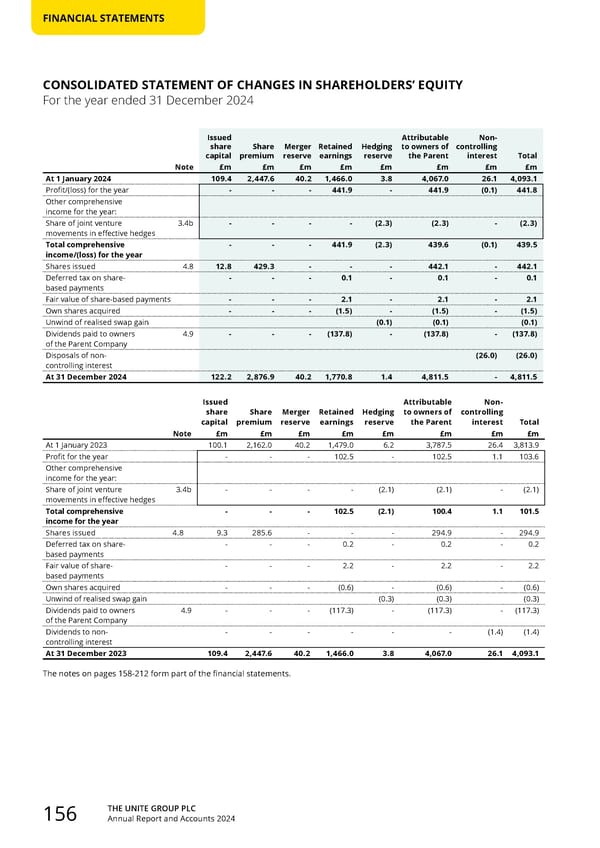

THE UNITE GROUP PLC Annual Report and Accounts 2024 156 FINANCIAL STATEMENTS CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS’ EQUITY For the year ended 31 December 2024 Issued share capital Share premium Merger reserve Retained earnings Hedging reserve Attributable to owners of the Parent Non- controlling interest Total Note £m £m £m £m £m £m £m £m At 1 January 2024 109.4 2,447.6 40.2 1,466.0 3.8 4,067.0 26.1 4,093.1 Profit/(loss) for the year - - - 441.9 - 441.9 (0.1) 441.8 Other comprehensive income for the year: Share of joint venture movements in effective hedges 3.4b - - - - (2.3) (2.3) - (2.3) Total comprehensive income/(loss) for the year - - - 441.9 (2.3) 439.6 (0.1) 439.5 Shares issued 4.8 12.8 429.3 - - - 442.1 - 442.1 Deferred tax on share- based payments - - - 0.1 - 0.1 - 0.1 Fair value of share-based payments - - - 2.1 - 2.1 - 2.1 Own shares acquired - - - (1.5) - (1.5) - (1.5) Unwind of realised swap gain (0.1) (0.1) (0.1) Dividends paid to owners of the Parent Company 4.9 - - - (137.8) - (137.8) - (137.8) Disposals of non- controlling interest (26.0) (26.0) At 31 December 2024 122.2 2,876.9 40.2 1,770.8 1.4 4,811.5 - 4,811.5 Issued share capital Share premium Merger reserve Retained earnings Hedging reserve Attributable to owners of the Parent Non- controlling interest Total Note £m £m £m £m £m £m £m £m At 1 January 2023 100.1 2,162.0 40.2 1,479.0 6.2 3,787.5 26.4 3,813.9 Profit for the year - - - 102.5 - 102.5 1.1 103.6 Other comprehensive income for the year: Share of joint venture movements in effective hedges 3.4b - - - - (2.1) (2.1) - (2.1) Total comprehensive income for the year - - - 102.5 (2.1) 100.4 1.1 101.5 Shares issued 4.8 9.3 285.6 - - - 294.9 - 294.9 Deferred tax on share- based payments - - - 0.2 - 0.2 - 0.2 Fair value of share- based payments - - - 2.2 - 2.2 - 2.2 Own shares acquired - - - (0.6) - (0.6) - (0.6) Unwind of realised swap gain (0.3) (0.3) (0.3) Dividends paid to owners of the Parent Company 4.9 - - - (117.3) - (117.3) - (117.3) Dividends to non- controlling interest - - - - - - (1.4) (1.4) At 31 December 2023 109.4 2,447.6 40.2 1,466.0 3.8 4,067.0 26.1 4,093.1 The notes on pages 158-212 form part of the financial statements.

Home for Success: Unite Students Annual Report 2024 Page 157 Page 159

Home for Success: Unite Students Annual Report 2024 Page 157 Page 159