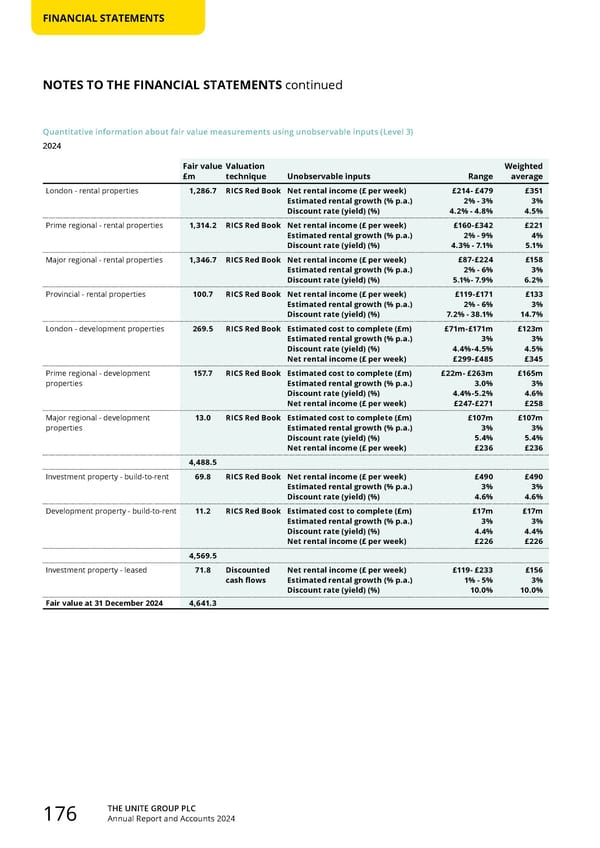

THE UNITE GROUP PLC Annual Report and Accounts 2024 176 FINANCIAL STATEMENTS Quantitative information about fair value measurements using unobservable inputs (Level 3) 2024 Fair value £m Valuation technique Unobservable inputs Range Weighted average London - rental properties 1,286.7 RICS Red Book Net rental income (£ per week) Estimated rental growth (% p.a.) Discount rate (yield) (%) £214- £479 2% - 3% 4.2% - 4.8% £351 3% 4.5% Prime regional - rental properties 1,314.2 RICS Red Book Net rental income (£ per week) Estimated rental growth (% p.a.) Discount rate (yield) (%) £160-£342 2% - 9% 4.3% - 7.1% £221 4% 5.1% Major regional - rental properties 1,346.7 RICS Red Book Net rental income (£ per week) Estimated rental growth (% p.a.) Discount rate (yield) (%) £87-£224 2% - 6% 5.1%- 7.9% £158 3% 6.2% Provincial - rental properties 100.7 RICS Red Book Net rental income (£ per week) Estimated rental growth (% p.a.) Discount rate (yield) (%) £119-£171 2% - 6% 7.2% - 38.1% £133 3% 14.7% London - development properties 269.5 RICS Red Book Estimated cost to complete (£m) Estimated rental growth (% p.a.) Discount rate (yield) (%) Net rental income (£ per week) £71m-£171m 3% 4.4%-4.5% £299-£485 £123m 3% 4.5% £345 Prime regional - development properties 157.7 RICS Red Book Estimated cost to complete (£m) Estimated rental growth (% p.a.) Discount rate (yield) (%) Net rental income (£ per week) £22m- £263m 3.0% 4.4%-5.2% £247-£271 £165m 3% 4.6% £258 Major regional - development properties 13.0 RICS Red Book Estimated cost to complete (£m) Estimated rental growth (% p.a.) Discount rate (yield) (%) Net rental income (£ per week) £107m 3% 5.4% £236 £107m 3% 5.4% £236 4,488.5 Investment property - build-to-rent 69.8 RICS Red Book Net rental income (£ per week) Estimated rental growth (% p.a.) Discount rate (yield) (%) £490 3% 4.6% £490 3% 4.6% Development property - build-to-rent 11.2 RICS Red Book Estimated cost to complete (£m) Estimated rental growth (% p.a.) Discount rate (yield) (%) Net rental income (£ per week) £17m 3% 4.4% £226 £17m 3% 4.4% £226 4,569.5 Investment property - leased 71.8 Discounted cash flows Net rental income (£ per week) Estimated rental growth (% p.a.) Discount rate (yield) (%) £119- £233 1% - 5% 10.0% £156 3% 10.0% Fair value at 31 December 2024 4,641.3 NOTES TO THE FINANCIAL STATEMENTS continued

Home for Success: Unite Students Annual Report 2024 Page 177 Page 179

Home for Success: Unite Students Annual Report 2024 Page 177 Page 179