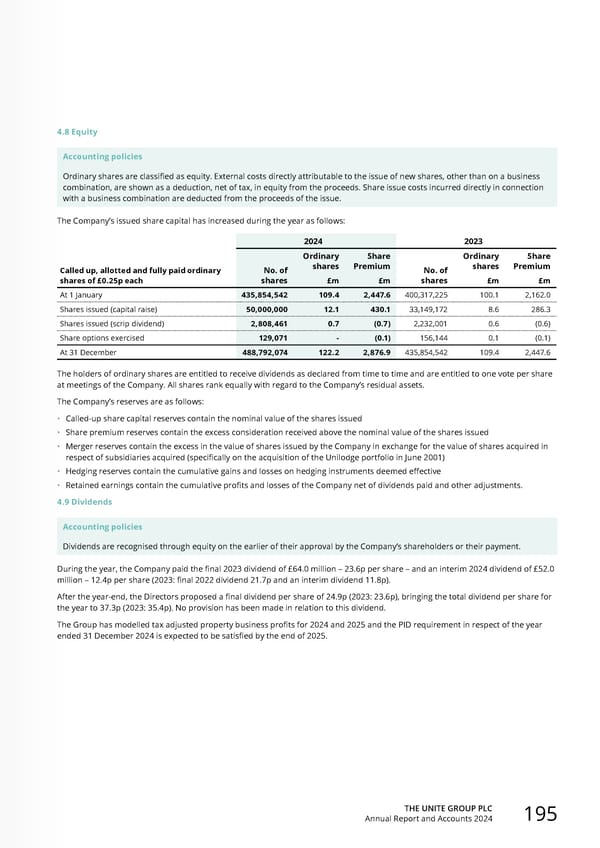

THE UNITE GROUP PLC Annual Report and Accounts 2024 195 4.8 Equity Accounting policies Ordinary shares are classified as equity. External costs directly attributable to the issue of new shares, other than on a business combination, are shown as a deduction, net of tax, in equity from the proceeds. Share issue costs incurred directly in connection with a business combination are deducted from the proceeds of the issue. The Company’s issued share capital has increased during the year as follows: 2024 2023 Called up, allotted and fully paid ordinary shares of £0.25p each No. of shares Ordinary shares Share Premium No. of shares Ordinary shares Share Premium £m £m £m £m At 1 January 435,854,542 109.4 2,447.6 400,317,225 100.1 2,162.0 Shares issued (capital raise) 50,000,000 12.1 430.1 33,149,172 8.6 286.3 Shares issued (scrip dividend) 2,808,461 0.7 (0.7) 2,232,001 0.6 (0.6) Share options exercised 129,071 - (0.1) 156,144 0.1 (0.1) At 31 December 488,792,074 122.2 2,876.9 435,854,542 109.4 2,447.6 The holders of ordinary shares are entitled to receive dividends as declared from time to time and are entitled to one vote per share at meetings of the Company. All shares rank equally with regard to the Company’s residual assets. The Company’s reserves are as follows: • Called-up share capital reserves contain the nominal value of the shares issued • Share premium reserves contain the excess consideration received above the nominal value of the shares issued • Merger reserves contain the excess in the value of shares issued by the Company in exchange for the value of shares acquired in respect of subsidiaries acquired (specifically on the acquisition of the Unilodge portfolio in June 2001) • Hedging reserves contain the cumulative gains and losses on hedging instruments deemed effective • Retained earnings contain the cumulative profits and losses of the Company net of dividends paid and other adjustments. 4.9 Dividends Accounting policies Dividends are recognised through equity on the earlier of their approval by the Company’s shareholders or their payment. During the year, the Company paid the final 2023 dividend of £64.0 million – 23.6p per share – and an interim 2024 dividend of £52.0 million – 12.4p per share (2023: final 2022 dividend 21.7p and an interim dividend 11.8p). After the year-end, the Directors proposed a final dividend per share of 24.9p (2023: 23.6p), bringing the total dividend per share for the year to 37.3p (2023: 35.4p). No provision has been made in relation to this dividend. The Group has modelled tax adjusted property business profits for 2024 and 2025 and the PID requirement in respect of the year ended 31 December 2024 is expected to be satisfied by the end of 2025.

Home for Success: Unite Students Annual Report 2024 Page 196 Page 198

Home for Success: Unite Students Annual Report 2024 Page 196 Page 198