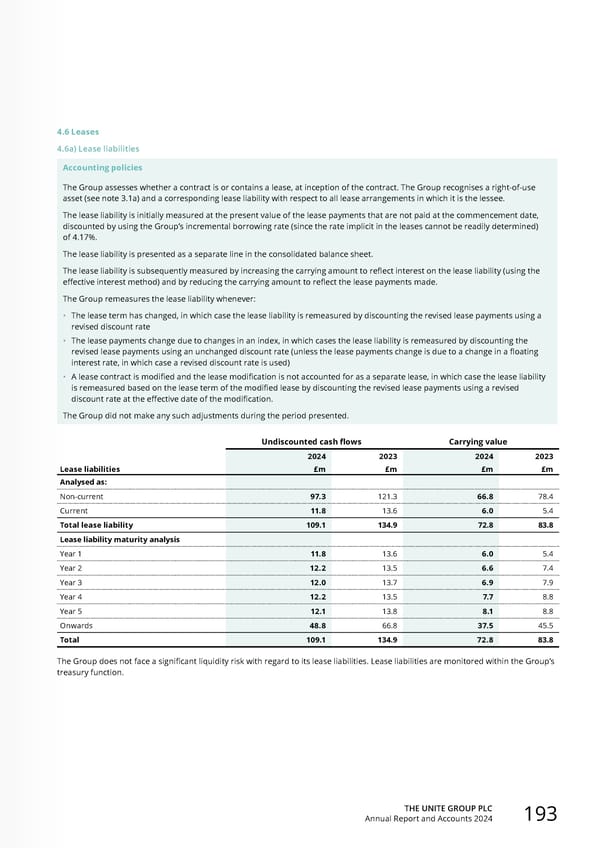

THE UNITE GROUP PLC Annual Report and Accounts 2024 193 4.6 Leases 4.6a) Lease liabilities Accounting policies The Group assesses whether a contract is or contains a lease, at inception of the contract. The Group recognises a right-of-use asset (see note 3.1a) and a corresponding lease liability with respect to all lease arrangements in which it is the lessee. The lease liability is initially measured at the present value of the lease payments that are not paid at the commencement date, discounted by using the Group’s incremental borrowing rate (since the rate implicit in the leases cannot be readily determined) of 4.17%. The lease liability is presented as a separate line in the consolidated balance sheet. The lease liability is subsequently measured by increasing the carrying amount to reflect interest on the lease liability (using the effective interest method) and by reducing the carrying amount to reflect the lease payments made. The Group remeasures the lease liability whenever: • The lease term has changed, in which case the lease liability is remeasured by discounting the revised lease payments using a revised discount rate • The lease payments change due to changes in an index, in which cases the lease liability is remeasured by discounting the revised lease payments using an unchanged discount rate (unless the lease payments change is due to a change in a floating interest rate, in which case a revised discount rate is used) • A lease contract is modified and the lease modification is not accounted for as a separate lease, in which case the lease liability is remeasured based on the lease term of the modified lease by discounting the revised lease payments using a revised discount rate at the effective date of the modification. The Group did not make any such adjustments during the period presented. Undiscounted cash flows Carrying value 2024 2023 2024 2023 Lease liabilities £m £m £m £m Analysed as: Non-current 97.3 121.3 66.8 78.4 Current 11.8 13.6 6.0 5.4 Total lease liability 109.1 134.9 72.8 83.8 Lease liability maturity analysis Year 1 11.8 13.6 6.0 5.4 Year 2 12.2 13.5 6.6 7.4 Year 3 12.0 13.7 6.9 7.9 Year 4 12.2 13.5 7.7 8.8 Year 5 12.1 13.8 8.1 8.8 Onwards 48.8 66.8 37.5 45.5 Total 109.1 134.9 72.8 83.8 The Group does not face a significant liquidity risk with regard to its lease liabilities. Lease liabilities are monitored within the Group’s treasury function.

Home for Success: Unite Students Annual Report 2024 Page 194 Page 196

Home for Success: Unite Students Annual Report 2024 Page 194 Page 196