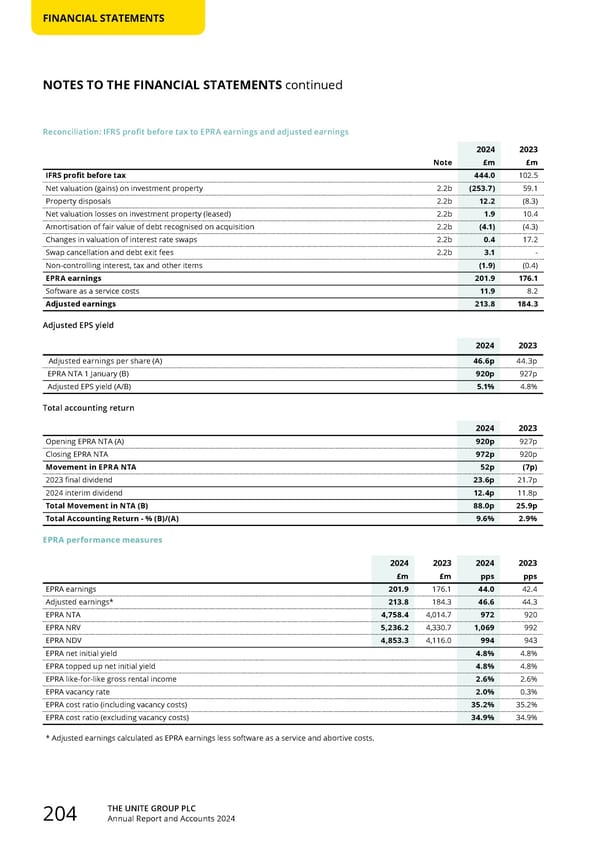

THE UNITE GROUP PLC Annual Report and Accounts 2024 204 FINANCIAL STATEMENTS Reconciliation: IFRS profit before tax to EPRA earnings and adjusted earnings 2024 2023 Note £m £m IFRS profit before tax 444.0 102.5 Net valuation (gains) on investment property 2.2b (253.7) 59.1 Property disposals 2.2b 12.2 (8.3) Net valuation losses on investment property (leased) 2.2b 1.9 10.4 Amortisation of fair value of debt recognised on acquisition 2.2b (4.1) (4.3) Changes in valuation of interest rate swaps 2.2b 0.4 17.2 Swap cancellation and debt exit fees 2.2b 3.1 - Non-controlling interest, tax and other items (1.9) (0.4) EPRA earnings 201.9 176.1 Software as a service costs 11.9 8.2 Adjusted earnings 213.8 184.3 Adjusted EPS yield 2024 2023 Adjusted earnings per share (A) 46.6p 44.3p EPRA NTA 1 January (B) 920p 927p Adjusted EPS yield (A/B) 5.1% 4.8% Total accounting return 2024 2023 Opening EPRA NTA (A) 920p 927p Closing EPRA NTA 972p 920p Movement in EPRA NTA 52p (7p) 2023 final dividend 23.6p 21.7p 2024 interim dividend 12.4p 11.8p Total Movement in NTA (B) 88.0p 25.9p Total Accounting Return - % (B)/(A) 9.6% 2.9% EPRA performance measures 2024 2023 2024 2023 £m £m pps pps EPRA earnings 201.9 176.1 44.0 42.4 Adjusted earnings* 213.8 184.3 46.6 44.3 EPRA NTA 4,758.4 4,014.7 972 920 EPRA NRV 5,236.2 4,330.7 1,069 992 EPRA NDV 4,853.3 4,116.0 994 943 EPRA net initial yield 4.8% 4.8% EPRA topped up net initial yield 4.8% 4.8% EPRA like-for-like gross rental income 2.6% 2.6% EPRA vacancy rate 2.0% 0.3% EPRA cost ratio (including vacancy costs) 35.2% 35.2% EPRA cost ratio (excluding vacancy costs) 34.9% 34.9% * Adjusted earnings calculated as EPRA earnings less software as a service and abortive costs. NOTES TO THE FINANCIAL STATEMENTS continued

Home for Success: Unite Students Annual Report 2024 Page 205 Page 207

Home for Success: Unite Students Annual Report 2024 Page 205 Page 207