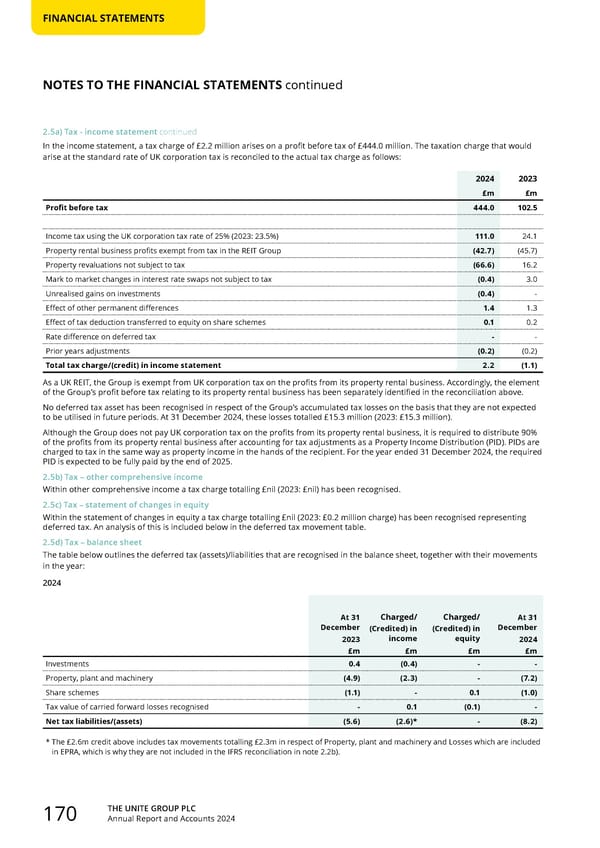

THE UNITE GROUP PLC Annual Report and Accounts 2024 170 FINANCIAL STATEMENTS 2.5a) Tax - income statement continued In the income statement, a tax charge of £2.2 million arises on a profit before tax of £444.0 million. The taxation charge that would arise at the standard rate of UK corporation tax is reconciled to the actual tax charge as follows: 2024 2023 £m £m Profit before tax 444.0 102.5 Income tax using the UK corporation tax rate of 25% (2023: 23.5%) 111.0 24.1 Property rental business profits exempt from tax in the REIT Group (42.7) (45.7) Property revaluations not subject to tax (66.6) 16.2 Mark to market changes in interest rate swaps not subject to tax (0.4) 3.0 Unrealised gains on investments (0.4) - Effect of other permanent differences 1.4 1.3 Effect of tax deduction transferred to equity on share schemes 0.1 0.2 Rate difference on deferred tax - - Prior years adjustments (0.2) (0.2) Total tax charge/(credit) in income statement 2.2 (1.1) As a UK REIT, the Group is exempt from UK corporation tax on the profits from its property rental business. Accordingly, the element of the Group’s profit before tax relating to its property rental business has been separately identified in the reconciliation above. No deferred tax asset has been recognised in respect of the Group’s accumulated tax losses on the basis that they are not expected to be utilised in future periods. At 31 December 2024, these losses totalled £15.3 million (2023: £15.3 million). Although the Group does not pay UK corporation tax on the profits from its property rental business, it is required to distribute 90% of the profits from its property rental business after accounting for tax adjustments as a Property Income Distribution (PID). PIDs are charged to tax in the same way as property income in the hands of the recipient. For the year ended 31 December 2024, the required PID is expected to be fully paid by the end of 2025. 2.5b) Tax – other comprehensive income Within other comprehensive income a tax charge totalling £nil (2023: £nil) has been recognised. 2.5c) Tax – statement of changes in equity Within the statement of changes in equity a tax charge totalling £nil (2023: £0.2 million charge) has been recognised representing deferred tax. An analysis of this is included below in the deferred tax movement table. 2.5d) Tax – balance sheet The table below outlines the deferred tax (assets)/liabilities that are recognised in the balance sheet, together with their movements in the year: 2024 Charged/ Charged/ At 31 (Credited) in (Credited) in At 31 December 2023 income equity December 2024 £m £m £m £m Investments 0.4 (0.4) - - Property, plant and machinery (4.9) (2.3) - (7.2) Share schemes (1.1) - 0.1 (1.0) Tax value of carried forward losses recognised - 0.1 (0.1) - Net tax liabilities/(assets) (5.6) (2.6)* - (8.2) * The £2.6m credit above includes tax movements totalling £2.3m in respect of Property, plant and machinery and Losses which are included in EPRA, which is why they are not included in the IFRS reconciliation in note 2.2b). NOTES TO THE FINANCIAL STATEMENTS continued

Home for Success: Unite Students Annual Report 2024 Page 171 Page 173

Home for Success: Unite Students Annual Report 2024 Page 171 Page 173