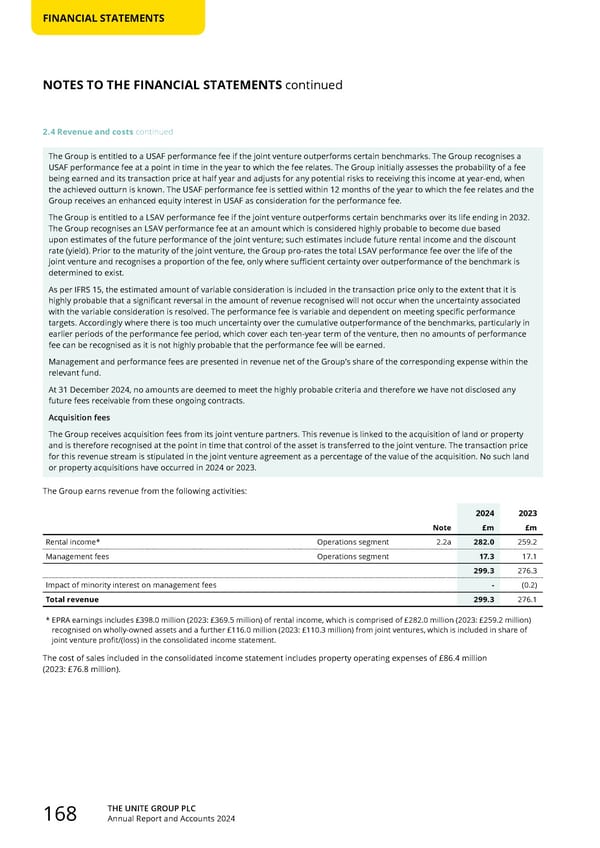

THE UNITE GROUP PLC Annual Report and Accounts 2024 168 FINANCIAL STATEMENTS 2.4 Revenue and costs continued The Group is entitled to a USAF performance fee if the joint venture outperforms certain benchmarks. The Group recognises a USAF performance fee at a point in time in the year to which the fee relates. The Group initially assesses the probability of a fee being earned and its transaction price at half year and adjusts for any potential risks to receiving this income at year-end, when the achieved outturn is known. The USAF performance fee is settled within 12 months of the year to which the fee relates and the Group receives an enhanced equity interest in USAF as consideration for the performance fee. The Group is entitled to a LSAV performance fee if the joint venture outperforms certain benchmarks over its life ending in 2032. The Group recognises an LSAV performance fee at an amount which is considered highly probable to become due based upon estimates of the future performance of the joint venture; such estimates include future rental income and the discount rate (yield). Prior to the maturity of the joint venture, the Group pro-rates the total LSAV performance fee over the life of the joint venture and recognises a proportion of the fee, only where sufficient certainty over outperformance of the benchmark is determined to exist. As per IFRS 15, the estimated amount of variable consideration is included in the transaction price only to the extent that it is highly probable that a significant reversal in the amount of revenue recognised will not occur when the uncertainty associated with the variable consideration is resolved. The performance fee is variable and dependent on meeting specific performance targets. Accordingly where there is too much uncertainty over the cumulative outperformance of the benchmarks, particularly in earlier periods of the performance fee period, which cover each ten-year term of the venture, then no amounts of performance fee can be recognised as it is not highly probable that the performance fee will be earned. Management and performance fees are presented in revenue net of the Group’s share of the corresponding expense within the relevant fund. At 31 December 2024, no amounts are deemed to meet the highly probable criteria and therefore we have not disclosed any future fees receivable from these ongoing contracts. Acquisition fees The Group receives acquisition fees from its joint venture partners. This revenue is linked to the acquisition of land or property and is therefore recognised at the point in time that control of the asset is transferred to the joint venture. The transaction price for this revenue stream is stipulated in the joint venture agreement as a percentage of the value of the acquisition. No such land or property acquisitions have occurred in 2024 or 2023. The Group earns revenue from the following activities: 2024 2023 Note £m £m Rental income* Operations segment 2.2a 282.0 259.2 Management fees Operations segment 17.3 17.1 299.3 276.3 Impact of minority interest on management fees - (0.2) Total revenue 299.3 276.1 * EPRA earnings includes £398.0 million (2023: £369.5 million) of rental income, which is comprised of £282.0 million (2023: £259.2 million) recognised on wholly-owned assets and a further £116.0 million (2023: £110.3 million) from joint ventures, which is included in share of joint venture profit/(loss) in the consolidated income statement. The cost of sales included in the consolidated income statement includes property operating expenses of £86.4 million (2023: £76.8 million). NOTES TO THE FINANCIAL STATEMENTS continued

Home for Success: Unite Students Annual Report 2024 Page 169 Page 171

Home for Success: Unite Students Annual Report 2024 Page 169 Page 171