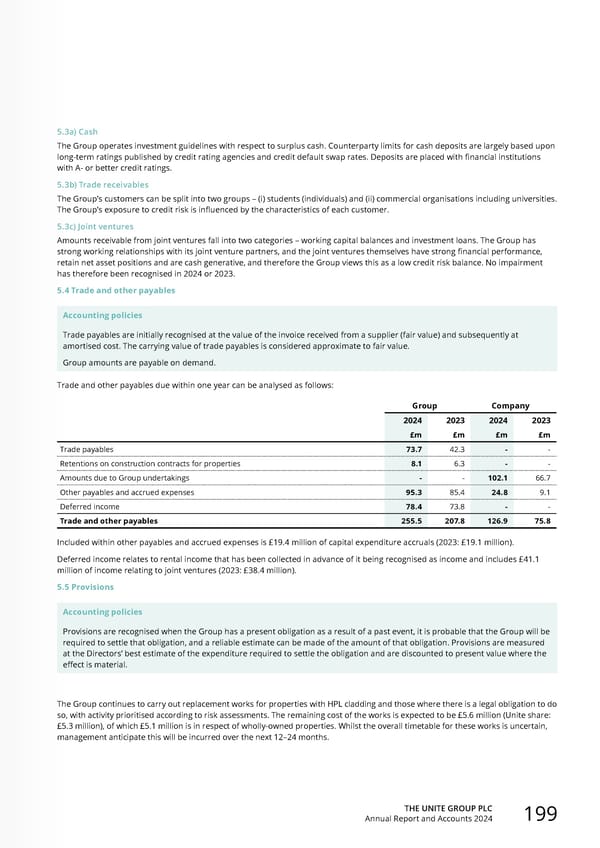

THE UNITE GROUP PLC Annual Report and Accounts 2024 199 5.3a) Cash The Group operates investment guidelines with respect to surplus cash. Counterparty limits for cash deposits are largely based upon long-term ratings published by credit rating agencies and credit default swap rates. Deposits are placed with financial institutions with A- or better credit ratings. 5.3b) Trade receivables The Group’s customers can be split into two groups – (i) students (individuals) and (ii) commercial organisations including universities. The Group’s exposure to credit risk is influenced by the characteristics of each customer. 5.3c) Joint ventures Amounts receivable from joint ventures fall into two categories – working capital balances and investment loans. The Group has strong working relationships with its joint venture partners, and the joint ventures themselves have strong financial performance, retain net asset positions and are cash generative, and therefore the Group views this as a low credit risk balance. No impairment has therefore been recognised in 2024 or 2023. 5.4 Trade and other payables Accounting policies Trade payables are initially recognised at the value of the invoice received from a supplier (fair value) and subsequently at amortised cost. The carrying value of trade payables is considered approximate to fair value. Group amounts are payable on demand. Trade and other payables due within one year can be analysed as follows: Group Company 2024 2023 2024 2023 £m £m £m £m Trade payables 73.7 42.3 - - Retentions on construction contracts for properties 8.1 6.3 - - Amounts due to Group undertakings - - 102.1 66.7 Other payables and accrued expenses 95.3 85.4 24.8 9.1 Deferred income 78.4 73.8 - - Trade and other payables 255.5 207.8 126.9 75.8 Included within other payables and accrued expenses is £19.4 million of capital expenditure accruals (2023: £19.1 million). Deferred income relates to rental income that has been collected in advance of it being recognised as income and includes £41.1 million of income relating to joint ventures (2023: £38.4 million). 5.5 Provisions Accounting policies Provisions are recognised when the Group has a present obligation as a result of a past event, it is probable that the Group will be required to settle that obligation, and a reliable estimate can be made of the amount of that obligation. Provisions are measured at the Directors’ best estimate of the expenditure required to settle the obligation and are discounted to present value where the effect is material. The Group continues to carry out replacement works for properties with HPL cladding and those where there is a legal obligation to do so, with activity prioritised according to risk assessments. The remaining cost of the works is expected to be £5.6 million (Unite share: £5.3 million), of which £5.1 million is in respect of wholly-owned properties. Whilst the overall timetable for these works is uncertain, management anticipate this will be incurred over the next 12–24 months.

Home for Success: Unite Students Annual Report 2024 Page 200 Page 202

Home for Success: Unite Students Annual Report 2024 Page 200 Page 202