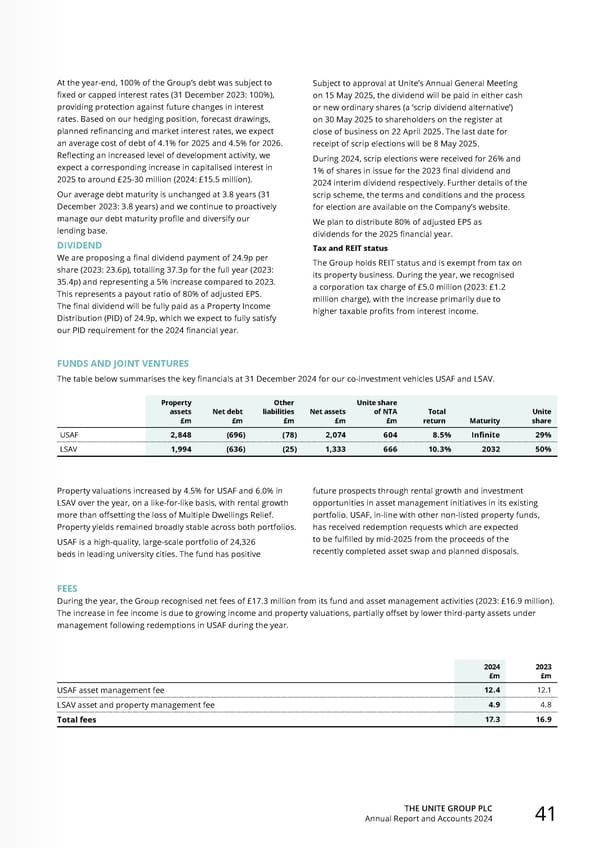

THE UNITE GROUP PLC Annual Report and Accounts 2024 41 At the year-end, 100% of the Group’s debt was subject to fixed or capped interest rates (31 December 2023: 100%), providing protection against future changes in interest rates. Based on our hedging position, forecast drawings, planned refinancing and market interest rates, we expect an average cost of debt of 4.1% for 2025 and 4.5% for 2026. Reflecting an increased level of development activity, we expect a corresponding increase in capitalised interest in 2025 to around £25-30 million (2024: £15.5 million). Our average debt maturity is unchanged at 3.8 years (31 December 2023: 3.8 years) and we continue to proactively manage our debt maturity profile and diversify our lending base. DIVIDEND We are proposing a final dividend payment of 24.9p per share (2023: 23.6p), totalling 37.3p for the full year (2023: 35.4p) and representing a 5% increase compared to 2023. This represents a payout ratio of 80% of adjusted EPS. The final dividend will be fully paid as a Property Income Distribution (PID) of 24.9p, which we expect to fully satisfy our PID requirement for the 2024 financial year. Subject to approval at Unite’s Annual General Meeting on 15 May 2025, the dividend will be paid in either cash or new ordinary shares (a ‘scrip dividend alternative’) on 30 May 2025 to shareholders on the register at close of business on 22 April 2025. The last date for receipt of scrip elections will be 8 May 2025. During 2024, scrip elections were received for 26% and 1% of shares in issue for the 2023 final dividend and 2024 interim dividend respectively. Further details of the scrip scheme, the terms and conditions and the process for election are available on the Company’s website. We plan to distribute 80% of adjusted EPS as dividends for the 2025 financial year. Tax and REIT status The Group holds REIT status and is exempt from tax on its property business. During the year, we recognised a corporation tax charge of £5.0 million (2023: £1.2 million charge), with the increase primarily due to higher taxable profits from interest income. FUNDS AND JOINT VENTURES The table below summarises the key financials at 31 December 2024 for our co-investment vehicles USAF and LSAV. Property assets £m Net debt £m Other liabilities £m Net assets £m Unite share of NTA £m Total return Maturity Unite share USAF 2,848 (696) (78) 2,074 604 8.5% Infinite 29% LSAV 1,994 (636) (25) 1,333 666 10.3% 2032 50% Property valuations increased by 4.5% for USAF and 6.0% in LSAV over the year, on a like-for-like basis, with rental growth more than offsetting the loss of Multiple Dwellings Relief. Property yields remained broadly stable across both portfolios. USAF is a high-quality, large-scale portfolio of 24,326 beds in leading university cities. The fund has positive future prospects through rental growth and investment opportunities in asset management initiatives in its existing portfolio. USAF, in-line with other non-listed property funds, has received redemption requests which are expected to be fulfilled by mid-2025 from the proceeds of the recently completed asset swap and planned disposals. FEES During the year, the Group recognised net fees of £17.3 million from its fund and asset management activities (2023: £16.9 million). The increase in fee income is due to growing income and property valuations, partially offset by lower third-party assets under management following redemptions in USAF during the year. 2024 £m 2023 £m USAF asset management fee 12.4 12.1 LSAV asset and property management fee 4.9 4.8 Total fees 17.3 16.9

Home for Success: Unite Students Annual Report 2024 Page 42 Page 44

Home for Success: Unite Students Annual Report 2024 Page 42 Page 44