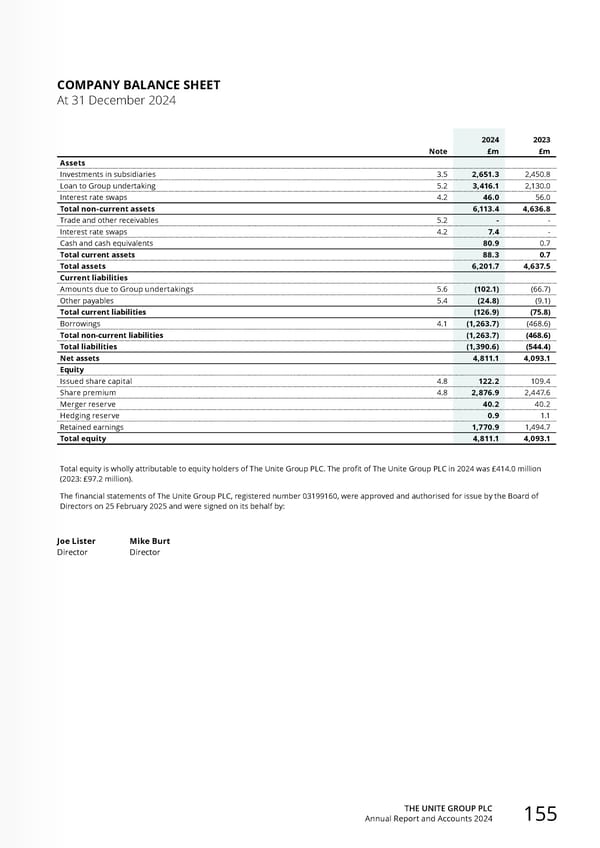

THE UNITE GROUP PLC Annual Report and Accounts 2024 155 COMPANY BALANCE SHEET At 31 December 2024 2024 2023 Note £m £m Assets Investments in subsidiaries 3.5 2,651.3 2,450.8 Loan to Group undertaking 5.2 3,416.1 2,130.0 Interest rate swaps 4.2 46.0 56.0 Total non-current assets 6,113.4 4,636.8 Trade and other receivables 5.2 - - Interest rate swaps 4.2 7.4 - Cash and cash equivalents 80.9 0.7 Total current assets 88.3 0.7 Total assets 6,201.7 4,637.5 Current liabilities Amounts due to Group undertakings 5.6 (102.1) (66.7) Other payables 5.4 (24.8) (9.1) Total current liabilities (126.9) (75.8) Borrowings 4.1 (1,263.7) (468.6) Total non-current liabilities (1,263.7) (468.6) Total liabilities (1,390.6) (544.4) Net assets 4,811.1 4,093.1 Equity Issued share capital 4.8 122.2 109.4 Share premium 4.8 2,876.9 2,447.6 Merger reserve 40.2 40.2 Hedging reserve 0.9 1.1 Retained earnings 1,770.9 1,494.7 Total equity 4,811.1 4,093.1 Total equity is wholly attributable to equity holders of The Unite Group PLC. The profit of The Unite Group PLC in 2024 was £414.0 million (2023: £97.2 million). The financial statements of The Unite Group PLC, registered number 03199160, were approved and authorised for issue by the Board of Directors on 25 February 2025 and were signed on its behalf by: Joe Lister Mike Burt Director Director

Home for Success: Unite Students Annual Report 2024 Page 156 Page 158

Home for Success: Unite Students Annual Report 2024 Page 156 Page 158