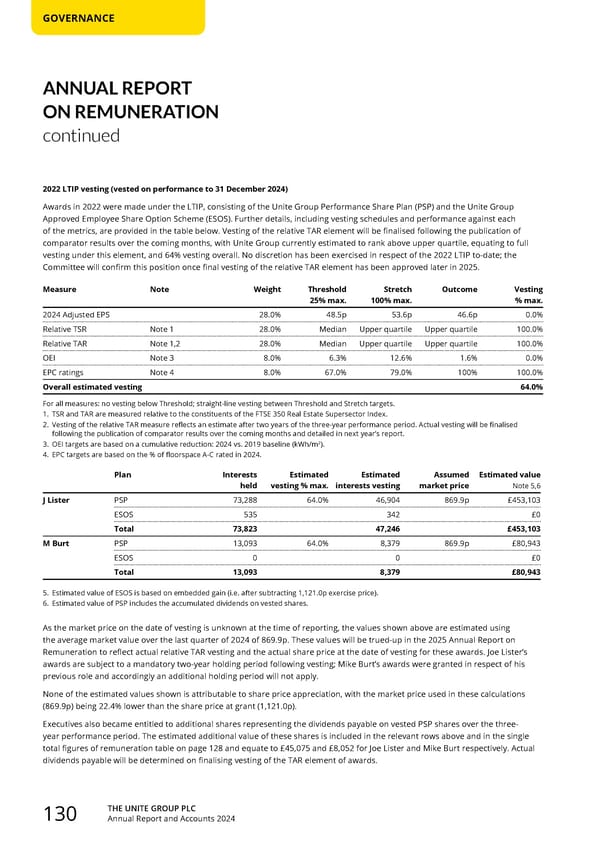

THE UNITE GROUP PLC Annual Report and Accounts 2024 130 2022 LTIP vesting (vested on performance to 31 December 2024) Awards in 2022 were made under the LTIP, consisting of the Unite Group Performance Share Plan (PSP) and the Unite Group Approved Employee Share Option Scheme (ESOS). Further details, including vesting schedules and performance against each of the metrics, are provided in the table below. Vesting of the relative TAR element will be finalised following the publication of comparator results over the coming months, with Unite Group currently estimated to rank above upper quartile, equating to full vesting under this element, and 64% vesting overall. No discretion has been exercised in respect of the 2022 LTIP to-date; the Committee will confirm this position once final vesting of the relative TAR element has been approved later in 2025. Measure Note Weight Threshold 25% max. Stretch 100% max. Outcome Vesting % max. 2024 Adjusted EPS 28.0% 48.5p 53.6p 46.6p 0.0% Relative TSR Note 1 28.0% Median Upper quartile Upper quartile 100.0% Relative TAR Note 1,2 28.0% Median Upper quartile Upper quartile 100.0% OEI Note 3 8.0% 6.3% 12.6% 1.6% 0.0% EPC ratings Note 4 8.0% 67.0% 79.0% 100% 100.0% Overall estimated vesting 64.0% For all measures: no vesting below Threshold; straight-line vesting between Threshold and Stretch targets. 1. TSR and TAR are measured relative to the constituents of the FTSE 350 Real Estate Supersector Index. 2. Vesting of the relative TAR measure reflects an estimate after two years of the three-year performance period. Actual vesting will be finalised following the publication of comparator results over the coming months and detailed in next year’s report. 3. OEI targets are based on a cumulative reduction: 2024 vs. 2019 baseline (kWh/m2). 4. EPC targets are based on the % of floorspace A-C rated in 2024. 5. Estimated value of ESOS is based on embedded gain (i.e. after subtracting 1,121.0p exercise price). 6. Estimated value of PSP includes the accumulated dividends on vested shares. Plan Interests held Estimated vesting % max. Estimated interests vesting Assumed market price Estimated value Note 5,6 J Lister PSP 73,288 64.0% 46,904 869.9p £453,103 ESOS 535 342 £0 Total 73,823 47,246 £453,103 M Burt PSP 13,093 64.0% 8,379 869.9p £80,943 ESOS 0 0 £0 Total 13,093 8,379 £80,943 As the market price on the date of vesting is unknown at the time of reporting, the values shown above are estimated using the average market value over the last quarter of 2024 of 869.9p. These values will be trued-up in the 2025 Annual Report on Remuneration to reflect actual relative TAR vesting and the actual share price at the date of vesting for these awards. Joe Lister’s awards are subject to a mandatory two-year holding period following vesting; Mike Burt’s awards were granted in respect of his previous role and accordingly an additional holding period will not apply. None of the estimated values shown is attributable to share price appreciation, with the market price used in these calculations (869.9p) being 22.4% lower than the share price at grant (1,121.0p). Executives also became entitled to additional shares representing the dividends payable on vested PSP shares over the three- year performance period. The estimated additional value of these shares is included in the relevant rows above and in the single total figures of remuneration table on page 128 and equate to £45,075 and £8,052 for Joe Lister and Mike Burt respectively. Actual dividends payable will be determined on finalising vesting of the TAR element of awards. ANNUAL REPORT ON REMUNERATION continued GOVERNANCE

Home for Success: Unite Students Annual Report 2024 Page 131 Page 133

Home for Success: Unite Students Annual Report 2024 Page 131 Page 133