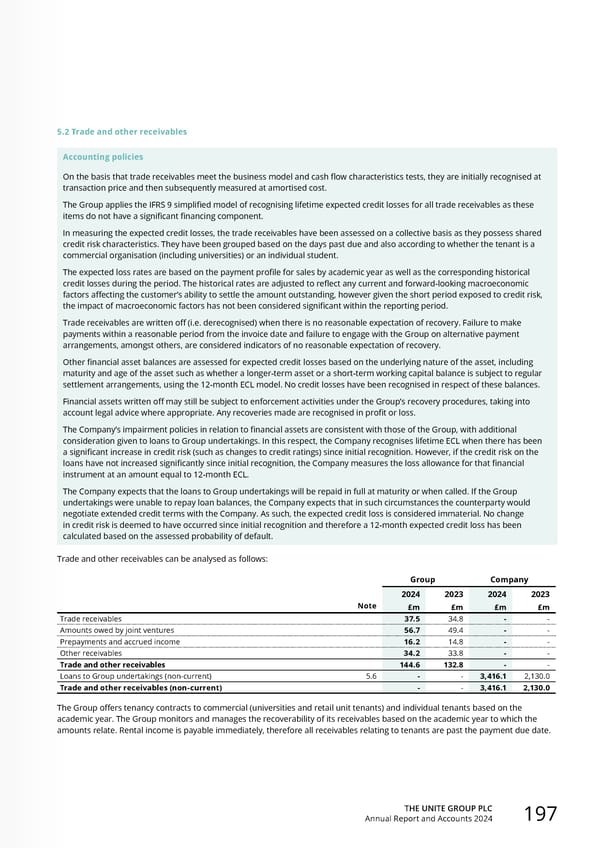

THE UNITE GROUP PLC Annual Report and Accounts 2024 197 5.2 Trade and other receivables Accounting policies On the basis that trade receivables meet the business model and cash flow characteristics tests, they are initially recognised at transaction price and then subsequently measured at amortised cost. The Group applies the IFRS 9 simplified model of recognising lifetime expected credit losses for all trade receivables as these items do not have a significant financing component. In measuring the expected credit losses, the trade receivables have been assessed on a collective basis as they possess shared credit risk characteristics. They have been grouped based on the days past due and also according to whether the tenant is a commercial organisation (including universities) or an individual student. The expected loss rates are based on the payment profile for sales by academic year as well as the corresponding historical credit losses during the period. The historical rates are adjusted to reflect any current and forward-looking macroeconomic factors affecting the customer’s ability to settle the amount outstanding, however given the short period exposed to credit risk, the impact of macroeconomic factors has not been considered significant within the reporting period. Trade receivables are written off (i.e. derecognised) when there is no reasonable expectation of recovery. Failure to make payments within a reasonable period from the invoice date and failure to engage with the Group on alternative payment arrangements, amongst others, are considered indicators of no reasonable expectation of recovery. Other financial asset balances are assessed for expected credit losses based on the underlying nature of the asset, including maturity and age of the asset such as whether a longer-term asset or a short-term working capital balance is subject to regular settlement arrangements, using the 12-month ECL model. No credit losses have been recognised in respect of these balances. Financial assets written off may still be subject to enforcement activities under the Group’s recovery procedures, taking into account legal advice where appropriate. Any recoveries made are recognised in profit or loss. The Company’s impairment policies in relation to financial assets are consistent with those of the Group, with additional consideration given to loans to Group undertakings. In this respect, the Company recognises lifetime ECL when there has been a significant increase in credit risk (such as changes to credit ratings) since initial recognition. However, if the credit risk on the loans have not increased significantly since initial recognition, the Company measures the loss allowance for that financial instrument at an amount equal to 12-month ECL. The Company expects that the loans to Group undertakings will be repaid in full at maturity or when called. If the Group undertakings were unable to repay loan balances, the Company expects that in such circumstances the counterparty would negotiate extended credit terms with the Company. As such, the expected credit loss is considered immaterial. No change in credit risk is deemed to have occurred since initial recognition and therefore a 12-month expected credit loss has been calculated based on the assessed probability of default. Trade and other receivables can be analysed as follows: Group Company Note 2024 2023 2024 2023 £m £m £m £m Trade receivables 37.5 34.8 - - Amounts owed by joint ventures 56.7 49.4 - - Prepayments and accrued income 16.2 14.8 - - Other receivables 34.2 33.8 - - Trade and other receivables 144.6 132.8 - - Loans to Group undertakings (non-current) 5.6 - - 3,416.1 2,130.0 Trade and other receivables (non-current) - - 3,416.1 2,130.0 The Group offers tenancy contracts to commercial (universities and retail unit tenants) and individual tenants based on the academic year. The Group monitors and manages the recoverability of its receivables based on the academic year to which the amounts relate. Rental income is payable immediately, therefore all receivables relating to tenants are past the payment due date.

Home for Success: Unite Students Annual Report 2024 Page 198 Page 200

Home for Success: Unite Students Annual Report 2024 Page 198 Page 200