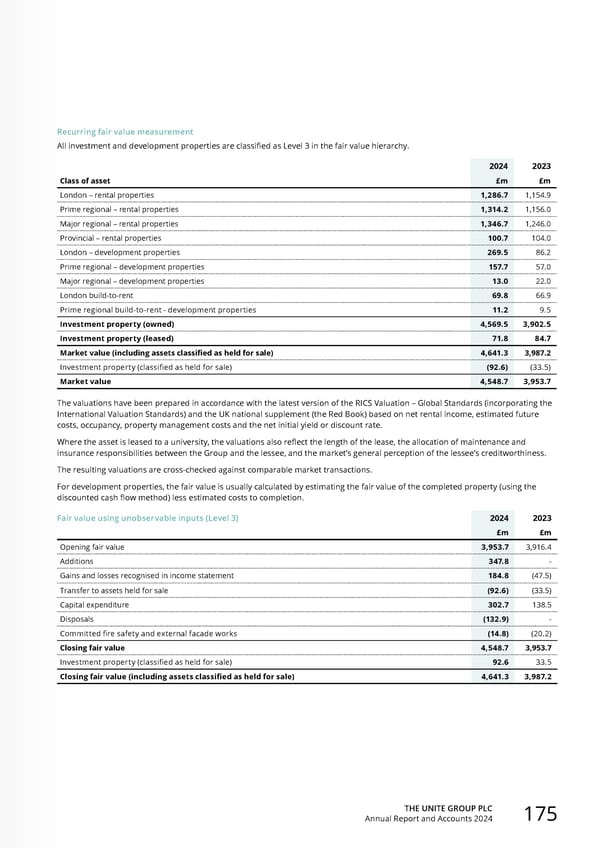

THE UNITE GROUP PLC Annual Report and Accounts 2024 175 Recurring fair value measurement All investment and development properties are classified as Level 3 in the fair value hierarchy. 2024 2023 Class of asset £m £m London – rental properties 1,286.7 1,154.9 Prime regional – rental properties 1,314.2 1,156.0 Major regional – rental properties 1,346.7 1,246.0 Provincial – rental properties 100.7 104.0 London – development properties 269.5 86.2 Prime regional – development properties 157.7 57.0 Major regional – development properties 13.0 22.0 London build-to-rent 69.8 66.9 Prime regional build-to-rent - development properties 11.2 9.5 Investment property (owned) 4,569.5 3,902.5 Investment property (leased) 71.8 84.7 Market value (including assets classified as held for sale) 4,641.3 3,987.2 Investment property (classified as held for sale) (92.6) (33.5) Market value 4,548.7 3,953.7 The valuations have been prepared in accordance with the latest version of the RICS Valuation – Global Standards (incorporating the International Valuation Standards) and the UK national supplement (the Red Book) based on net rental income, estimated future costs, occupancy, property management costs and the net initial yield or discount rate. Where the asset is leased to a university, the valuations also reflect the length of the lease, the allocation of maintenance and insurance responsibilities between the Group and the lessee, and the market’s general perception of the lessee’s creditworthiness. The resulting valuations are cross-checked against comparable market transactions. For development properties, the fair value is usually calculated by estimating the fair value of the completed property (using the discounted cash flow method) less estimated costs to completion. Fair value using unobservable inputs (Level 3) 2024 2023 £m £m Opening fair value 3,953.7 3,916.4 Additions 347.8 - Gains and losses recognised in income statement 184.8 (47.5) Transfer to assets held for sale (92.6) (33.5) Capital expenditure 302.7 138.5 Disposals (132.9) - Committed fire safety and external facade works (14.8) (20.2) Closing fair value 4,548.7 3,953.7 Investment property (classified as held for sale) 92.6 33.5 Closing fair value (including assets classified as held for sale) 4,641.3 3,987.2

Home for Success: Unite Students Annual Report 2024 Page 176 Page 178

Home for Success: Unite Students Annual Report 2024 Page 176 Page 178