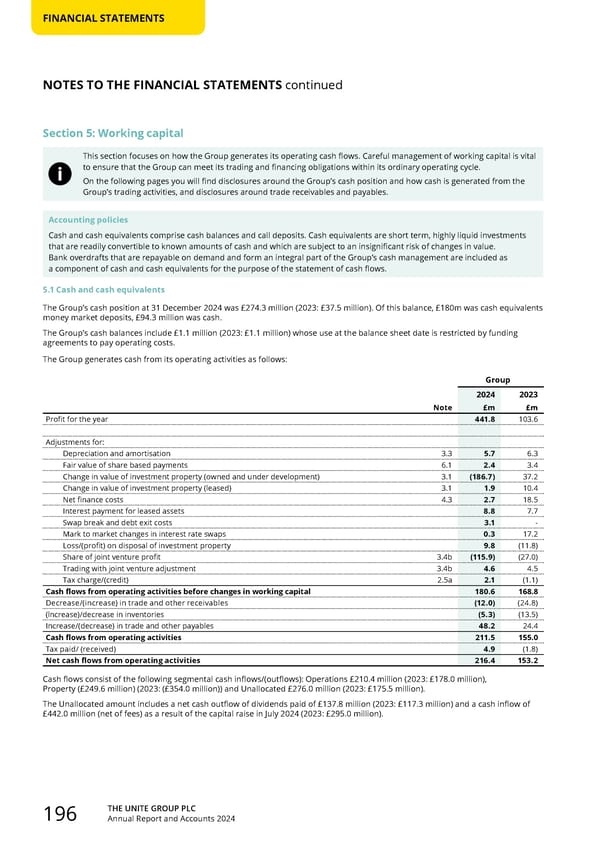

THE UNITE GROUP PLC Annual Report and Accounts 2024 196 FINANCIAL STATEMENTS Section 5: Working capital This section focuses on how the Group generates its operating cash flows. Careful management of working capital is vital to ensure that the Group can meet its trading and financing obligations within its ordinary operating cycle. On the following pages you will find disclosures around the Group’s cash position and how cash is generated from the Group’s trading activities, and disclosures around trade receivables and payables. Accounting policies Cash and cash equivalents comprise cash balances and call deposits. Cash equivalents are short term, highly liquid investments that are readily convertible to known amounts of cash and which are subject to an insignificant risk of changes in value. Bank overdrafts that are repayable on demand and form an integral part of the Group’s cash management are included as a component of cash and cash equivalents for the purpose of the statement of cash flows. 5.1 Cash and cash equivalents The Group’s cash position at 31 December 2024 was £274.3 million (2023: £37.5 million). Of this balance, £180m was cash equivalents money market deposits, £94.3 million was cash. The Group’s cash balances include £1.1 million (2023: £1.1 million) whose use at the balance sheet date is restricted by funding agreements to pay operating costs. The Group generates cash from its operating activities as follows: Group 2024 2023 Note £m £m Profit for the year 441.8 103.6 Adjustments for: Depreciation and amortisation 3.3 5.7 6.3 Fair value of share based payments 6.1 2.4 3.4 Change in value of investment property (owned and under development) 3.1 (186.7) 37.2 Change in value of investment property (leased) 3.1 1.9 10.4 Net finance costs 4.3 2.7 18.5 Interest payment for leased assets 8.8 7.7 Swap break and debt exit costs 3.1 - Mark to market changes in interest rate swaps 0.3 17.2 Loss/(profit) on disposal of investment property 9.8 (11.8) Share of joint venture profit 3.4b (115.9) (27.0) Trading with joint venture adjustment 3.4b 4.6 4.5 Tax charge/(credit) 2.5a 2.1 (1.1) Cash flows from operating activities before changes in working capital 180.6 168.8 Decrease/(increase) in trade and other receivables (12.0) (24.8) (lncrease)/decrease in inventories (5.3) (13.5) Increase/(decrease) in trade and other payables 48.2 24.4 Cash flows from operating activities 211.5 155.0 Tax paid/ (received) 4.9 (1.8) Net cash flows from operating activities 216.4 153.2 Cash flows consist of the following segmental cash inflows/(outflows): Operations £210.4 million (2023: £178.0 million), Property (£249.6 million) (2023: (£354.0 million)) and Unallocated £276.0 million (2023: £175.5 million). The Unallocated amount includes a net cash outflow of dividends paid of £137.8 million (2023: £117.3 million) and a cash inflow of £442.0 million (net of fees) as a result of the capital raise in July 2024 (2023: £295.0 million). NOTES TO THE FINANCIAL STATEMENTS continued

Home for Success: Unite Students Annual Report 2024 Page 197 Page 199

Home for Success: Unite Students Annual Report 2024 Page 197 Page 199