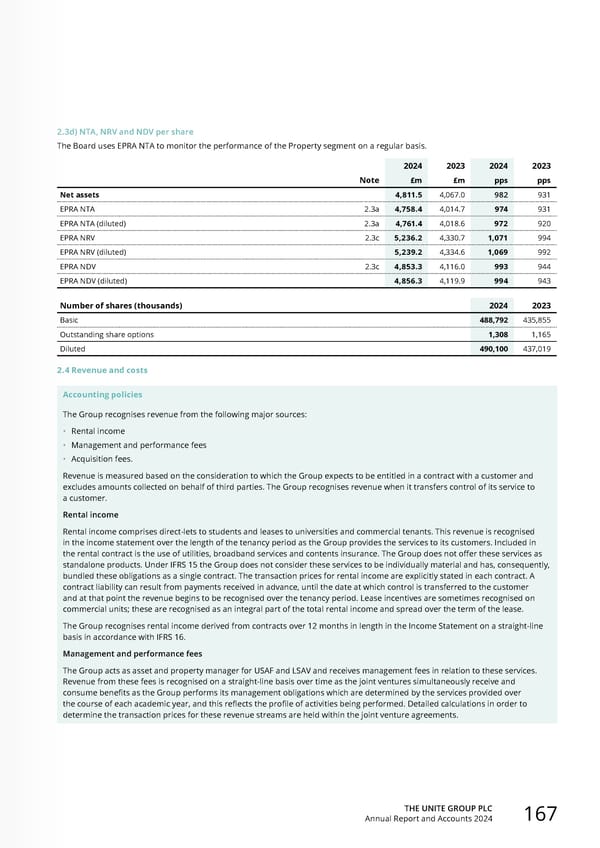

THE UNITE GROUP PLC Annual Report and Accounts 2024 167 2.3d) NTA, NRV and NDV per share The Board uses EPRA NTA to monitor the performance of the Property segment on a regular basis. Note 2024 2023 2024 2023 £m £m pps pps Net assets 4,811.5 4,067.0 982 931 EPRA NTA 2.3a 4,758.4 4,014.7 974 931 EPRA NTA (diluted) 2.3a 4,761.4 4,018.6 972 920 EPRA NRV 2.3c 5,236.2 4,330.7 1,071 994 EPRA NRV (diluted) 5,239.2 4,334.6 1,069 992 EPRA NDV 2.3c 4,853.3 4,116.0 993 944 EPRA NDV (diluted) 4,856.3 4,119.9 994 943 Number of shares (thousands) 2024 2023 Basic 488,792 435,855 Outstanding share options 1,308 1,165 Diluted 490,100 437,019 2.4 Revenue and costs Accounting policies The Group recognises revenue from the following major sources: • Rental income • Management and performance fees • Acquisition fees. Revenue is measured based on the consideration to which the Group expects to be entitled in a contract with a customer and excludes amounts collected on behalf of third parties. The Group recognises revenue when it transfers control of its service to a customer. Rental income Rental income comprises direct-lets to students and leases to universities and commercial tenants. This revenue is recognised in the income statement over the length of the tenancy period as the Group provides the services to its customers. Included in the rental contract is the use of utilities, broadband services and contents insurance. The Group does not offer these services as standalone products. Under IFRS 15 the Group does not consider these services to be individually material and has, consequently, bundled these obligations as a single contract. The transaction prices for rental income are explicitly stated in each contract. A contract liability can result from payments received in advance, until the date at which control is transferred to the customer and at that point the revenue begins to be recognised over the tenancy period. Lease incentives are sometimes recognised on commercial units; these are recognised as an integral part of the total rental income and spread over the term of the lease. The Group recognises rental income derived from contracts over 12 months in length in the Income Statement on a straight-line basis in accordance with IFRS 16. Management and performance fees The Group acts as asset and property manager for USAF and LSAV and receives management fees in relation to these services. Revenue from these fees is recognised on a straight-line basis over time as the joint ventures simultaneously receive and consume benefits as the Group performs its management obligations which are determined by the services provided over the course of each academic year, and this reflects the profile of activities being performed. Detailed calculations in order to determine the transaction prices for these revenue streams are held within the joint venture agreements.

Home for Success: Unite Students Annual Report 2024 Page 168 Page 170

Home for Success: Unite Students Annual Report 2024 Page 168 Page 170