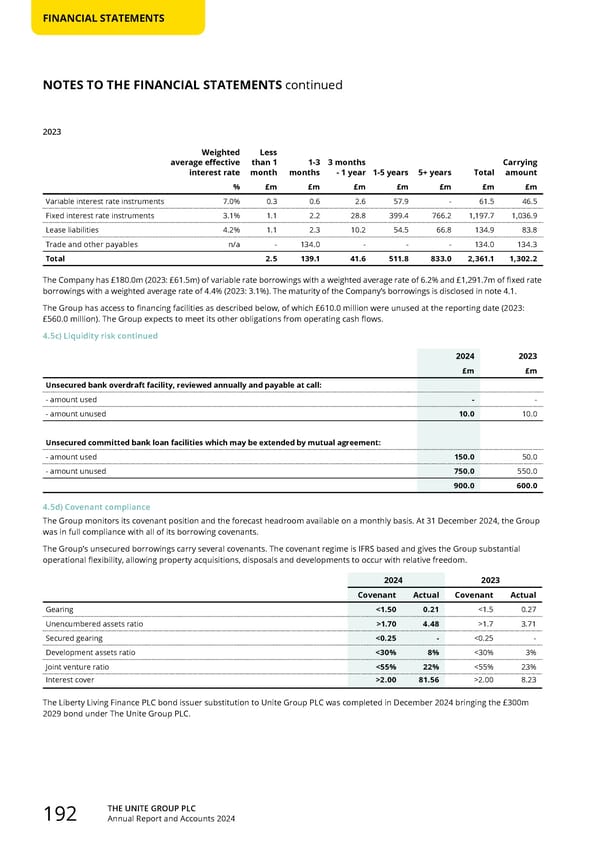

THE UNITE GROUP PLC Annual Report and Accounts 2024 192 FINANCIAL STATEMENTS 2023 Weighted average effective interest rate Less than 1 month 1-3 months 3 months - 1 year 1-5 years 5+ years Total Carrying amount % £m £m £m £m £m £m £m Variable interest rate instruments 7.0% 0.3 0.6 2.6 57.9 - 61.5 46.5 Fixed interest rate instruments 3.1% 1.1 2.2 28.8 399.4 766.2 1,197.7 1,036.9 Lease liabilities 4.2% 1.1 2.3 10.2 54.5 66.8 134.9 83.8 Trade and other payables n/a - 134.0 - - - 134.0 134.3 Total 2.5 139.1 41.6 511.8 833.0 2,361.1 1,302.2 The Company has £180.0m (2023: £61.5m) of variable rate borrowings with a weighted average rate of 6.2% and £1,291.7m of fixed rate borrowings with a weighted average rate of 4.4% (2023: 3.1%). The maturity of the Company’s borrowings is disclosed in note 4.1. The Group has access to financing facilities as described below, of which £610.0 million were unused at the reporting date (2023: £560.0 million). The Group expects to meet its other obligations from operating cash flows. 4.5c) Liquidity risk continued 2024 2023 £m £m Unsecured bank overdraft facility, reviewed annually and payable at call: - amount used - - - amount unused 10.0 10.0 Unsecured committed bank loan facilities which may be extended by mutual agreement: - amount used 150.0 50.0 - amount unused 750.0 550.0 900.0 600.0 4.5d) Covenant compliance The Group monitors its covenant position and the forecast headroom available on a monthly basis. At 31 December 2024, the Group was in full compliance with all of its borrowing covenants. The Group’s unsecured borrowings carry several covenants. The covenant regime is IFRS based and gives the Group substantial operational flexibility, allowing property acquisitions, disposals and developments to occur with relative freedom. 2024 2023 Covenant Actual Covenant Actual Gearing 1.7 3.71 Secured gearing

Home for Success: Unite Students Annual Report 2024 Page 193 Page 195

Home for Success: Unite Students Annual Report 2024 Page 193 Page 195