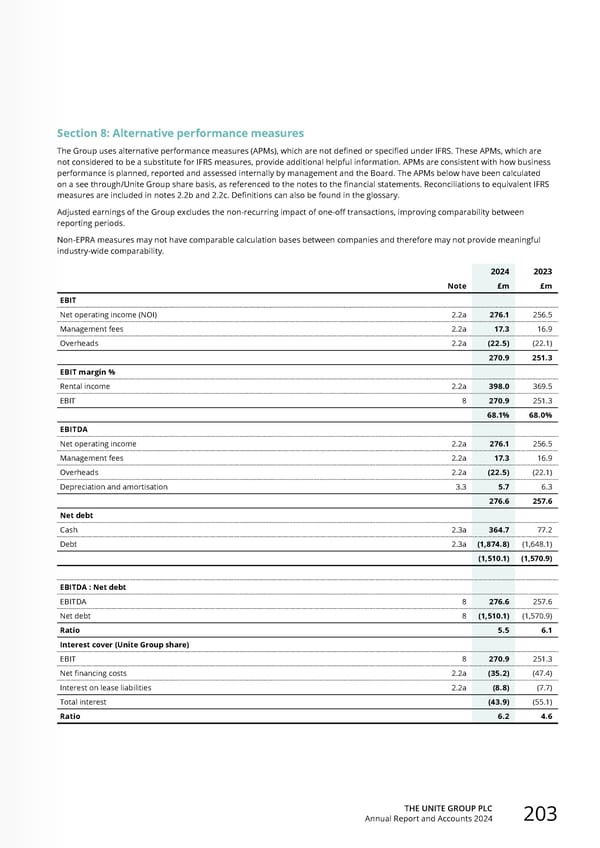

THE UNITE GROUP PLC Annual Report and Accounts 2024 203 Section 8: Alternative performance measures The Group uses alternative performance measures (APMs), which are not defined or specified under IFRS. These APMs, which are not considered to be a substitute for IFRS measures, provide additional helpful information. APMs are consistent with how business performance is planned, reported and assessed internally by management and the Board. The APMs below have been calculated on a see through/Unite Group share basis, as referenced to the notes to the financial statements. Reconciliations to equivalent IFRS measures are included in notes 2.2b and 2.2c. Definitions can also be found in the glossary. Adjusted earnings of the Group excludes the non-recurring impact of one-off transactions, improving comparability between reporting periods. Non-EPRA measures may not have comparable calculation bases between companies and therefore may not provide meaningful industry-wide comparability. 2024 2023 Note £m £m EBIT Net operating income (NOI) 2.2a 276.1 256.5 Management fees 2.2a 17.3 16.9 Overheads 2.2a (22.5) (22.1) 270.9 251.3 EBIT margin % Rental income 2.2a 398.0 369.5 EBIT 8 270.9 251.3 68.1% 68.0% EBITDA Net operating income 2.2a 276.1 256.5 Management fees 2.2a 17.3 16.9 Overheads 2.2a (22.5) (22.1) Depreciation and amortisation 3.3 5.7 6.3 276.6 257.6 Net debt Cash 2.3a 364.7 77.2 Debt 2.3a (1,874.8) (1,648.1) (1,510.1) (1,570.9) EBITDA : Net debt EBITDA 8 276.6 257.6 Net debt 8 (1,510.1) (1,570.9) Ratio 5.5 6.1 Interest cover (Unite Group share) EBIT 8 270.9 251.3 Net financing costs 2.2a (35.2) (47.4) Interest on lease liabilities 2.2a (8.8) (7.7) Total interest (43.9) (55.1) Ratio 6.2 4.6

Home for Success: Unite Students Annual Report 2024 Page 204 Page 206

Home for Success: Unite Students Annual Report 2024 Page 204 Page 206