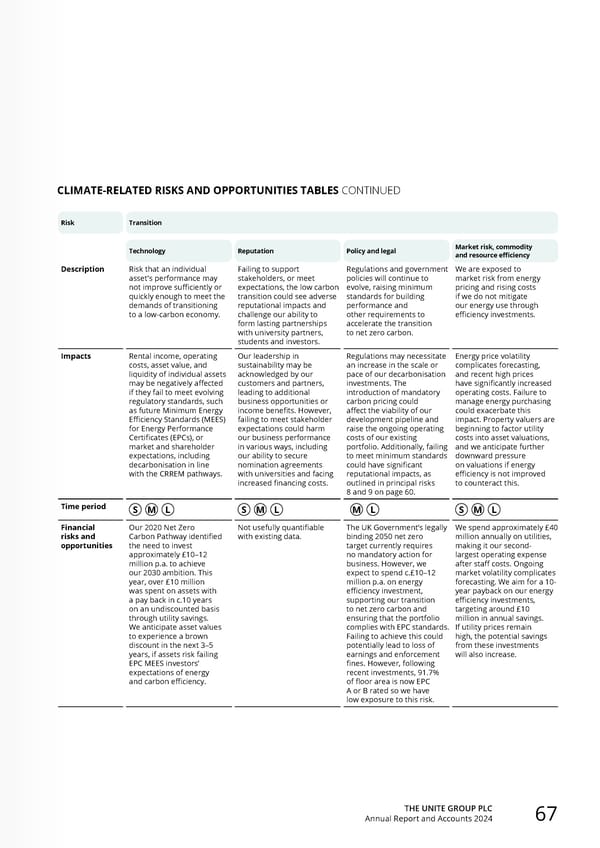

THE UNITE GROUP PLC Annual Report and Accounts 2024 67 Risk Transition Technology Reputation Policy and legal Market risk, commodity and resource efficiency Description Risk that an individual asset's performance may not improve sufficiently or quickly enough to meet the demands of transitioning to a low-carbon economy. Failing to support stakeholders, or meet expectations, the low carbon transition could see adverse reputational impacts and challenge our ability to form lasting partnerships with university partners, students and investors. Regulations and government policies will continue to evolve, raising minimum standards for building performance and other requirements to accelerate the transition to net zero carbon. We are exposed to market risk from energy pricing and rising costs if we do not mitigate our energy use through efficiency investments. Impacts Rental income, operating costs, asset value, and liquidity of individual assets may be negatively affected if they fail to meet evolving regulatory standards, such as future Minimum Energy Efficiency Standards (MEES) for Energy Performance Certificates (EPCs), or market and shareholder expectations, including decarbonisation in line with the CRREM pathways. Our leadership in sustainability may be acknowledged by our customers and partners, leading to additional business opportunities or income benefits. However, failing to meet stakeholder expectations could harm our business performance in various ways, including our ability to secure nomination agreements with universities and facing increased financing costs. Regulations may necessitate an increase in the scale or pace of our decarbonisation investments. The introduction of mandatory carbon pricing could affect the viability of our development pipeline and raise the ongoing operating costs of our existing portfolio. Additionally, failing to meet minimum standards could have significant reputational impacts, as outlined in principal risks 8 and 9 on page 60. Energy price volatility complicates forecasting, and recent high prices have significantly increased operating costs. Failure to manage energy purchasing could exacerbate this impact. Property valuers are beginning to factor utility costs into asset valuations, and we anticipate further downward pressure on valuations if energy efficiency is not improved to counteract this. Time period S M L S M L M L S M L Financial risks and opportunities Our 2020 Net Zero Carbon Pathway identified the need to invest approximately £10–12 million p.a. to achieve our 2030 ambition. This year, over £10 million was spent on assets with a pay back in c.10 years on an undiscounted basis through utility savings. We anticipate asset values to experience a brown discount in the next 3–5 years, if assets risk failing EPC MEES investors’ expectations of energy and carbon efficiency. Not usefully quantifiable with existing data. The UK Government’s legally binding 2050 net zero target currently requires no mandatory action for business. However, we expect to spend c.£10–12 million p.a. on energy efficiency investment, supporting our transition to net zero carbon and ensuring that the portfolio complies with EPC standards. Failing to achieve this could potentially lead to loss of earnings and enforcement fines. However, following recent investments, 91.7% of floor area is now EPC A or B rated so we have low exposure to this risk. We spend approximately £40 million annually on utilities, making it our second- largest operating expense after staff costs. Ongoing market volatility complicates forecasting. We aim for a 10- year payback on our energy efficiency investments, targeting around £10 million in annual savings. If utility prices remain high, the potential savings from these investments will also increase. CLIMATE-RELATED RISKS AND OPPORTUNITIES TABLES CONTINUED

Home for Success: Unite Students Annual Report 2024 Page 68 Page 70

Home for Success: Unite Students Annual Report 2024 Page 68 Page 70