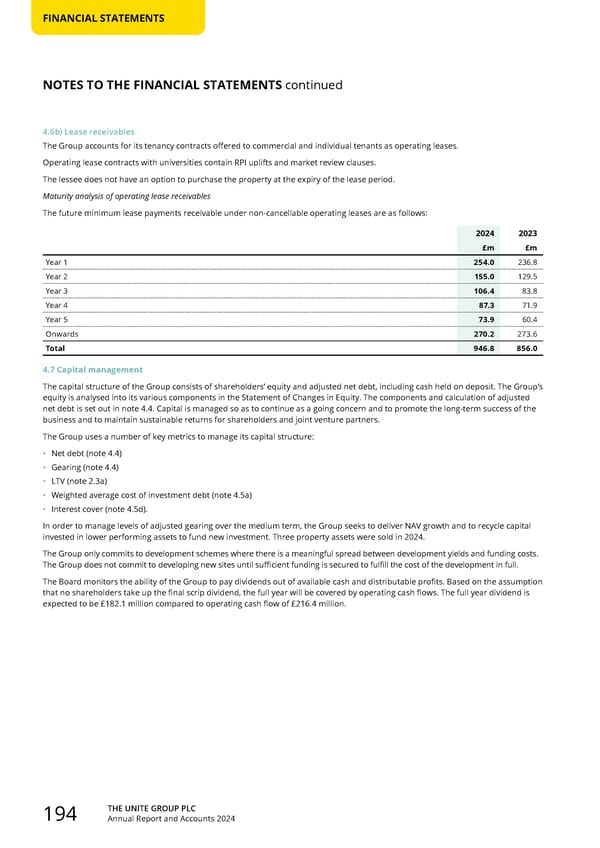

THE UNITE GROUP PLC Annual Report and Accounts 2024 194 FINANCIAL STATEMENTS 4.6b) Lease receivables The Group accounts for its tenancy contracts offered to commercial and individual tenants as operating leases. Operating lease contracts with universities contain RPI uplifts and market review clauses. The lessee does not have an option to purchase the property at the expiry of the lease period. Maturity analysis of operating lease receivables The future minimum lease payments receivable under non-cancellable operating leases are as follows: 2024 2023 £m £m Year 1 254.0 236.8 Year 2 155.0 129.5 Year 3 106.4 83.8 Year 4 87.3 71.9 Year 5 73.9 60.4 Onwards 270.2 273.6 Total 946.8 856.0 4.7 Capital management The capital structure of the Group consists of shareholders’ equity and adjusted net debt, including cash held on deposit. The Group’s equity is analysed into its various components in the Statement of Changes in Equity. The components and calculation of adjusted net debt is set out in note 4.4. Capital is managed so as to continue as a going concern and to promote the long-term success of the business and to maintain sustainable returns for shareholders and joint venture partners. The Group uses a number of key metrics to manage its capital structure: • Net debt (note 4.4) • Gearing (note 4.4) • LTV (note 2.3a) • Weighted average cost of investment debt (note 4.5a) • Interest cover (note 4.5d). In order to manage levels of adjusted gearing over the medium term, the Group seeks to deliver NAV growth and to recycle capital invested in lower performing assets to fund new investment. Three property assets were sold in 2024. The Group only commits to development schemes where there is a meaningful spread between development yields and funding costs. The Group does not commit to developing new sites until sufficient funding is secured to fulfill the cost of the development in full. The Board monitors the ability of the Group to pay dividends out of available cash and distributable profits. Based on the assumption that no shareholders take up the final scrip dividend, the full year will be covered by operating cash flows. The full year dividend is expected to be £182.1 million compared to operating cash flow of £216.4 million. NOTES TO THE FINANCIAL STATEMENTS continued

Home for Success: Unite Students Annual Report 2024 Page 195 Page 197

Home for Success: Unite Students Annual Report 2024 Page 195 Page 197