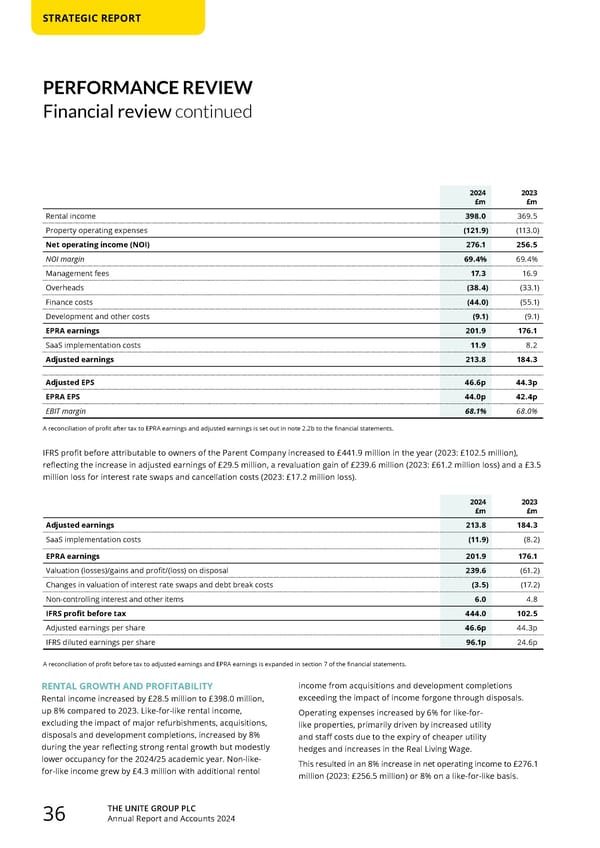

STRATEGIC REPORT PERFORMANCE REVIEW Financial review continued THE UNITE GROUP PLC Annual Report and Accounts 2024 36 2024 £m 2023 £m Adjusted earnings 213.8 184.3 SaaS implementation costs (11.9) (8.2) EPRA earnings 201.9 176.1 Valuation (losses)/gains and profit/(loss) on disposal 239.6 (61.2) Changes in valuation of interest rate swaps and debt break costs (3.5) (17.2) Non-controlling interest and other items 6.0 4.8 IFRS profit before tax 444.0 102.5 Adjusted earnings per share 46.6p 44.3p IFRS diluted earnings per share 96.1p 24.6p A reconciliation of profit before tax to adjusted earnings and EPRA earnings is expanded in section 7 of the financial statements. 2024 £m 2023 £m Rental income 398.0 369.5 Property operating expenses (121.9) (113.0) Net operating income (NOI) 276.1 256.5 NOI margin 69.4% 69.4% Management fees 17.3 16.9 Overheads (38.4) (33.1) Finance costs (44.0) (55.1) Development and other costs (9.1) (9.1) EPRA earnings 201.9 176.1 SaaS implementation costs 11.9 8.2 Adjusted earnings 213.8 184.3 Adjusted EPS 46.6p 44.3p EPRA EPS 44.0p 42.4p EBIT margin 68.1% 68.0% A reconciliation of profit after tax to EPRA earnings and adjusted earnings is set out in note 2.2b to the financial statements. IFRS profit before attributable to owners of the Parent Company increased to £441.9 million in the year (2023: £102.5 million), reflecting the increase in adjusted earnings of £29.5 million, a revaluation gain of £239.6 million (2023: £61.2 million loss) and a £3.5 million loss for interest rate swaps and cancellation costs (2023: £17.2 million loss). RENTAL GROWTH AND PROFITABILITY Rental income increased by £28.5 million to £398.0 million, up 8% compared to 2023. Like-for-like rental income, excluding the impact of major refurbishments, acquisitions, disposals and development completions, increased by 8% during the year reflecting strong rental growth but modestly lower occupancy for the 2024/25 academic year. Non-like- for-like income grew by £4.3 million with additional rentol income from acquisitions and development completions exceeding the impact of income forgone through disposals. Operating expenses increased by 6% for like-for- like properties, primarily driven by increased utility and staff costs due to the expiry of cheaper utility hedges and increases in the Real Living Wage. This resulted in an 8% increase in net operating income to £276.1 million (2023: £256.5 million) or 8% on a like-for-like basis.

Home for Success: Unite Students Annual Report 2024 Page 37 Page 39

Home for Success: Unite Students Annual Report 2024 Page 37 Page 39