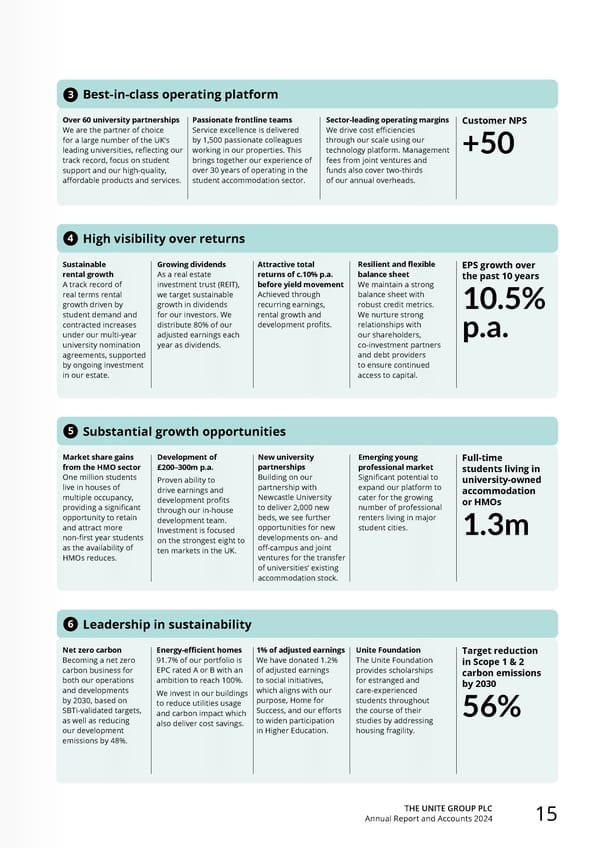

THE UNITE GROUP PLC Annual Report and Accounts 2024 15 High visibility over returns Sustainable rental growth A track record of real terms rental growth driven by student demand and contracted increases under our multi-year university nomination agreements, supported by ongoing investment in our estate. Growing dividends As a real estate investment trust (REIT), we target sustainable growth in dividends for our investors. We distribute 80% of our adjusted earnings each year as dividends. Attractive total returns of c.10% p.a. before yield movement Achieved through recurring earnings, rental growth and development profits. Resilient and flexible balance sheet We maintain a strong balance sheet with robust credit metrics. We nurture strong relationships with our shareholders, co-investment partners and debt providers to ensure continued access to capital. EPS growth over the past 10 years 10.5% p.a. Best-in-class operating platform Substantial growth opportunities Market share gains from the HMO sector One million students live in houses of multiple occupancy, providing a significant opportunity to retain and attract more non-first year students as the availability of HMOs reduces. Development of £200–300m p.a. Proven ability to drive earnings and development profits through our in-house development team. Investment is focused on the strongest eight to ten markets in the UK. New university partnerships Building on our partnership with Newcastle University to deliver 2,000 new beds, we see further opportunities for new developments on- and off-campus and joint ventures for the transfer of universities’ existing accommodation stock. Full-time students living in university-owned accommodation or HMOs 1.3m Emerging young professional market Significant potential to expand our platform to cater for the growing number of professional renters living in major student cities. Leadership in sustainability Net zero carbon Becoming a net zero carbon business for both our operations and developments by 2030, based on SBTi-validated targets, as well as reducing our development emissions by 48%. Energy-efficient homes 91.7% of our portfolio is EPC rated A or B with an ambition to reach 100%. We invest in our buildings to reduce utilities usage and carbon impact which also deliver cost savings. 1% of adjusted earnings We have donated 1.2% of adjusted earnings to social initiatives, which aligns with our purpose, Home for Success, and our efforts to widen participation in Higher Education. Target reduction in Scope 1 & 2 carbon emissions by 2030 56% Unite Foundation The Unite Foundation provides scholarships for estranged and care-experienced students throughout the course of their studies by addressing housing fragility. Over 60 university partnerships We are the partner of choice for a large number of the UK’s leading universities, reflecting our track record, focus on student support and our high-quality, affordable products and services. Passionate frontline teams Service excellence is delivered by 1,500 passionate colleagues working in our properties. This brings together our experience of over 30 years of operating in the student accommodation sector. Sector-leading operating margins We drive cost efficiencies through our scale using our technology platform. Management fees from joint ventures and funds also cover two-thirds of our annual overheads. Customer NPS +50 3 4 5 6

Home for Success: Unite Students Annual Report 2024 Page 16 Page 18

Home for Success: Unite Students Annual Report 2024 Page 16 Page 18