25 academic year and the resilience of our platform as international student recruitment was disrupted by policy changes. Priorities going forward Deliver sustainable growth in adjusted EPS through 97-98% occupancy and rental growth for the 2025/26 academic year and continued cost discipline. Link to remuneration Bonus and LTIP (indirectly). Measure IFRS diluted earnings per share measures IFRS earnings on a per share basis taking account of dilutive potential ordinary shares – share options. Performance in 2024 The increase in EPS reflects an increase in the value of the Unite Group’s property portfolio, profits from our development pipeline and earnings from the operational portfolio, partially offset by additional provisions for cladding remediation projects. Priorities going forward Grow EPS through rental growth, asset management and development profits, while continuing to maintain the portfolio and remedy fire safety defects. Link to remuneration Bonus and LTIP. Measure The amount of annual earnings distributed to shareholders. Performance in 2024 The total final dividend for 2024 is proposed to be 37.3p representing 80% of final adjusted EPS. The dividend also meets our PID requirement to distribute 80% of relevant earnings. Priorities going forward Continue to meet our PID requirement of distributing 80% of relevant earnings as dividends. 1. The financial statements are prepared in accordance with International Financial Reporting Standards (IFRS). The Unite Group uses Alternative Performance Measures (APMs) which are not defined or specified under IFRS. These APMs, which are not considered to be a substitute for IFRS measures, provide additional helpful information and are based on European Public Real Estate Association (EPRA) best practice recommendations. The metrics are also used internally to measure and manage the business and to align to the performance-related conditions for Directors’ remuneration. See the glossary for definitions and note 8 for calculations and reconciliations. 2024 2023 2022 2021 2020 2024 2023 2022 2021 2020 2024 2023 2022 2021 2020

Home for Success: Unite Students Annual Report 2024 Page 17 Page 19

Home for Success: Unite Students Annual Report 2024 Page 17 Page 19