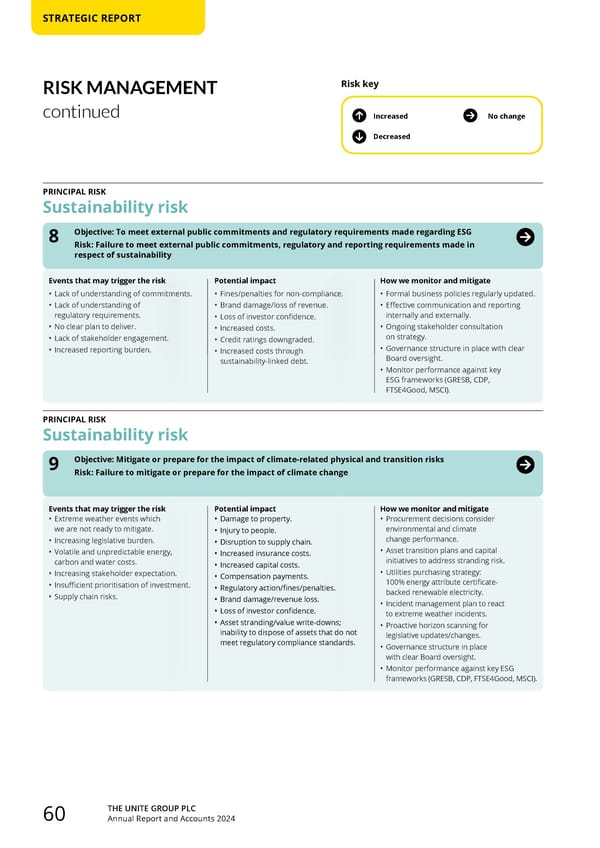

THE UNITE GROUP PLC Annual Report and Accounts 2024 60 STRATEGIC REPORT RISK MANAGEMENT continued PRINCIPAL RISK Sustainability risk 9 Objective: Mitigate or prepare for the impact of climate-related physical and transition risks Risk: Failure to mitigate or prepare for the impact of climate change Events that may trigger the risk • Extreme weather events which we are not ready to mitigate. • Increasing legislative burden. • Volatile and unpredictable energy, carbon and water costs. • Increasing stakeholder expectation. • Insufficient prioritisation of investment. • Supply chain risks. Potential impact • Damage to property. • Injury to people. • Disruption to supply chain. • Increased insurance costs. • Increased capital costs. • Compensation payments. • Regulatory action/fines/penalties. • Brand damage/revenue loss. • Loss of investor confidence. • Asset stranding/value write-downs; inability to dispose of assets that do not meet regulatory compliance standards. How we monitor and mitigate • Procurement decisions consider environmental and climate change performance. • Asset transition plans and capital initiatives to address stranding risk. • Utilities purchasing strategy: 100% energy attribute certificate- backed renewable electricity. • Incident management plan to react to extreme weather incidents. • Proactive horizon scanning for legislative updates/changes. • Governance structure in place with clear Board oversight. • Monitor performance against key ESG frameworks (GRESB, CDP, FTSE4Good, MSCI). PRINCIPAL RISK Sustainability risk 8 Objective: To meet external public commitments and regulatory requirements made regarding ESG Risk: Failure to meet external public commitments, regulatory and reporting requirements made in respect of sustainability Events that may trigger the risk • Lack of understanding of commitments. • Lack of understanding of regulatory requirements. • No clear plan to deliver. • Lack of stakeholder engagement. • Increased reporting burden. Potential impact • Fines/penalties for non-compliance. • Brand damage/loss of revenue. • Loss of investor confidence. • Increased costs. • Credit ratings downgraded. • Increased costs through sustainability-linked debt. How we monitor and mitigate • Formal business policies regularly updated. • Effective communication and reporting internally and externally. • Ongoing stakeholder consultation on strategy. • Governance structure in place with clear Board oversight. • Monitor performance against key ESG frameworks (GRESB, CDP, FTSE4Good, MSCI). Increased Decreased Risk key No change

Home for Success: Unite Students Annual Report 2024 Page 61 Page 63

Home for Success: Unite Students Annual Report 2024 Page 61 Page 63