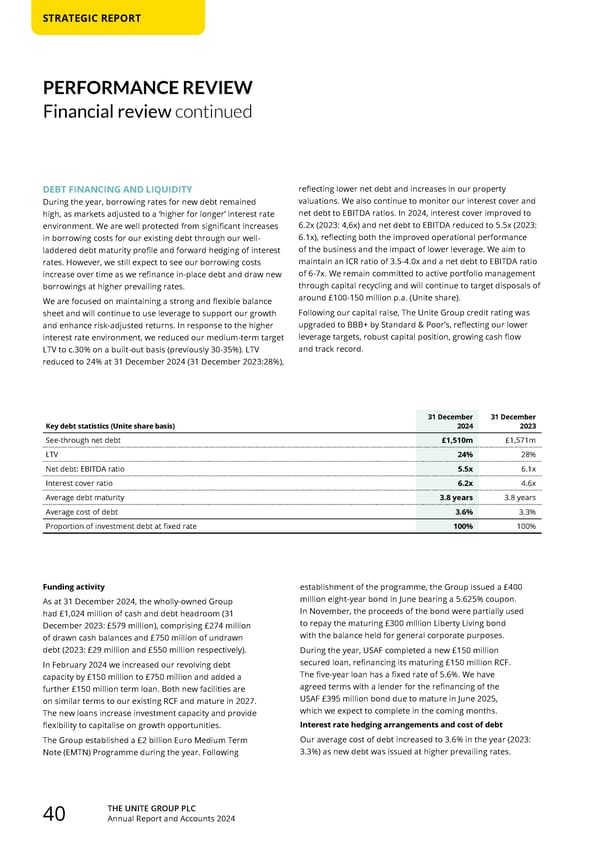

THE UNITE GROUP PLC Annual Report and Accounts 2024 40 STRATEGIC REPORT PERFORMANCE REVIEW Financial review continued DEBT FINANCING AND LIQUIDITY During the year, borrowing rates for new debt remained high, as markets adjusted to a ‘higher for longer’ interest rate environment. We are well protected from significant increases in borrowing costs for our existing debt through our well- laddered debt maturity profile and forward hedging of interest rates. However, we still expect to see our borrowing costs increase over time as we refinance in-place debt and draw new borrowings at higher prevailing rates. We are focused on maintaining a strong and flexible balance sheet and will continue to use leverage to support our growth and enhance risk-adjusted returns. In response to the higher interest rate environment, we reduced our medium-term target LTV to c.30% on a built-out basis (previously 30-35%). LTV reduced to 24% at 31 December 2024 (31 December 2023:28%), Key debt statistics (Unite share basis) 31 December 2024 31 December 2023 See-through net debt £1,510m £1,571m LTV 24% 28% Net debt: EBITDA ratio 5.5x 6.1x Interest cover ratio 6.2x 4.6x Average debt maturity 3.8 years 3.8 years Average cost of debt 3.6% 3.3% Proportion of investment debt at fixed rate 100% 100% Funding activity As at 31 December 2024, the wholly-owned Group had £1,024 million of cash and debt headroom (31 December 2023: £579 million), comprising £274 million of drawn cash balances and £750 million of undrawn debt (2023: £29 million and £550 million respectively). In February 2024 we increased our revolving debt capacity by £150 million to £750 million and added a further £150 million term loan. Both new facilities are on similar terms to our existing RCF and mature in 2027. The new loans increase investment capacity and provide flexibility to capitalise on growth opportunities. The Group established a £2 billion Euro Medium Term Note (EMTN) Programme during the year. Following establishment of the programme, the Group issued a £400 million eight-year bond in June bearing a 5.625% coupon. In November, the proceeds of the bond were partially used to repay the maturing £300 million Liberty Living bond with the balance held for general corporate purposes. During the year, USAF completed a new £150 million secured loan, refinancing its maturing £150 million RCF. The five-year loan has a fixed rate of 5.6%. We have agreed terms with a lender for the refinancing of the USAF £395 million bond due to mature in June 2025, which we expect to complete in the coming months. Interest rate hedging arrangements and cost of debt Our average cost of debt increased to 3.6% in the year (2023: 3.3%) as new debt was issued at higher prevailing rates. reflecting lower net debt and increases in our property valuations. We also continue to monitor our interest cover and net debt to EBITDA ratios. In 2024, interest cover improved to 6.2x (2023: 4,6x) and net debt to EBITDA reduced to 5.5x (2023: 6.1x), reflecting both the improved operational performance of the business and the impact of lower leverage. We aim to maintain an ICR ratio of 3.5-4.0x and a net debt to EBITDA ratio of 6-7x. We remain committed to active portfolio management through capital recycling and will continue to target disposals of around £100-150 million p.a. (Unite share). Following our capital raise, The Unite Group credit rating was upgraded to BBB+ by Standard & Poor’s, reflecting our lower leverage targets, robust capital position, growing cash flow and track record.

Home for Success: Unite Students Annual Report 2024 Page 41 Page 43

Home for Success: Unite Students Annual Report 2024 Page 41 Page 43