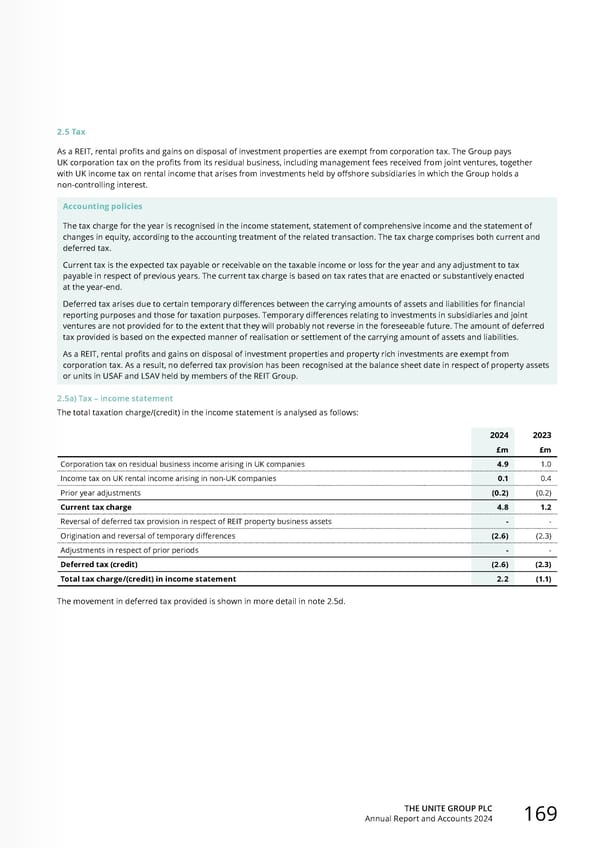

THE UNITE GROUP PLC Annual Report and Accounts 2024 169 2.5 Tax As a REIT, rental profits and gains on disposal of investment properties are exempt from corporation tax. The Group pays UK corporation tax on the profits from its residual business, including management fees received from joint ventures, together with UK income tax on rental income that arises from investments held by offshore subsidiaries in which the Group holds a non-controlling interest. Accounting policies The tax charge for the year is recognised in the income statement, statement of comprehensive income and the statement of changes in equity, according to the accounting treatment of the related transaction. The tax charge comprises both current and deferred tax. Current tax is the expected tax payable or receivable on the taxable income or loss for the year and any adjustment to tax payable in respect of previous years. The current tax charge is based on tax rates that are enacted or substantively enacted at the year-end. Deferred tax arises due to certain temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and those for taxation purposes. Temporary differences relating to investments in subsidiaries and joint ventures are not provided for to the extent that they will probably not reverse in the foreseeable future. The amount of deferred tax provided is based on the expected manner of realisation or settlement of the carrying amount of assets and liabilities. As a REIT, rental profits and gains on disposal of investment properties and property rich investments are exempt from corporation tax. As a result, no deferred tax provision has been recognised at the balance sheet date in respect of property assets or units in USAF and LSAV held by members of the REIT Group. 2.5a) Tax – income statement The total taxation charge/(credit) in the income statement is analysed as follows: 2024 2023 £m £m Corporation tax on residual business income arising in UK companies 4.9 1.0 Income tax on UK rental income arising in non-UK companies 0.1 0.4 Prior year adjustments (0.2) (0.2) Current tax charge 4.8 1.2 Reversal of deferred tax provision in respect of REIT property business assets - - Origination and reversal of temporary differences (2.6) (2.3) Adjustments in respect of prior periods - - Deferred tax (credit) (2.6) (2.3) Total tax charge/(credit) in income statement 2.2 (1.1) The movement in deferred tax provided is shown in more detail in note 2.5d.

Home for Success: Unite Students Annual Report 2024 Page 170 Page 172

Home for Success: Unite Students Annual Report 2024 Page 170 Page 172