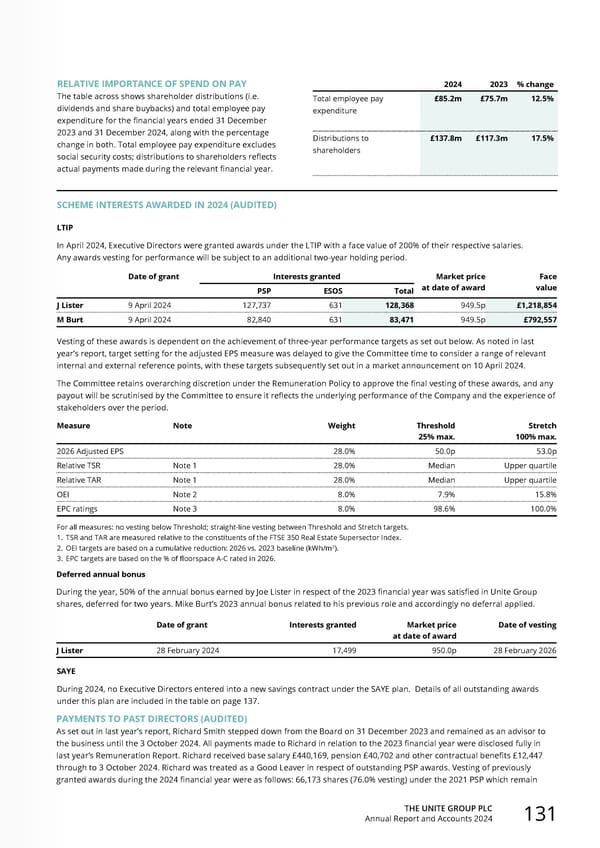

THE UNITE GROUP PLC Annual Report and Accounts 2024 131 RELATIVE IMPORTANCE OF SPEND ON PAY The table across shows shareholder distributions (i.e. dividends and share buybacks) and total employee pay expenditure for the financial years ended 31 December 2023 and 31 December 2024, along with the percentage change in both. Total employee pay expenditure excludes social security costs; distributions to shareholders reflects actual payments made during the relevant financial year. 2024 2023 % change Total employee pay expenditure £85.2m £75.7m 12.5% Distributions to shareholders £137.8m £117.3m 17.5% SCHEME INTERESTS AWARDED IN 2024 (AUDITED) LTIP In April 2024, Executive Directors were granted awards under the LTIP with a face value of 200% of their respective salaries. Any awards vesting for performance will be subject to an additional two-year holding period. Date of grant Interests granted Market price at date of award Face value PSP ESOS Total J Lister 9 April 2024 127,737 631 128,368 949.5p £1,218,854 M Burt 9 April 2024 82,840 631 83,471 949.5p £792,557 Vesting of these awards is dependent on the achievement of three-year performance targets as set out below. As noted in last year’s report, target setting for the adjusted EPS measure was delayed to give the Committee time to consider a range of relevant internal and external reference points, with these targets subsequently set out in a market announcement on 10 April 2024. The Committee retains overarching discretion under the Remuneration Policy to approve the final vesting of these awards, and any payout will be scrutinised by the Committee to ensure it reflects the underlying performance of the Company and the experience of stakeholders over the period. Measure Note Weight Threshold 25% max. Stretch 100% max. 2026 Adjusted EPS 28.0% 50.0p 53.0p Relative TSR Note 1 28.0% Median Upper quartile Relative TAR Note 1 28.0% Median Upper quartile OEI Note 2 8.0% 7.9% 15.8% EPC ratings Note 3 8.0% 98.6% 100.0% For all measures: no vesting below Threshold; straight-line vesting between Threshold and Stretch targets. 1. TSR and TAR are measured relative to the constituents of the FTSE 350 Real Estate Supersector Index. 2. OEI targets are based on a cumulative reduction: 2026 vs. 2023 baseline (kWh/m2). 3. EPC targets are based on the % of floorspace A-C rated in 2026. Deferred annual bonus During the year, 50% of the annual bonus earned by Joe Lister in respect of the 2023 financial year was satisfied in Unite Group shares, deferred for two years. Mike Burt’s 2023 annual bonus related to his previous role and accordingly no deferral applied. SAYE During 2024, no Executive Directors entered into a new savings contract under the SAYE plan. Details of all outstanding awards under this plan are included in the table on page 137. Date of grant Interests granted Market price at date of award Date of vesting J Lister 28 February 2024 17,499 950.0p 28 February 2026 PAYMENTS TO PAST DIRECTORS (AUDITED) As set out in last year’s report, Richard Smith stepped down from the Board on 31 December 2023 and remained as an advisor to the business until the 3 October 2024. All payments made to Richard in relation to the 2023 financial year were disclosed fully in last year’s Remuneration Report. Richard received base salary £440,169, pension £40,702 and other contractual benefits £12,447 through to 3 October 2024. Richard was treated as a Good Leaver in respect of outstanding PSP awards. Vesting of previously granted awards during the 2024 financial year were as follows: 66,173 shares (76.0% vesting) under the 2021 PSP which remain

Home for Success: Unite Students Annual Report 2024 Page 132 Page 134

Home for Success: Unite Students Annual Report 2024 Page 132 Page 134