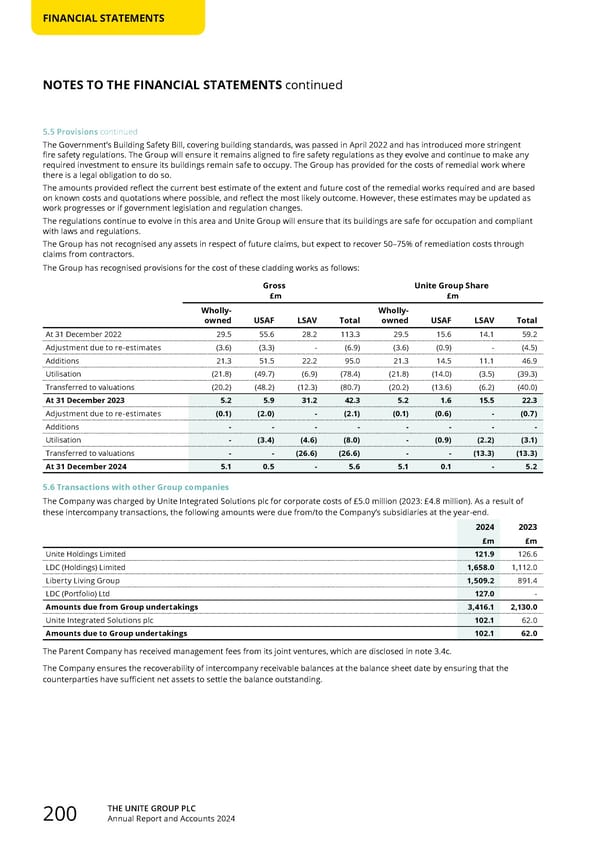

THE UNITE GROUP PLC Annual Report and Accounts 2024 200 FINANCIAL STATEMENTS 5.5 Provisions continued The Government’s Building Safety Bill, covering building standards, was passed in April 2022 and has introduced more stringent fire safety regulations. The Group will ensure it remains aligned to fire safety regulations as they evolve and continue to make any required investment to ensure its buildings remain safe to occupy. The Group has provided for the costs of remedial work where there is a legal obligation to do so. The amounts provided reflect the current best estimate of the extent and future cost of the remedial works required and are based on known costs and quotations where possible, and reflect the most likely outcome. However, these estimates may be updated as work progresses or if government legislation and regulation changes. The regulations continue to evolve in this area and Unite Group will ensure that its buildings are safe for occupation and compliant with laws and regulations. The Group has not recognised any assets in respect of future claims, but expect to recover 50–75% of remediation costs through claims from contractors. The Group has recognised provisions for the cost of these cladding works as follows: Gross £m Unite Group Share £m Wholly- owned USAF LSAV Total Wholly- owned USAF LSAV Total At 31 December 2022 29.5 55.6 28.2 113.3 29.5 15.6 14.1 59.2 Adjustment due to re-estimates (3.6) (3.3) - (6.9) (3.6) (0.9) - (4.5) Additions 21.3 51.5 22.2 95.0 21.3 14.5 11.1 46.9 Utilisation (21.8) (49.7) (6.9) (78.4) (21.8) (14.0) (3.5) (39.3) Transferred to valuations (20.2) (48.2) (12.3) (80.7) (20.2) (13.6) (6.2) (40.0) At 31 December 2023 5.2 5.9 31.2 42.3 5.2 1.6 15.5 22.3 Adjustment due to re-estimates (0.1) (2.0) - (2.1) (0.1) (0.6) - (0.7) Additions - - - - - - - - Utilisation - (3.4) (4.6) (8.0) - (0.9) (2.2) (3.1) Transferred to valuations - - (26.6) (26.6) - - (13.3) (13.3) At 31 December 2024 5.1 0.5 - 5.6 5.1 0.1 - 5.2 5.6 Transactions with other Group companies The Company was charged by Unite Integrated Solutions plc for corporate costs of £5.0 million (2023: £4.8 million). As a result of these intercompany transactions, the following amounts were due from/to the Company’s subsidiaries at the year-end. 2024 2023 £m £m Unite Holdings Limited 121.9 126.6 LDC (Holdings) Limited 1,658.0 1,112.0 Liberty Living Group 1,509.2 891.4 LDC (Portfolio) Ltd 127.0 - Amounts due from Group undertakings 3,416.1 2,130.0 Unite Integrated Solutions plc 102.1 62.0 Amounts due to Group undertakings 102.1 62.0 The Parent Company has received management fees from its joint ventures, which are disclosed in note 3.4c. The Company ensures the recoverability of intercompany receivable balances at the balance sheet date by ensuring that the counterparties have sufficient net assets to settle the balance outstanding. NOTES TO THE FINANCIAL STATEMENTS continued

Home for Success: Unite Students Annual Report 2024 Page 201 Page 203

Home for Success: Unite Students Annual Report 2024 Page 201 Page 203