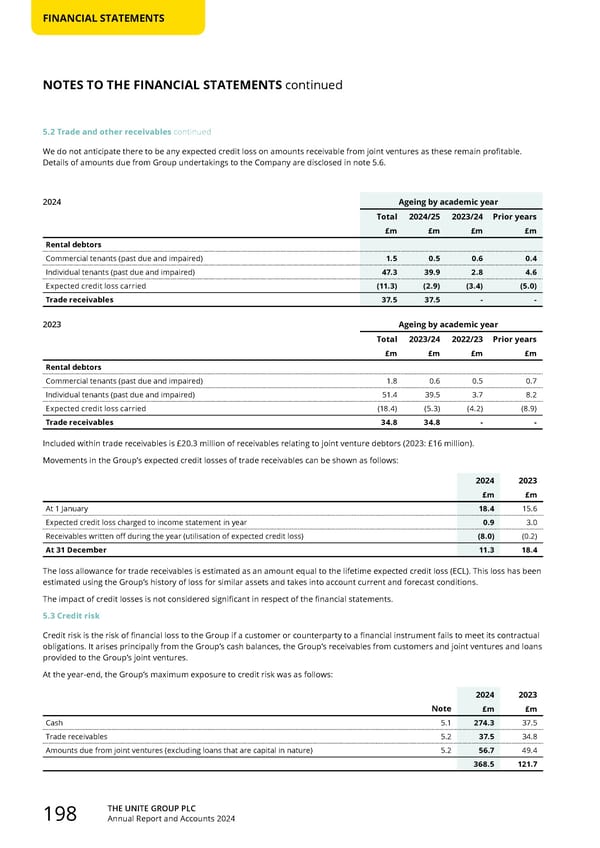

THE UNITE GROUP PLC Annual Report and Accounts 2024 198 FINANCIAL STATEMENTS 5.2 Trade and other receivables continued We do not anticipate there to be any expected credit loss on amounts receivable from joint ventures as these remain profitable. Details of amounts due from Group undertakings to the Company are disclosed in note 5.6. 2024 Ageing by academic year Total 2024/25 2023/24 Prior years £m £m £m £m Rental debtors Commercial tenants (past due and impaired) 1.5 0.5 0.6 0.4 Individual tenants (past due and impaired) 47.3 39.9 2.8 4.6 Expected credit loss carried (11.3) (2.9) (3.4) (5.0) Trade receivables 37.5 37.5 - - 2023 Ageing by academic year Total 2023/24 2022/23 Prior years £m £m £m £m Rental debtors Commercial tenants (past due and impaired) 1.8 0.6 0.5 0.7 Individual tenants (past due and impaired) 51.4 39.5 3.7 8.2 Expected credit loss carried (18.4) (5.3) (4.2) (8.9) Trade receivables 34.8 34.8 - - Included within trade receivables is £20.3 million of receivables relating to joint venture debtors (2023: £16 million). Movements in the Group’s expected credit losses of trade receivables can be shown as follows: 2024 2023 £m £m At 1 January 18.4 15.6 Expected credit loss charged to income statement in year 0.9 3.0 Receivables written off during the year (utilisation of expected credit loss) (8.0) (0.2) At 31 December 11.3 18.4 The loss allowance for trade receivables is estimated as an amount equal to the lifetime expected credit loss (ECL). This loss has been estimated using the Group’s history of loss for similar assets and takes into account current and forecast conditions. The impact of credit losses is not considered significant in respect of the financial statements. 5.3 Credit risk Credit risk is the risk of financial loss to the Group if a customer or counterparty to a financial instrument fails to meet its contractual obligations. It arises principally from the Group’s cash balances, the Group’s receivables from customers and joint ventures and loans provided to the Group’s joint ventures. At the year-end, the Group’s maximum exposure to credit risk was as follows: Note 2024 2023 £m £m Cash 5.1 274.3 37.5 Trade receivables 5.2 37.5 34.8 Amounts due from joint ventures (excluding loans that are capital in nature) 5.2 56.7 49.4 368.5 121.7 NOTES TO THE FINANCIAL STATEMENTS continued

Home for Success: Unite Students Annual Report 2024 Page 199 Page 201

Home for Success: Unite Students Annual Report 2024 Page 199 Page 201